Tax Exempt Form

What is the Tax Exempt Form

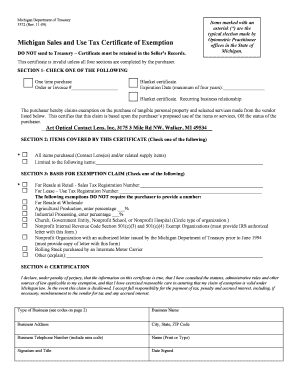

The tax exempt form in Michigan is a crucial document that allows eligible organizations to purchase goods and services without paying sales tax. This form is typically used by non-profit organizations, government entities, and certain educational institutions. By providing this form to vendors, these entities can ensure they are not charged sales tax on qualifying purchases, thereby maximizing their resources for their missions and services.

How to Obtain the Tax Exempt Form

To obtain the printable tax exempt form in Michigan, organizations must first verify their eligibility. This usually involves confirming their non-profit status or other qualifying criteria. Once eligibility is established, the form can typically be downloaded from the Michigan Department of Treasury's website or obtained directly from the organization’s financial department. It is essential to ensure that the most current version of the form is used to avoid any compliance issues.

Steps to Complete the Tax Exempt Form

Completing the tax exempt form correctly is vital for ensuring its acceptance by vendors. The following steps outline the process:

- Gather necessary information, including the organization’s name, address, and tax identification number.

- Clearly state the purpose of the exemption and the type of purchases that will be made.

- Sign and date the form, ensuring that the authorized representative of the organization completes this section.

- Provide the completed form to vendors when making purchases to avoid sales tax charges.

Legal Use of the Tax Exempt Form

The tax exempt form must be used in accordance with Michigan state laws and regulations. Misuse of the form, such as using it for personal purchases or by ineligible entities, can result in penalties. It is important for organizations to maintain accurate records of their tax exempt purchases and to ensure that the form is only presented to vendors for legitimate business purposes.

Key Elements of the Tax Exempt Form

Understanding the key elements of the tax exempt form is essential for proper usage. The form typically includes:

- The name and address of the exempt organization.

- The tax identification number of the organization.

- A declaration of the purpose for which the exemption is claimed.

- Signature of an authorized representative, confirming the accuracy of the information provided.

Examples of Using the Tax Exempt Form

Organizations can utilize the tax exempt form in various scenarios. For instance, a non-profit organization purchasing office supplies can present the form to the supplier to avoid sales tax. Similarly, educational institutions may use the form when acquiring textbooks or educational materials. Each instance helps these organizations allocate more funds towards their core missions rather than on tax expenses.

Quick guide on how to complete tax exempt form 6060858

Effortlessly Prepare Tax Exempt Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Tax Exempt Form on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to Modify and eSign Tax Exempt Form with Ease

- Find Tax Exempt Form and select Get Form to begin.

- Use the tools available to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it onto your computer.

Say goodbye to missing or lost documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow manages your document needs in just a few clicks from your preferred device. Edit and eSign Tax Exempt Form to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax exempt form 6060858

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a printable tax exempt form michigan?

A printable tax exempt form michigan is a document that allows qualifying organizations to make tax-free purchases in the state of Michigan. This form is essential for non-profit organizations and other exempt entities to comply with tax regulations while making purchases. By using this form, businesses can save on sales tax for eligible transactions.

-

How can I obtain a printable tax exempt form michigan?

You can obtain a printable tax exempt form michigan directly from the Michigan Department of Treasury's website or through authorized providers. Many online platforms, including airSlate SignNow, offer templates for this form that you can easily fill out and print. This simplifies the process and ensures you have the correct format.

-

Is there a cost associated with obtaining a printable tax exempt form michigan?

The printable tax exempt form michigan itself is typically free to download and print. However, if you opt for professional services or software like airSlate SignNow to generate and manage your forms, there might be associated costs. Thankfully, airSlate SignNow offers an easy and cost-effective solution for document management.

-

Can I use airSlate SignNow to send a printable tax exempt form michigan?

Yes, airSlate SignNow enables you to send, eSign, and manage your printable tax exempt form michigan seamlessly. This solution streamlines the process, allowing you to get the necessary signatures quickly. Plus, it ensures that your documents are securely stored and accessible whenever you need them.

-

What are the benefits of using airSlate SignNow for a printable tax exempt form michigan?

Using airSlate SignNow for your printable tax exempt form michigan offers several benefits including ease of use, cost-effectiveness, and secure document handling. The platform allows for quick eSigning and sharing, reducing the time spent on paperwork. Additionally, you can integrate with various applications to enhance your workflow.

-

Are there any integrations available with airSlate SignNow for the printable tax exempt form michigan?

Yes, airSlate SignNow offers numerous integrations with other applications such as CRM software, cloud storage, and accounting tools that can help streamline your processes when handling a printable tax exempt form michigan. This enhances collaboration and efficiency, making it easier to manage your tax-exempt transactions.

-

How should I complete the printable tax exempt form michigan?

To complete the printable tax exempt form michigan, ensure you provide all required information accurately, including your organization’s details and tax-exempt status. Be sure to follow the instructions carefully to avoid mistakes. Using airSlate SignNow can help ensure you fill out the form correctly, facilitating the eSignature process.

Get more for Tax Exempt Form

Find out other Tax Exempt Form

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free