DOMESTIC PARTNER DECLARATION Benefits from MetLife Form

What is the Domestic Partner Declaration Benefits From MetLife

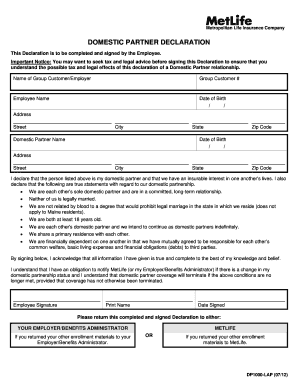

The Domestic Partner Declaration Benefits from MetLife is a formal document that allows employees to declare their domestic partnership for the purpose of accessing specific benefits offered by MetLife. This declaration is essential for partners who live together and share a domestic life but are not legally married. By completing this form, employees can ensure that their domestic partners are eligible for health insurance and other benefits typically reserved for spouses, thereby extending vital support to their loved ones.

Steps to Complete the Domestic Partner Declaration Benefits From MetLife

Completing the Domestic Partner Declaration Benefits from MetLife involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your domestic partner, including full name, date of birth, and social security number. Next, fill out the form with accurate details, ensuring that both partners sign where required. It is crucial to review the completed form for any errors before submission. Once finalized, submit the form according to the instructions provided, either online or by mail, ensuring that you keep a copy for your records.

Legal Use of the Domestic Partner Declaration Benefits From MetLife

The legal use of the Domestic Partner Declaration Benefits from MetLife hinges on compliance with applicable laws and regulations. This form serves as a declaration that can be recognized by employers and insurance providers, establishing the legitimacy of the domestic partnership. It is important to understand that the legal recognition of domestic partnerships can vary by state, so it is advisable to consult local laws to ensure that your declaration meets all necessary legal standards.

Key Elements of the Domestic Partner Declaration Benefits From MetLife

Several key elements must be included in the Domestic Partner Declaration Benefits from MetLife to ensure its validity. These elements typically include the full names and contact information of both partners, a statement affirming the domestic partnership, and signatures from both parties. Additionally, the form may require the date of the declaration and any other pertinent details that demonstrate the nature of the partnership. Ensuring that all required elements are present can help avoid delays in processing the benefits.

Eligibility Criteria for the Domestic Partner Declaration Benefits From MetLife

To be eligible for the Domestic Partner Declaration Benefits from MetLife, both partners must meet specific criteria. Generally, partners must reside together and share a committed relationship that is akin to marriage. They should not be related by blood in a way that would prohibit marriage in their state, and both partners must be at least eighteen years old. Additionally, the partnership should be exclusive, meaning that neither partner is involved in a similar relationship with anyone else. Understanding these criteria can help ensure that the declaration is valid and accepted.

IRS Guidelines Related to Domestic Partner Benefits

IRS guidelines play a significant role in the taxation of benefits provided to domestic partners. According to IRS regulations, employers must treat the value of health insurance coverage provided to domestic partners as imputed income, which may affect the tax obligations of the employee. This means that the employee may need to report the value of the benefits on their tax return, potentially leading to higher taxable income. It is essential for individuals to consult with a tax professional to understand how these guidelines apply to their specific situation.

Form Submission Methods for the Domestic Partner Declaration Benefits From MetLife

Submitting the Domestic Partner Declaration Benefits from MetLife can typically be done through various methods, depending on the employer's policies. Common submission methods include online submission via the employer's benefits portal, mailing a hard copy of the completed form to the HR department, or delivering it in person. Each method has its own advantages, such as immediate processing for online submissions or the ability to confirm receipt when delivering in person. It is advisable to choose a method that aligns with your preferences and the requirements set by your employer.

Quick guide on how to complete domestic partner declaration benefits from metlife

Complete DOMESTIC PARTNER DECLARATION Benefits From MetLife seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-conscious substitute for conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Handle DOMESTIC PARTNER DECLARATION Benefits From MetLife on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to alter and electronically sign DOMESTIC PARTNER DECLARATION Benefits From MetLife effortlessly

- Locate DOMESTIC PARTNER DECLARATION Benefits From MetLife and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools provided specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes moments and carries the same legal authority as a traditional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign DOMESTIC PARTNER DECLARATION Benefits From MetLife to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the domestic partner declaration benefits from metlife

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is metlifeca com and how does it relate to airSlate SignNow?

Metlifeca com is an online platform that provides users with access to various services, including document management. airSlate SignNow integrates seamlessly with metlifeca com, allowing users to easily send, sign, and manage documents efficiently.

-

How much does airSlate SignNow cost for users from metlifeca com?

Pricing for airSlate SignNow varies depending on the plan selected. Users visiting metlifeca com can choose from different subscription tiers that best fit their business needs, with a focus on delivering a cost-effective eSignature solution.

-

What features does airSlate SignNow offer to metlifeca com users?

AirSlate SignNow provides a range of features including document templates, real-time tracking, and multi-party signing. Users accessing metlifeca com can leverage these features to enhance their document workflows and streamline their processes.

-

What are the benefits of using airSlate SignNow available on metlifeca com?

Using airSlate SignNow improves efficiency and reduces turnaround time for documentation processes. Users on metlifeca com will benefit from increased productivity, enhanced security, and the flexibility of electronic signatures.

-

Can I integrate airSlate SignNow with other applications through metlifeca com?

Yes, airSlate SignNow supports integration with various applications and platforms. When using metlifeca com, users can connect their existing tools and services to streamline their workflows and improve overall efficiency.

-

Is airSlate SignNow secure for users accessing it via metlifeca com?

Absolutely! airSlate SignNow employs robust security measures to protect your documents and data. Users who access the platform through metlifeca com can trust that their information remains secure and confidential throughout the signing process.

-

How can I get support for airSlate SignNow if I access it through metlifeca com?

Users can access dedicated support for airSlate SignNow through metlifeca com. Whether it's through live chat, email support, or a comprehensive help center, assistance is readily available to address any issues or queries.

Get more for DOMESTIC PARTNER DECLARATION Benefits From MetLife

Find out other DOMESTIC PARTNER DECLARATION Benefits From MetLife

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT