SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds Form

What is the SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds

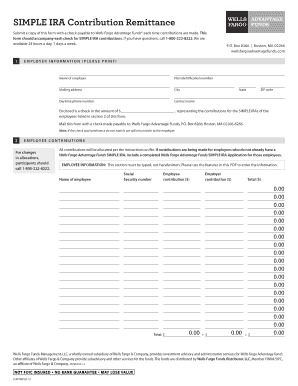

The SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds form is a document used by employers to submit employee contributions to a SIMPLE IRA plan. This plan is designed to help small businesses and their employees save for retirement. The contributions made through this form are typically deducted from employees' paychecks and are deposited into their individual SIMPLE IRA accounts. This form ensures that contributions are remitted accurately and in a timely manner, complying with IRS regulations.

Steps to complete the SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds

Completing the SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds form involves several key steps:

- Gather necessary employee information, including names, Social Security numbers, and contribution amounts.

- Fill out the form with accurate details, ensuring that all contributions are correctly calculated.

- Review the completed form for any errors or omissions before submission.

- Submit the form to Wells Fargo, either electronically or via mail, as per your preference.

Legal use of the SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds

The legal use of the SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds form is crucial for compliance with IRS regulations. This form must be filled out accurately to ensure that contributions are made correctly and on time. Failure to comply with IRS guidelines can result in penalties for both employers and employees. It is essential to maintain proper records of contributions and submissions to avoid any legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds form are critical for ensuring compliance. Contributions must be remitted to the financial institution by the due date specified by the IRS. Typically, contributions should be made as soon as possible after payroll deductions, but no later than the 15th day of the month following the month in which the contributions were withheld. Employers should keep track of these deadlines to avoid penalties.

Required Documents

To complete the SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds form, certain documents are required:

- Employee payroll records showing the amounts to be contributed.

- Completed SIMPLE IRA Contribution Remittance form.

- Any additional documentation required by Wells Fargo for processing contributions.

Eligibility Criteria

Eligibility for participating in a SIMPLE IRA plan is generally limited to small businesses with fewer than one hundred employees. Employees must also meet specific criteria, such as earning at least five thousand dollars in compensation during any two preceding years and expecting to earn at least five thousand dollars in the current year. Understanding these eligibility requirements is essential for both employers and employees to ensure compliance with IRS regulations.

Quick guide on how to complete simple ira contribution remittance wells fargo advantage funds

Easily Prepare SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents swiftly without delays. Manage SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Effortlessly Edit and eSign SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds

- Obtain SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds and click Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize important sections of your documents or hide confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the simple ira contribution remittance wells fargo advantage funds

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds?

The SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds is a retirement savings plan that allows employees to save for their future while benefiting from tax advantages. This plan is specifically designed for small businesses and offers flexible contribution options for both employers and employees.

-

How can I make contributions to my SIMPLE IRA through Wells Fargo Advantage Funds?

You can make contributions to your SIMPLE IRA through direct deposits or payroll deductions set up with your employer. Additionally, you can initiate direct contributions through your Wells Fargo Advantage Funds account, ensuring your funds are securely allocated to your retirement savings.

-

Are there any fees associated with the SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds?

While there may be some fees associated with account maintenance and transactions, the SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds typically offers a cost-effective structure that benefits small business owners and employees alike. It’s advisable to review the fee schedule provided by Wells Fargo to understand any potential costs.

-

What are the benefits of using the SIMPLE IRA Contribution Remittance with Wells Fargo Advantage Funds?

The SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds provides several benefits, including tax-deferred growth, low contribution limits suitable for small businesses, and employer matching options. This plan encourages employees to save for retirement while the employer can enjoy tax deductions for their contributions.

-

Can I change my contribution amount for the SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds?

Yes, you can adjust your contribution amount for the SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds during the designated enrollment periods. It’s important to communicate any changes to your employer or financial institution to ensure your retirement savings align with your financial goals.

-

How is the SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds integrated with airSlate SignNow?

airSlate SignNow offers seamless integration to streamline your document signing and remittance processes for SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds. This integration enables easy eSignatures on necessary documents, making the contribution process more efficient for all parties involved.

-

What documents do I need to provide for the SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds?

To set up your SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds, you will typically need to provide your identification, Social Security number, and employment details. Additional forms may be requested by Wells Fargo during the account setup to ensure compliance and secure processing of your contributions.

Get more for SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds

Find out other SIMPLE IRA Contribution Remittance Wells Fargo Advantage Funds

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure