Fsa 851 Form

What is the FSA 851?

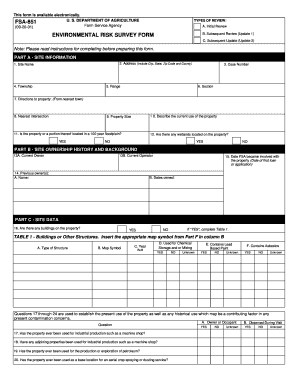

The FSA 851 is a form utilized in the United States for environmental assessments related to agricultural practices. This form is essential for farmers and landowners who are seeking to ensure compliance with environmental regulations while managing their agricultural operations. The FSA 851 form collects data regarding land use, conservation practices, and environmental impacts, which helps in evaluating the sustainability of farming practices. Proper completion of this form is crucial for obtaining necessary approvals and funding for environmental programs.

How to Use the FSA 851

Using the FSA 851 involves several steps to ensure accurate completion and submission. First, gather all relevant information about your agricultural practices and land usage. This includes details about crop types, conservation measures, and any previous environmental assessments. Next, fill out the form with this information, ensuring that all sections are completed accurately. Once filled out, review the form for any errors or omissions before submission. It is recommended to keep a copy for your records. Finally, submit the form to the appropriate local USDA office or designated agency for processing.

Steps to Complete the FSA 851

Completing the FSA 851 requires careful attention to detail. Follow these steps:

- Gather necessary documents, including land ownership records and previous environmental assessments.

- Fill out the form, providing accurate information about land use and conservation practices.

- Review the completed form for accuracy and completeness.

- Sign and date the form to certify that the information provided is true and correct.

- Submit the form to your local USDA office.

Legal Use of the FSA 851

The FSA 851 form is legally binding when completed and submitted according to USDA regulations. It serves as a formal declaration of the environmental practices employed on agricultural land. Compliance with the requirements outlined in the form is necessary to avoid potential legal repercussions, including fines or loss of eligibility for federal programs. Understanding the legal implications of the information provided is essential for landowners and farmers to ensure they are meeting all regulatory obligations.

Key Elements of the FSA 851

Several key elements are critical when filling out the FSA 851. These include:

- Identification of the landowner and property location.

- Details on the types of crops grown and farming practices used.

- Information regarding conservation efforts and environmental impact assessments.

- Signatures of the landowner or authorized representative.

Each of these elements plays a vital role in ensuring that the form meets regulatory standards and accurately reflects the environmental practices of the agricultural operation.

Who Issues the Form

The FSA 851 form is issued by the United States Department of Agriculture (USDA). The USDA is responsible for overseeing agricultural practices and ensuring compliance with environmental regulations. Local USDA offices provide resources and assistance for farmers and landowners in completing the form and understanding its requirements. It is important to consult with these offices for any specific guidance related to the FSA 851.

Quick guide on how to complete fsa 851

Effortlessly Prepare Fsa 851 on Any Device

Managing documents online has become increasingly popular among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Fsa 851 on any platform through airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Edit and Electronically Sign Fsa 851 with Ease

- Find Fsa 851 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or mistakes that require printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Fsa 851 to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fsa 851

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FSA 851 and how does it relate to airSlate SignNow?

FSA 851 refers to a specific account structure used in financial services for managing flexible spending accounts. airSlate SignNow offers an easy-to-use platform that supports the management of documents related to FSA 851, making it simple for businesses to send and eSign necessary forms efficiently.

-

How can I integrate FSA 851 documents into airSlate SignNow?

Integrating FSA 851 documents into airSlate SignNow is seamless. You can upload your documents directly into the platform, customize them, and then send them out for eSignature. Our user-friendly interface ensures that you can easily handle all FSA 851 related paperwork.

-

What features does airSlate SignNow provide for managing FSA 851?

airSlate SignNow provides a range of features designed specifically for managing FSA 851 documents, such as customizable templates, automated workflows, and secure electronic signatures. These features streamline your document handling process, ensuring compliance with FSA regulations while enhancing efficiency.

-

Is there a cost associated with using airSlate SignNow for FSA 851 management?

Yes, there is a cost for utilizing airSlate SignNow for FSA 851 management; however, it is a cost-effective solution. Our pricing plans cater to businesses of all sizes, ensuring you can find a package that meets your needs without exceeding your budget.

-

What are the benefits of eSigning FSA 851 documents with airSlate SignNow?

eSigning FSA 851 documents with airSlate SignNow offers numerous benefits, including faster processing times, enhanced security, and reduced paperwork. By adopting our solution, businesses can streamline their administrative tasks and improve overall efficiency.

-

Can airSlate SignNow help with compliance for FSA 851 documentation?

Absolutely! airSlate SignNow is designed to help maintain compliance with FSA 851 documentation requirements by offering secure storage and audit trails for all signed documents. This level of documentation support ensures that businesses can stay compliant with regulatory standards.

-

What integrations does airSlate SignNow offer for handling FSA 851 processes?

airSlate SignNow integrates with various services and applications to help manage FSA 851 processes efficiently. These integrations include CRM systems, project management tools, and data storage solutions, ensuring a smooth workflow and enhanced productivity.

Get more for Fsa 851

Find out other Fsa 851

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template