Form 5500 Sf Instructions

What is the Form 5500 Sf Instructions

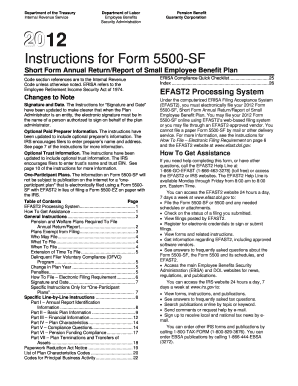

The Form 5500 Sf Instructions provide essential guidelines for completing the Form 5500-SF, a streamlined version of the Form 5500 used by certain employee benefit plans. This form is primarily utilized by small retirement plans with fewer than 100 participants, allowing them to report information about their plan's financial condition, investments, and operations. Understanding these instructions is crucial for ensuring compliance with the Employee Retirement Income Security Act (ERISA) and Internal Revenue Service (IRS) regulations.

Steps to Complete the Form 5500 Sf Instructions

Completing the Form 5500 Sf requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about your employee benefit plan, including participant data, financial statements, and investment details.

- Access the Form 5500-SF and its instructions from the IRS website or authorized sources.

- Fill out the form accurately, ensuring all required fields are completed. Pay special attention to the financial information section.

- Review the completed form for accuracy, ensuring that all data aligns with your plan's records.

- Submit the form electronically through the EFAST2 system or via mail, if applicable, before the filing deadline.

Legal Use of the Form 5500 Sf Instructions

The Form 5500 Sf Instructions hold legal significance as they outline the requirements for filing the Form 5500-SF. Adhering to these instructions ensures that the form is completed correctly and filed on time, which is essential for maintaining compliance with federal regulations. Failure to follow these guidelines may result in penalties or additional scrutiny from regulatory bodies.

Filing Deadlines / Important Dates

Timely filing of the Form 5500-SF is critical to avoid penalties. The standard deadline for filing is the last day of the seventh month after the plan year ends. For plans that operate on a calendar year, this typically falls on July 31. If additional time is needed, a six-month extension can be requested, but this must be done before the original deadline.

Required Documents

When completing the Form 5500-SF, certain documents are necessary to ensure accurate reporting. These may include:

- Plan financial statements, including balance sheets and income statements.

- Participant count and demographic information.

- Investment information related to the plan's assets.

- Any relevant amendments or changes to the plan during the reporting period.

Form Submission Methods

The Form 5500-SF can be submitted electronically through the EFAST2 system, which is the preferred method. This system allows for faster processing and confirmation of receipt. Alternatively, if electronic submission is not feasible, the form can be mailed to the appropriate address provided in the instructions. Ensure that all submissions are completed by the deadline to avoid penalties.

Quick guide on how to complete form 5500 sf instructions

Accomplish Form 5500 Sf Instructions effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without waiting. Manage Form 5500 Sf Instructions on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to alter and eSign Form 5500 Sf Instructions effortlessly

- Obtain Form 5500 Sf Instructions and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or redact sensitive information using the tools provided specifically for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or via an invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Modify and eSign Form 5500 Sf Instructions and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5500 sf instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'formulario 5500 instrucciones'?

The 'formulario 5500 instrucciones' refers to the set of guidelines for completing Form 5500, which is essential for reporting employee benefit plans. Understanding these instructions can help business owners ensure compliance with ERISA regulations and avoid potential penalties.

-

How can airSlate SignNow help with 'formulario 5500 instrucciones'?

airSlate SignNow simplifies the document signing process, allowing businesses to easily create, send, and eSign documents related to 'formulario 5500 instrucciones.' Our platform helps ensure that all necessary forms are completed accurately and signed in compliance with regulations, streamlining your workflow.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to different business needs, starting with a free trial for new users. This means that businesses can explore features related to document signing and the 'formulario 5500 instrucciones' without any initial investment before deciding on an ideal subscription plan.

-

What features does airSlate SignNow provide for managing forms?

With airSlate SignNow, users can enjoy features like customizable templates, automated reminders, and real-time tracking for documents, making it ideal for managing 'formulario 5500 instrucciones.' These tools enhance productivity and ensure that necessary forms are completed and submitted on time.

-

Is airSlate SignNow compliant with legal standards?

Yes, airSlate SignNow is designed to comply with all relevant electronic signature laws, including those applicable to the 'formulario 5500 instrucciones.' This means that documents signed through our platform hold the same legal standing as traditional signatures, ensuring security and compliance.

-

Can airSlate SignNow integrate with other software systems?

Absolutely! airSlate SignNow offers various integrations with popular business applications, helping users handle the 'formulario 5500 instrucciones' seamlessly. These integrations can improve overall workflow efficiency and data syncing between platforms.

-

What are the benefits of using airSlate SignNow for business documentation?

Utilizing airSlate SignNow for business documentation, including 'formulario 5500 instrucciones,' enhances operational efficiency, reduces turnaround time, and minimizes paperwork. The ease of eSigning combined with automated workflows simplifies the management of essential documents for any business.

Get more for Form 5500 Sf Instructions

Find out other Form 5500 Sf Instructions

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document