Sole Proprietery Resolution of Authority 2003-2026

Understanding the Sole Proprietorship Resolution of Authority

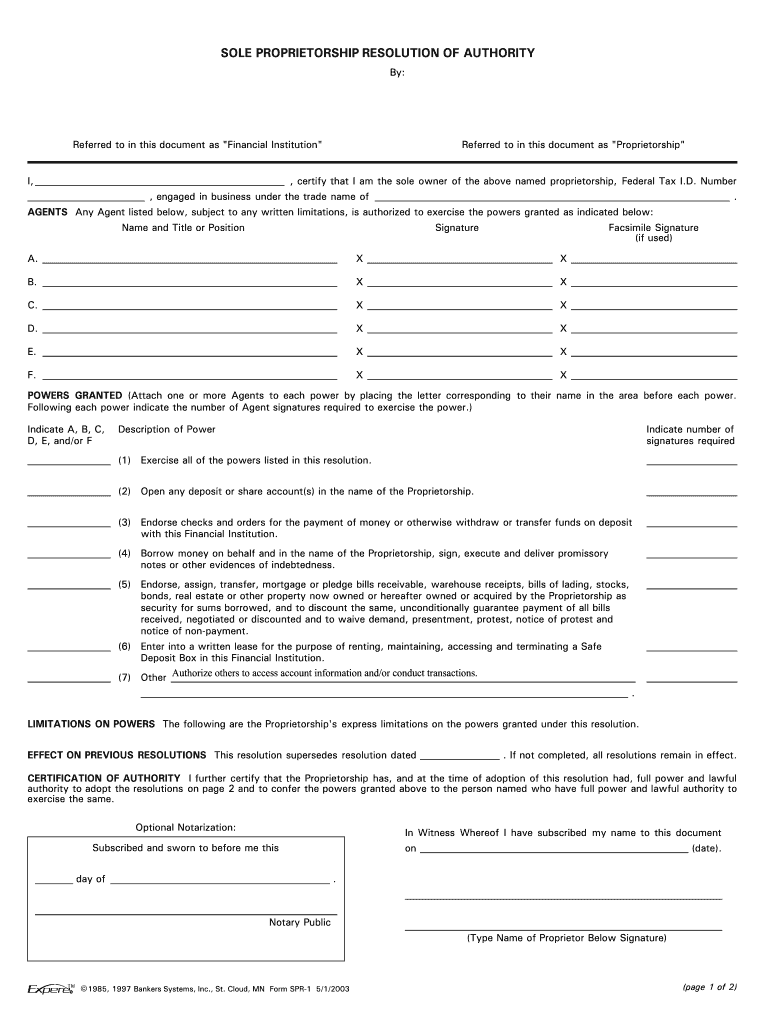

The Sole Proprietorship Resolution of Authority is a crucial document that grants specific powers to the owner of a sole proprietorship. This form outlines the authority of the sole proprietor to make decisions on behalf of the business, including entering contracts, opening bank accounts, and managing finances. It serves as a formal declaration that the individual has the legal capacity to act in the business's best interests, ensuring clarity and accountability in operations.

Steps to Complete the Sole Proprietorship Resolution of Authority

Completing the Sole Proprietorship Resolution of Authority involves several key steps:

- Gather necessary information, such as your business name, address, and the specific powers you wish to grant.

- Fill out the resolution form, ensuring all fields are completed accurately.

- Sign and date the document to validate it.

- Store the completed resolution in a secure location, as it may be required for various business transactions.

Legal Use of the Sole Proprietorship Resolution of Authority

This resolution is legally binding and can be used in various situations, such as when opening a business bank account or entering into contracts. It provides third parties with assurance that the sole proprietor has the authority to act on behalf of the business. Ensuring that this document is properly executed can help prevent disputes and misunderstandings in business dealings.

Key Elements of the Sole Proprietorship Resolution of Authority

When drafting the Sole Proprietorship Resolution of Authority, it is important to include the following elements:

- The name of the sole proprietor and the business.

- A clear statement of the authority being granted.

- The date of the resolution.

- The signature of the sole proprietor.

Required Documents for the Sole Proprietorship Resolution of Authority

To complete the Sole Proprietorship Resolution of Authority, you typically need the following documents:

- A copy of your business license or registration.

- Identification, such as a driver's license or passport.

- Any previous resolutions or documents related to business authority, if applicable.

Examples of Using the Sole Proprietorship Resolution of Authority

Common scenarios where the Sole Proprietorship Resolution of Authority is utilized include:

- Opening a business bank account to manage finances.

- Signing contracts with vendors or clients.

- Applying for business loans or credit.

Filing Deadlines and Important Dates

While the Sole Proprietorship Resolution of Authority does not have specific filing deadlines, it is advisable to complete it before engaging in significant business transactions. Keeping the resolution updated is also important, especially if there are changes in authority or business structure.

Quick guide on how to complete sole proprietorship resolution form

Manage Sole Proprietery Resolution Of Authority from anywhere, anytime

Your daily business activities might necessitate additional attention when handling state-specific documentation. Reclaim your working hours and reduce paper costs associated with document-based processes using airSlate SignNow. airSlate SignNow provides you with a variety of pre-uploaded business documents, including Sole Proprietery Resolution Of Authority, which you can utilize and share with your business associates. Handle your Sole Proprietery Resolution Of Authority seamlessly with powerful editing and eSignature functionalities and send it directly to your recipients.

How to obtain Sole Proprietery Resolution Of Authority in just a few clicks:

- Select a form relevant to your state.

- Click Learn More to open the document and verify its accuracy.

- Choose Get Form to start using it.

- Sole Proprietery Resolution Of Authority will automatically open in the editor. No further steps are necessary.

- Utilize airSlate SignNow’s advanced editing tools to complete or modify the form.

- Click the Sign tool to create your unique signature and eSign your document.

- Once ready, simply click Done, save changes, and access your document.

- Distribute the form via email or SMS, or opt for a link-to-fill feature with your associates or allow them to download the document.

airSlate SignNow signNowly saves your time managing Sole Proprietery Resolution Of Authority and enables you to find vital documents all in one place. An extensive collection of forms is organized and designed to address essential business operations required for your organization. The advanced editor minimizes the chances of errors, allowing you to easily correct mistakes and review your documents on any device prior to sending them out. Start your free trial today to explore all the benefits of airSlate SignNow for your daily business operations.

Create this form in 5 minutes or less

FAQs

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I fill out a W9 if I am a sole-proprietorship operating with a DBA?

Put your name on line 1 and the business name on line 2. Use your social security number or if you have an EIN for the business, you can use that.

-

When starting out on Amazon FBA, is it better to form an LLC or sole proprietorship?

This depends on a range of factors. Here are a few questions to consider:How seriously are you planning to take your FBA business?How much money are you prepared to commit to getting started?What type of products are you selling? Are they high-risk goods such as nutritional supplements and electronics containing lithium-ion batteries?Let’s take a look at this question from a few different angles…Liability:LLC stands for ‘limited liability company’ - by conducting your business through an LLC, you are limiting your downside risk to the total amount invested in the company.Sole proprietors have unlimited liability. In other words, if something goes seriously wrong with a product that you’ve sold and you are found to be responsible, then your liability extends to all assets that you personally own.Cost:The cost of incorporating an LLC varies by state. Fees begin around $40USD. There are also additional fees that you need to be aware of - such as publishing a formal notification of the creation of your company in the local paper and lawyer’s fees.You don’t need to register to trade as a sole proprietor, so this option is free.Convenience:Incorporating an LLC takes a little bit of work. However, if you are going to begin as a sole trader, it is very simple to get started with FBA.If you want to test out Amazon FBA as an individual seller before committing more resources, then by all means, begin as a sole proprietor. However, if you start selling larger volumes or decide to take your Amazon business more seriously, then make sure to set up an appropriate legal structure to protect yourself from downside risk.

-

Being in a sole proprietorship business in the Philippines, do I need to fill out any W8/W9 forms in order to be paid by a company that was recently bought by a US corporation?

NOT a W-9 as that is for domestic vendors.You do not even have to fill out a W-8BEN (probably the actual correct form) if you wish to have US taxes taken out of your payments and paid to the IRS. It is only required if you wish to have no US taxes withheld on your payment.

-

How are sole proprietorships started?

The sole proprietorship is the simplest business form and is not a legal entity. Sole proprietorship is the easiest type of business to establish which means that there’s no state filing required. It is simply an enterprise owned and operated by an individual. By default, once you start selling goods or services, you have created a sole proprietorship. So there’s no actual filing requirements and you simply report your business’s earnings on your personal taxes. A sole proprietorship is not legally separate from its owner and it offers no personal liability protection. The law does not distinguish between the owner’s personal assets and the business’s obligations. In fact, a sole proprietor’s assets can be and often are used to satisfy the debts and liabilities of the business. In other words, if your business gets sued, your personal assets (such as your house, car, or any other properties you own) may also be in risk. Accidents happen, and businesses end all the time. Such circumstances may quickly become a nightmare for a business owner who operates as a sole proprietor.In my course, LLC or Corporation - Choosing the Correct Business Structure, you can learn how sole proprietorship and other common business structures are formed. Feel free to contact me if you if you have any other questions about how to protect yourself from liability.Best of luck!

-

How does a sole proprietorship firm in India fill the W-8BEN-E?

This form is used by foreign entities to document their status for some code provision in the US. so if you are a registered entity in India then you can fill up the same but there is myth i.e Sole Proprietorship Firm is a registered legal entity.Basically there is no proper legal registration or way to register the sole proprietorship firm. in the solo firm you got only the tax registration or some other local license. so for the filings any above forms you have to register the legal entity like Pvt ltd company or LLP or OPC etc.in the US pvt ltd company is similar to the INC Corporation & LLP is similar to LLC.

-

If business can be carried out in a sole proprietorship format, then why do we form a pvt. Ltd company?

We are listing down the advantages of a Private Limited Company over a Sole Proprietorship .Ease of raising Seed and Venture Capital: -If you’re planning on raising Seed or Venture Capital then only a Private Limited Company makes sense. Angels, Seed Funds or Venture Capitalists only fund a Private Limited Company.Limited Liability: -The liability of the shareholders of a Private Limited Company is Limited to their Shareholding. Thus, if the Private Limited Company makes a Loss, shareholders will not pay the Loss beyond their Unpaid Share Capital.On the other hand a Sole Proprietorship has unlimited liability, therefore personal assets can be at risk.Separate Legal Entity: -A Private Limited Company is separate and distinct from its Shareholders and Directors. It can buy and sell property, enter into contracts, sue or be sued upon in its own name. The death, insanity, incapacity or insolvency of its shareholders and/or directors does not affect the existence or business of the Company in any way.A Sole Proprietorship is a legal entity which is not distinguishable from its owner and itself.Perpetual Existence: -Once formed, a Private Limited Company has a life-time existence until and unless it is liquidated.A Sole Proprietorship does not have Perpetual Existence.A good way to reward and retain talent-ESOP’s: -The success of a business depends on the quality of their team. It is therefore necessary for businesses to retain and attract talent. A Private Limited Company can issue ESOP’s or Sweat Equity Shares to deserving employees in order to retain and reward them.This is not possible if business is registered as a Proprietorship.Feel free to comment here or contact us on + 91 79778–63125 / info@businessguru.co.in to clear your doubts.

-

What ITR form should one fill to file his income tax returns in India for AY 2018-19 if he is a salaried employee and he also owns a sole proprietorship firm?

ITR 3 or 4 will be applicable.Accounting for the firm should be properly done and financial statements should be adequately prepared for the purpose of recording it in the ITR. Any TDS deducted on the incomes should also be properly captured in the ITR.Best regards,Aditiaditi.bhardwaj@outlook.com

-

How do I form a sole proprietorship job consultancy firm in Kolkata?

Traditionally, businesses in this sector incorporate their business as Private Limited Company, yet you can test your business model as a Sole Proprietorship firm.Things to keep in mind:Professional Tax RegistrationShops and Establishment registration.In case of sole proprietorship firms, registration with MCA is not mandatory.Do drop your doubts at WAZZEER. COMHappy to help!ThanksRegards,Nithya

Create this form in 5 minutes!

How to create an eSignature for the sole proprietorship resolution form

How to generate an electronic signature for the Sole Proprietorship Resolution Form online

How to make an electronic signature for your Sole Proprietorship Resolution Form in Google Chrome

How to generate an eSignature for signing the Sole Proprietorship Resolution Form in Gmail

How to create an electronic signature for the Sole Proprietorship Resolution Form from your mobile device

How to generate an eSignature for the Sole Proprietorship Resolution Form on iOS devices

How to create an electronic signature for the Sole Proprietorship Resolution Form on Android OS

People also ask

-

What is a sole proprietorship form?

A sole proprietorship form is a legal document that establishes a business owned and operated by a single individual. This form is crucial for formalizing your business identity and can be easily completed using platforms like airSlate SignNow to streamline the eSigning process.

-

How can airSlate SignNow help me with my sole proprietorship form?

airSlate SignNow simplifies the process of creating and signing your sole proprietorship form. With our user-friendly interface, you can quickly draft, send, and eSign your documents, ensuring a hassle-free setup for your business.

-

Is there a cost associated with using airSlate SignNow for my sole proprietorship form?

Yes, airSlate SignNow offers various pricing plans tailored to meet your business needs. Whether you are a startup or a small business owner, you can choose a plan that allows you to manage your sole proprietorship form efficiently at a competitive price.

-

What features does airSlate SignNow offer for eSigning my sole proprietorship form?

airSlate SignNow provides several features that enhance the eSigning experience for your sole proprietorship form, including template storing, automated reminders, and secure cloud storage. These features ensure that your documents are not only signed quickly but also organized effectively.

-

Are there integrations available with airSlate SignNow for managing my sole proprietorship form?

Yes, airSlate SignNow seamlessly integrates with various applications, helping you manage your sole proprietorship form easily. This includes connections with CRM systems, cloud storage services, and various business tools to enhance your document workflow.

-

Can I customize my sole proprietorship form using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your sole proprietorship form according to your business needs. You can add your branding, modify fields, and set the order of signing to create a personalized experience for both you and your clients.

-

How secure is my sole proprietorship form when using airSlate SignNow?

Security is a top priority for airSlate SignNow. Your sole proprietorship form and all other documents are encrypted and stored securely in the cloud, ensuring that sensitive information remains private and protected from unauthorized access.

Get more for Sole Proprietery Resolution Of Authority

- Csefel feelings chart form

- Authorization for payoff form

- 7th grade book report form

- Confidential case inventory form

- Afm form t2c 1109447

- The continuing education plan retirementtermination form

- Oklahoma choctaw form

- Tr 235 officer039s declaration trial by written declaration traffic judicial council forms

Find out other Sole Proprietery Resolution Of Authority

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself