CS1 Payment Form for Self Employed Persons National

What is the CS1 Payment Form for Self Employed Persons National

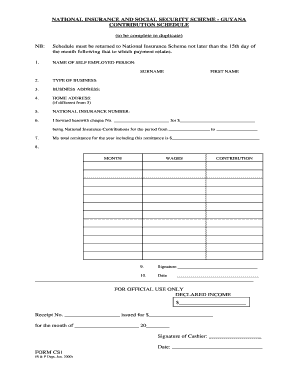

The CS1 Payment Form for Self Employed Persons National is a specialized document designed for individuals who operate as self-employed in the United States. This form facilitates the reporting of income and payment information to the relevant tax authorities. It is essential for self-employed individuals to accurately document their earnings and expenses to ensure compliance with federal and state tax regulations. The CS1 form serves as an official record that can be used during tax filing and may also be required for various financial transactions.

How to Use the CS1 Payment Form for Self Employed Persons National

Using the CS1 Payment Form involves several straightforward steps. First, ensure that you have all necessary financial information at hand, including income statements, expense receipts, and any other relevant documentation. Next, fill out the form accurately, providing detailed information about your earnings, deductions, and any applicable credits. Once completed, review the form for accuracy before submitting it to the appropriate tax authority. Utilizing digital tools can streamline this process, allowing for easy editing and secure submission.

Steps to Complete the CS1 Payment Form for Self Employed Persons National

Completing the CS1 Payment Form requires careful attention to detail. Follow these steps to ensure proper completion:

- Gather all necessary documents, including income statements and expense records.

- Access the CS1 form, either in digital format or as a printed copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Detail your income sources, ensuring that all earnings are accurately reported.

- List any deductible expenses that apply to your business operations.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, depending on your preference and requirements.

Legal Use of the CS1 Payment Form for Self Employed Persons National

The legal use of the CS1 Payment Form is governed by federal and state tax laws. To be considered valid, the form must be completed accurately and submitted within the designated deadlines. Electronic submissions are legally recognized, provided they comply with eSignature laws and regulations. It is crucial for self-employed individuals to maintain records of their submissions and any correspondence with tax authorities to safeguard against potential audits or disputes.

Key Elements of the CS1 Payment Form for Self Employed Persons National

Several key elements are essential for the CS1 Payment Form to fulfill its purpose effectively:

- Personal Information: Accurate identification details of the self-employed individual.

- Income Reporting: Comprehensive documentation of all income sources.

- Expense Deductions: A clear list of all business-related expenses that can be deducted.

- Signature: A valid signature, which can be electronic, to authenticate the form.

- Submission Date: The date on which the form is submitted, crucial for compliance with deadlines.

IRS Guidelines for the CS1 Payment Form for Self Employed Persons National

The IRS provides specific guidelines for the completion and submission of the CS1 Payment Form. These guidelines emphasize the importance of accuracy in reporting income and expenses. Self-employed individuals should familiarize themselves with the IRS requirements to avoid penalties. Adhering to these guidelines ensures that the form is processed correctly and helps maintain compliance with tax obligations.

Quick guide on how to complete cs1 payment form for self employed persons national

Complete CS1 Payment Form For Self Employed Persons National effortlessly on any device

Web-based document management has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Manage CS1 Payment Form For Self Employed Persons National on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign CS1 Payment Form For Self Employed Persons National with ease

- Locate CS1 Payment Form For Self Employed Persons National and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign CS1 Payment Form For Self Employed Persons National and ensure effective communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cs1 payment form for self employed persons national

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CS1 form and how is it used?

The CS1 form is a specific document utilized for various administrative tasks within organizations. It streamlines processes by allowing users to fill out, sign, and send documents electronically. With airSlate SignNow, creating and managing a CS1 form is simplified and efficient.

-

How does airSlate SignNow enhance the CS1 form experience?

airSlate SignNow provides a user-friendly interface that allows you to easily create and customize your CS1 form. It also includes features like drag-and-drop functionality and templates to streamline your document creation process, ensuring that you can get your forms sent and signed quickly.

-

What are the pricing options for airSlate SignNow when using the CS1 form?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs, even for handling CS1 forms. You can choose from individual, business, or enterprise plans, each designed to provide value by ensuring you can manage your documents efficiently and cost-effectively.

-

Can I integrate airSlate SignNow with other tools for my CS1 forms?

Yes, airSlate SignNow supports numerous integrations with popular applications, which can help manage your CS1 forms more effectively. Integrating with tools like Google Drive, Salesforce, and Microsoft Office enhances your workflow and document management capabilities.

-

What security features does airSlate SignNow provide for CS1 forms?

Security is a priority with airSlate SignNow, especially when handling CS1 forms. The platform employs robust encryption, authentication processes, and compliance with industry standards to ensure that your documents are secure and accessible only by authorized users.

-

Can I access my CS1 forms on mobile devices?

Absolutely! airSlate SignNow offers a mobile app that allows you to create, edit, and manage your CS1 forms on the go. This flexibility is crucial for businesses that need to operate efficiently outside of traditional office settings.

-

What benefits does airSlate SignNow offer for managing CS1 forms?

Using airSlate SignNow for your CS1 forms means faster turnaround times, reduced paper usage, and improved organization. The platform not only simplifies the signing process but also provides tracking and storage options that enhance productivity and accountability.

Get more for CS1 Payment Form For Self Employed Persons National

Find out other CS1 Payment Form For Self Employed Persons National

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer