CD 405 Corporation Tax Return N C Department of Form

What is the CD 405 Corporation Tax Return N C Department Of

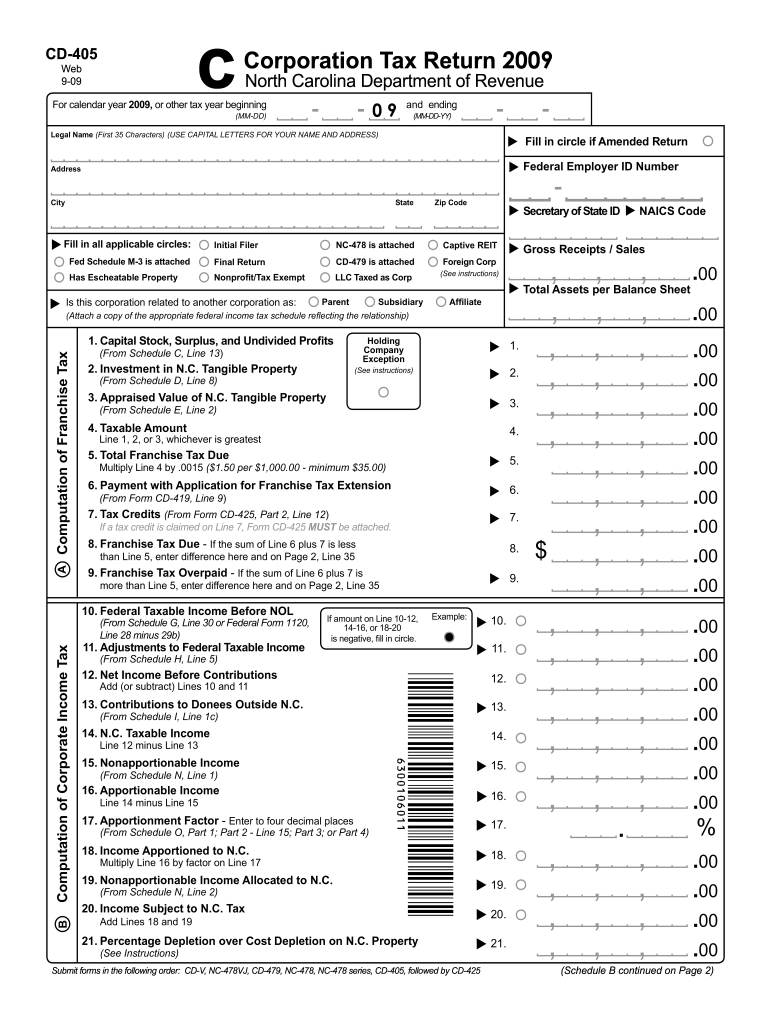

The CD 405 Corporation Tax Return is a specific form required by the North Carolina Department of Revenue for corporations operating within the state. This form is essential for reporting the income, deductions, and credits of a corporation, ensuring compliance with state tax laws. It serves as a means for the state to assess the corporation's tax liability based on its financial activities during the fiscal year.

Steps to complete the CD 405 Corporation Tax Return N C Department Of

Completing the CD 405 Corporation Tax Return involves several key steps:

- Gather financial records, including income statements and balance sheets.

- Calculate total income and allowable deductions for the tax year.

- Fill out the CD 405 form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the North Carolina Department of Revenue by the designated deadline.

Legal use of the CD 405 Corporation Tax Return N C Department Of

The CD 405 Corporation Tax Return is legally binding when completed and submitted in accordance with North Carolina tax laws. It must be signed by an authorized representative of the corporation, ensuring that the information provided is accurate and truthful. Failure to comply with the legal requirements of this form can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the CD 405 Corporation Tax Return. Generally, the form is due on the 15th day of the fourth month following the end of the corporation's fiscal year. It is crucial to be aware of these dates to avoid late filing penalties and ensure timely compliance with state tax regulations.

Required Documents

To successfully complete the CD 405 Corporation Tax Return, corporations need to prepare several documents, including:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets, liabilities, and equity.

- Documentation of any tax credits or deductions claimed.

- Prior year tax returns for reference.

Form Submission Methods (Online / Mail / In-Person)

The CD 405 Corporation Tax Return can be submitted through various methods to accommodate different preferences:

- Online submission via the North Carolina Department of Revenue's e-filing system.

- Mailing a printed copy of the completed form to the appropriate address.

- In-person submission at designated state revenue offices.

Quick guide on how to complete cd 405 corporation tax return n c department of

Complete CD 405 Corporation Tax Return N C Department Of effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage CD 405 Corporation Tax Return N C Department Of on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign CD 405 Corporation Tax Return N C Department Of with ease

- Locate CD 405 Corporation Tax Return N C Department Of and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow provides explicitly for that purpose.

- Craft your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document printouts. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and eSign CD 405 Corporation Tax Return N C Department Of and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cd 405 corporation tax return n c department of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CD 405 Corporation Tax Return N C Department Of?

The CD 405 Corporation Tax Return N C Department Of is a tax form necessary for corporations operating in North Carolina to report their income, deductions, and tax liability. This form ensures compliance with state tax regulations and is essential for accurate tax reporting.

-

How can airSlate SignNow assist with the CD 405 Corporation Tax Return N C Department Of?

airSlate SignNow provides a streamlined process for electronically signing and submitting the CD 405 Corporation Tax Return N C Department Of. With our user-friendly interface, businesses can efficiently manage their tax documents and ensure timely filing.

-

What are the costs associated with using airSlate SignNow for CD 405 Corporation Tax Return N C Department Of?

AirSlate SignNow offers various pricing plans to suit different business needs, including options for managing the CD 405 Corporation Tax Return N C Department Of. Our pricing is competitive, providing a cost-effective solution for signing and managing tax-related documents.

-

Are there specific features for handling the CD 405 Corporation Tax Return N C Department Of in airSlate SignNow?

Yes, airSlate SignNow includes features tailored for the CD 405 Corporation Tax Return N C Department Of, such as customizable templates, cloud storage, and tracking capabilities. These tools help ensure that your corporate tax forms are prepared and submitted accurately.

-

What are the benefits of using airSlate SignNow for the CD 405 Corporation Tax Return N C Department Of?

Using airSlate SignNow for the CD 405 Corporation Tax Return N C Department Of streamlines the filing process, reduces paperwork, and minimizes errors. Our platform enhances collaboration among team members, allowing for faster approvals and seamless document management.

-

Can I integrate airSlate SignNow with my accounting software for the CD 405 Corporation Tax Return N C Department Of?

Absolutely! airSlate SignNow offers integration capabilities with various accounting software, making it easy to import data for the CD 405 Corporation Tax Return N C Department Of. This integration simplifies the tax preparation process, ensuring all information is accurate and up-to-date.

-

Is support available when completing the CD 405 Corporation Tax Return N C Department Of with airSlate SignNow?

Yes, airSlate SignNow provides dedicated support for users navigating the CD 405 Corporation Tax Return N C Department Of. Our team is available to assist you with any questions or issues you may encounter during the eSigning and submission process.

Get more for CD 405 Corporation Tax Return N C Department Of

- New bookkeeping client intake form pdf 33996500

- Cardiovascular system worksheet pdf form

- Home health aide care plan pdf form

- Msf 4201 form

- Indiana driving skills test checklist form

- Chase voice authorization denial code 606 form

- Wedding decor rental contract template form

- Applying for benefits new york state comptroller form

Find out other CD 405 Corporation Tax Return N C Department Of

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast