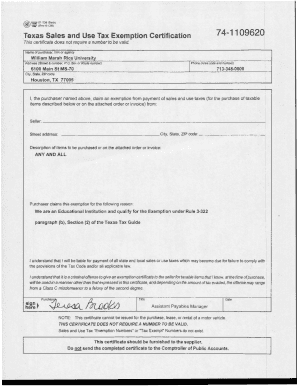

Rice Tax Exempt Form

What is the Rice Tax Exempt Form

The Rice Tax Exempt Form is a specific document utilized by organizations to claim tax-exempt status for purchases made for educational or charitable purposes. This form is particularly relevant for entities affiliated with Rice University, allowing them to avoid sales tax on qualifying purchases. By providing this form to vendors, the organization can ensure compliance with state tax laws while benefiting from the tax exemptions available to educational institutions.

How to Use the Rice Tax Exempt Form

Using the Rice Tax Exempt Form involves a straightforward process. First, ensure that the form is filled out completely with accurate information, including the name of the organization, tax identification number, and the purpose of the purchase. Once completed, present the form to the vendor at the time of purchase. It is essential to retain a copy of the form for your records, as it may be required for future audits or compliance checks.

Steps to Complete the Rice Tax Exempt Form

Completing the Rice Tax Exempt Form requires attention to detail. Follow these steps:

- Download the form from the appropriate source, ensuring it is the latest version.

- Fill in the organization’s name and address accurately.

- Provide the tax identification number issued by the IRS.

- Clearly state the purpose of the purchase to justify the tax exemption.

- Sign and date the form to validate it.

After completing these steps, the form is ready for submission to the vendor.

Legal Use of the Rice Tax Exempt Form

The legal use of the Rice Tax Exempt Form is governed by state tax regulations. This form must be used solely for purchases that qualify under the tax-exempt criteria established by state law. Misuse of the form, such as using it for personal purchases or non-qualifying items, can lead to penalties. It is crucial to understand the specific legal implications and ensure that all transactions are compliant with applicable tax laws.

Eligibility Criteria

To be eligible for using the Rice Tax Exempt Form, the organization must be recognized as a tax-exempt entity under IRS guidelines. Typically, this includes educational institutions, non-profit organizations, and other entities that serve a charitable purpose. The organization must also be in good standing with the state tax authority to maintain its eligibility for tax exemptions.

Required Documents

When preparing to use the Rice Tax Exempt Form, certain documents may be required to substantiate the claim for tax exemption. These may include:

- Proof of tax-exempt status from the IRS.

- Documentation of the purpose of the purchase.

- Identification details of the organization, such as a federal employer identification number (EIN).

Having these documents ready can facilitate a smoother transaction process and ensure compliance with tax regulations.

Form Submission Methods

The Rice Tax Exempt Form can be submitted in various ways, depending on the vendor's policies. Common submission methods include:

- In-person delivery at the time of purchase.

- Email submission, if the vendor accepts electronic copies.

- Faxing the completed form, where applicable.

It is advisable to confirm with the vendor regarding their preferred submission method to ensure acceptance of the form.

Quick guide on how to complete rice tax exempt form

Effortlessly Prepare Rice Tax Exempt Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Rice Tax Exempt Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related workflow today.

How to Modify and eSign Rice Tax Exempt Form with Ease

- Obtain Rice Tax Exempt Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and eSign Rice Tax Exempt Form to ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rice tax exempt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a rice tax exempt form and who needs it?

A rice tax exempt form is a specialized document that allows businesses and individuals to purchase rice without incurring sales tax. This form is particularly important for farmers, retailers, and distributors involved in the rice industry who want to maximize their profits by avoiding unnecessary tax costs.

-

How can airSlate SignNow help with filling out a rice tax exempt form?

airSlate SignNow offers an intuitive platform that makes filling out a rice tax exempt form simple and efficient. Users can easily upload the form, fill in their details, and securely eSign before sending it to relevant parties, ensuring a smooth transaction process without paper hassle.

-

Is there a cost involved when using airSlate SignNow for the rice tax exempt form?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs. Users can choose a plan that enables them to manage and send documents, including the rice tax exempt form, at a competitive price without compromising on features or usability.

-

What features does airSlate SignNow offer for managing a rice tax exempt form?

airSlate SignNow includes features such as customized templates for the rice tax exempt form, real-time tracking of document status, and secure storage options. These features streamline the completion process and help businesses manage their tax exemption documentation effectively.

-

Can airSlate SignNow integrate with other software for processing a rice tax exempt form?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRM systems, accounting software, and other business tools. This integration ensures that your rice tax exempt form data is synchronized across platforms, improving workflow efficiency.

-

What are the benefits of using airSlate SignNow for a rice tax exempt form?

Using airSlate SignNow for your rice tax exempt form provides numerous benefits, including reduced paperwork, faster processing times, and enhanced security for your sensitive information. This powerful platform helps businesses stay organized and compliant while saving both time and money.

-

How secure is the airSlate SignNow platform for handling a rice tax exempt form?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to safeguard your rice tax exempt form and all documents. Users can confidently send, sign, and store sensitive information, knowing that it remains protected from unauthorized access.

Get more for Rice Tax Exempt Form

- Wy bankruptcy form

- Bill of sale with warranty by individual seller wyoming form

- Bill of sale with warranty for corporate seller wyoming form

- Bill of sale without warranty by individual seller wyoming form

- Bill of sale without warranty by corporate seller wyoming form

- Verification of creditors matrix wyoming form

- Custody and child support modification information and instructions wyoming

- Petition modify form 497432364

Find out other Rice Tax Exempt Form

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip