Massmutual Application for Hardship Form

What is the Massmutual Application for Hardship?

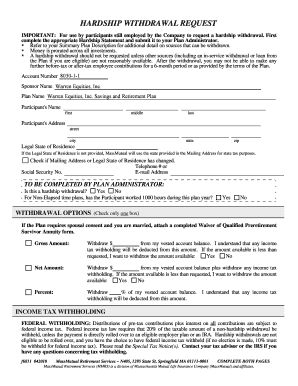

The Massmutual Application for Hardship is a specific form designed for individuals seeking to withdraw funds from their 401(k) plan due to financial difficulties. This application allows participants to request a distribution under the hardship withdrawal provisions set by the Internal Revenue Service (IRS). Hardship withdrawals can cover various needs, such as medical expenses, purchasing a primary residence, or preventing eviction. Understanding the purpose and function of this application is crucial for those who find themselves in urgent financial situations.

Eligibility Criteria for the Massmutual Application for Hardship

To qualify for a hardship withdrawal through the Massmutual Application for Hardship, applicants must meet specific criteria established by the IRS and their employer's plan. Generally, the following conditions apply:

- The withdrawal must be necessary to satisfy an immediate and urgent financial need.

- Applicants must have exhausted all other options for obtaining funds, such as loans from their 401(k) plan.

- Only certain expenses qualify, including medical bills, tuition payments, and home purchase costs.

It's essential for applicants to review their plan's specific guidelines, as these can vary by employer.

Steps to Complete the Massmutual Application for Hardship

Completing the Massmutual Application for Hardship involves several key steps to ensure that all necessary information is provided accurately. Here’s a simplified process:

- Gather required documentation that supports your hardship claim, such as medical bills or eviction notices.

- Access the Massmutual Application for Hardship form, which can typically be found on your employer's benefits portal.

- Fill out the form completely, ensuring that all personal and financial details are accurate.

- Attach the necessary documentation to your application.

- Submit the completed application through the designated method, whether online, by mail, or in person.

Following these steps carefully can help streamline the approval process.

Required Documents for the Massmutual Application for Hardship

When applying for a hardship withdrawal, specific documents are required to substantiate the claim. These typically include:

- Proof of the financial need, such as invoices or bills.

- Documentation showing that other resources have been exhausted, like bank statements.

- Any forms or signatures required by your employer’s plan.

Having these documents ready can facilitate a smoother application process and increase the chances of approval.

Legal Use of the Massmutual Application for Hardship

The Massmutual Application for Hardship must be completed and submitted in accordance with legal guidelines set by the IRS and your employer's retirement plan. It is crucial to provide truthful and accurate information, as any discrepancies can lead to penalties or denial of the application. Additionally, understanding the legal implications of withdrawing funds from a 401(k) can help applicants make informed decisions about their financial futures.

Form Submission Methods for the Massmutual Application for Hardship

Applicants can submit the Massmutual Application for Hardship through various methods, depending on their employer’s policies. Common submission methods include:

- Online submission via the employer's benefits portal.

- Mailing the completed form to the designated address provided by the employer.

- In-person submission at the employer's human resources department.

Choosing the appropriate submission method can help ensure that the application is processed promptly.

Quick guide on how to complete massmutual application for hardship

Effortlessly Prepare Massmutual Application For Hardship on Any Gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary format and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without any hold-ups. Manage Massmutual Application For Hardship on any gadget with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Alter and eSign Massmutual Application For Hardship with Ease

- Find Massmutual Application For Hardship and click on Get Form to initiate.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors requiring new document prints. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Modify and eSign Massmutual Application For Hardship and ensure effective communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the massmutual application for hardship

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the massmutual 401k enrollment form and how do I access it?

The massmutual 401k enrollment form is a document that allows employees to enroll in a 401(k) retirement plan offered by MassMutual. You can access this form through your company's HR department or directly on the MassMutual website. It is crucial for ensuring that you can start contributing to your retirement savings.

-

How do I fill out the massmutual 401k enrollment form?

Filling out the massmutual 401k enrollment form involves providing personal information such as your name, Social Security number, and employment details. Make sure to review the contribution choices and investment options before submitting the form to maximize your retirement savings potential.

-

What are the benefits of completing the massmutual 401k enrollment form?

Completing the massmutual 401k enrollment form allows you to begin saving for retirement with the potential for employer matching contributions. Additionally, it provides tax advantages that can help you grow your savings more efficiently over time.

-

Are there any costs associated with the massmutual 401k enrollment form?

Generally, there are no direct fees for completing the massmutual 401k enrollment form. However, be aware that there may be management fees associated with the investments you choose within your 401(k) plan. It’s advisable to read the plan disclosure documents for detailed information.

-

Can I update my massmutual 401k enrollment form later?

Yes, you can update your massmutual 401k enrollment form if your financial situation or retirement goals change. Usually, you can do this during open enrollment periods or if a qualifying life event occurs. Keep track of these opportunities to ensure your investment strategy aligns with your goals.

-

What features are offered with the massmutual 401k enrollment form?

The massmutual 401k enrollment form includes features such as customizable contribution levels, a variety of investment options, and the ability to manage your account online. These features aim to give you flexibility and control over your retirement planning.

-

How does the massmutual 401k enrollment form integrate with other financial tools?

The massmutual 401k enrollment form can integrate with various financial planning tools and software, allowing you to see a comprehensive view of your finances. This integration can help streamline your retirement planning and ensure that your overall strategy is on track.

Get more for Massmutual Application For Hardship

Find out other Massmutual Application For Hardship

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy