A Printable Tax Receipt Shoes 2 Share Form

What is the A Printable Tax Receipt Shoes 2 Share

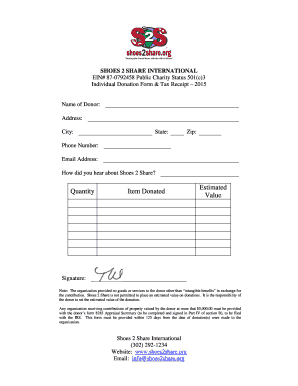

The A Printable Tax Receipt Shoes 2 Share is a document that serves as proof of a donation made to a charitable organization, specifically related to shoes. This receipt is essential for individuals who wish to claim tax deductions for their charitable contributions. It provides detailed information about the donation, including the date, value, and the organization receiving the shoes. Having this receipt ensures that donors can substantiate their claims during tax filing, aligning with IRS requirements for charitable contributions.

How to use the A Printable Tax Receipt Shoes 2 Share

Using the A Printable Tax Receipt Shoes 2 Share involves a straightforward process. First, ensure that you have made a qualifying donation to a recognized charity that accepts shoes. After the donation, you can obtain the receipt from the organization, which may provide a digital or physical copy. Once you have the receipt, keep it in a safe place for your records. When filing your taxes, include this receipt as part of your documentation to support your charitable contribution claims.

Steps to complete the A Printable Tax Receipt Shoes 2 Share

Completing the A Printable Tax Receipt Shoes 2 Share requires several key steps:

- Make a donation of shoes to a qualified charitable organization.

- Request a tax receipt from the charity, ensuring it includes necessary details such as the date of donation and estimated value.

- Fill out any required information on the receipt, if applicable, such as your name and address.

- Keep a copy of the receipt for your records, as it will be needed for tax filing.

Legal use of the A Printable Tax Receipt Shoes 2 Share

The legal use of the A Printable Tax Receipt Shoes 2 Share is governed by IRS regulations regarding charitable donations. To be considered valid, the receipt must include specific information, such as the name of the charity, the date of the donation, and a description of the donated items. This documentation is crucial for taxpayers seeking to claim deductions on their income tax returns. Failure to provide proper receipts may result in disallowed deductions during an audit.

IRS Guidelines

The IRS has established guidelines for documenting charitable contributions, including the use of receipts like the A Printable Tax Receipt Shoes 2 Share. According to IRS rules, taxpayers must maintain records of any donations valued at more than $250. The receipt should clearly state the amount donated, the date, and the organization’s name. Additionally, for non-cash donations, such as shoes, it is recommended to provide a fair market value estimate to support the deduction claimed on tax returns.

Filing Deadlines / Important Dates

When dealing with the A Printable Tax Receipt Shoes 2 Share, it is essential to be aware of key filing deadlines. Tax returns in the United States are generally due on April fifteenth each year. If you plan to claim a deduction for your shoe donation, ensure that you have the receipt in hand by this date. Additionally, if you file for an extension, be mindful of the extended deadline, which typically falls on October fifteenth. Keeping track of these dates ensures compliance with tax regulations.

Examples of using the A Printable Tax Receipt Shoes 2 Share

Examples of using the A Printable Tax Receipt Shoes 2 Share include various scenarios where individuals donate shoes to charitable organizations. For instance, a person may donate gently used shoes to a local nonprofit that provides footwear to those in need. Upon donation, they receive the printable tax receipt, which they then use to claim a deduction on their tax return. Another example could be a community drive where multiple individuals contribute shoes, and the organizer collects receipts to distribute to donors for tax purposes.

Quick guide on how to complete a printable tax receipt shoes 2 share

Complete A Printable Tax Receipt Shoes 2 Share seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without any hold-ups. Manage A Printable Tax Receipt Shoes 2 Share on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest method to revise and eSign A Printable Tax Receipt Shoes 2 Share with ease

- Find A Printable Tax Receipt Shoes 2 Share and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device of your choice. Revise and eSign A Printable Tax Receipt Shoes 2 Share and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the a printable tax receipt shoes 2 share

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is A Printable Tax Receipt Shoes 2 Share?

A Printable Tax Receipt Shoes 2 Share is a specific document that acknowledges your purchase or donation of shoes to Shoes 2 Share, allowing you to claim tax deductions for your contributions. This receipt is designed to be easy to print and keep for your records, providing you with a seamless way to manage your charitable contributions.

-

How can I obtain A Printable Tax Receipt Shoes 2 Share?

You can obtain A Printable Tax Receipt Shoes 2 Share by making a donation or purchase through the Shoes 2 Share website. Once your transaction is complete, you will be provided with the option to download and print your receipt instantly for your records and tax purposes.

-

Is there a cost associated with obtaining A Printable Tax Receipt Shoes 2 Share?

There is no cost associated with receiving A Printable Tax Receipt Shoes 2 Share itself, as it is generated upon your purchase or donation to Shoes 2 Share. However, the purchase or donation you make will determine the value of the receipt for tax purposes.

-

What benefits does A Printable Tax Receipt Shoes 2 Share offer?

A Printable Tax Receipt Shoes 2 Share offers signNow tax benefits, allowing you to claim deductions on your tax returns for charitable contributions. Additionally, it provides a clear record of your generosity, helping you keep track of your charitable activities throughout the year.

-

Can I customize A Printable Tax Receipt Shoes 2 Share?

A Printable Tax Receipt Shoes 2 Share has a standard format to comply with tax regulations, but it includes essential details like your name, the date of the transaction, and the amount donated. This ensures clarity and accuracy for your records while meeting IRS standards.

-

Is A Printable Tax Receipt Shoes 2 Share accepted by all tax authorities?

Yes, A Printable Tax Receipt Shoes 2 Share is formatted to meet the guidelines set by the IRS and should be accepted by tax authorities when submitted alongside your tax return. Always ensure that your receipt contains all necessary details for compliance.

-

What integration options are available for A Printable Tax Receipt Shoes 2 Share?

airSlate SignNow allows for easy integration with various software, enabling you to manage your donations and receipt generation seamlessly. Whether you use accounting software or spreadsheet tools, you can streamline the process of tracking A Printable Tax Receipt Shoes 2 Share.

Get more for A Printable Tax Receipt Shoes 2 Share

- Club risk assessment form japfest

- Club risk assessment form we ask all clubs that ar

- Your cooperation by fully completing the requested information

- Speak engagement contract template form

- Speaker speaker contract template form

- Speaker engagement contract template form

- Speakers contract template form

- Special event contract template form

Find out other A Printable Tax Receipt Shoes 2 Share

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien