Eftps Direct Payment Worksheet Long Form

What is the Eftps Direct Payment Worksheet Long Form

The Eftps Direct Payment Worksheet Long Form is a document used by taxpayers in the United States to facilitate electronic payments of federal taxes through the Electronic Federal Tax Payment System (EFTPS). This form is crucial for individuals and businesses who want to ensure their tax payments are processed accurately and on time. It provides a structured way to report payment details, including the type of tax, payment amount, and payment date. By using this worksheet, taxpayers can streamline their payment process and maintain compliance with IRS regulations.

How to use the Eftps Direct Payment Worksheet Long Form

Using the Eftps Direct Payment Worksheet Long Form involves several straightforward steps. First, gather all necessary information, such as your Employer Identification Number (EIN) or Social Security Number (SSN), the type of tax you are paying, and the payment amount. Next, fill out the worksheet by entering the required details in the designated fields. Ensure that all information is accurate to avoid delays in processing. Once completed, you can submit your payment electronically through the EFTPS website or by mail, depending on your preference.

Steps to complete the Eftps Direct Payment Worksheet Long Form

Completing the Eftps Direct Payment Worksheet Long Form requires careful attention to detail. Follow these steps for successful completion:

- Gather your tax identification information, including your EIN or SSN.

- Identify the type of tax you are paying, such as income tax, payroll tax, or estimated tax.

- Enter the payment amount accurately in the designated section.

- Specify the payment date, ensuring it aligns with IRS deadlines.

- Review all entries for accuracy before submission.

Legal use of the Eftps Direct Payment Worksheet Long Form

The Eftps Direct Payment Worksheet Long Form is legally recognized as a valid method for reporting and submitting federal tax payments. To ensure its legal standing, it must be completed accurately and submitted in accordance with IRS guidelines. The use of this form aligns with the requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act, which allows for electronic signatures and submissions in tax matters, provided that certain conditions are met.

Required Documents

When completing the Eftps Direct Payment Worksheet Long Form, certain documents may be required to ensure accuracy and compliance. These documents typically include:

- Your tax identification number (EIN or SSN).

- Any previous tax returns or payment records that may be relevant.

- Information regarding the specific type of tax being paid.

- Bank account details for electronic payment processing.

Form Submission Methods

The Eftps Direct Payment Worksheet Long Form can be submitted through various methods, allowing flexibility for taxpayers. The primary submission methods include:

- Online submission via the EFTPS website, which is the most efficient and secure method.

- Mailing a printed version of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if necessary.

Quick guide on how to complete eftps direct payment worksheet long form

Complete Eftps Direct Payment Worksheet Long Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without any holdups. Manage Eftps Direct Payment Worksheet Long Form on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The simplest method to modify and eSign Eftps Direct Payment Worksheet Long Form with ease

- Obtain Eftps Direct Payment Worksheet Long Form and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal power as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Eftps Direct Payment Worksheet Long Form and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the eftps direct payment worksheet long form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EFTPS direct payment worksheet long form PDF?

The EFTPS direct payment worksheet long form PDF is a detailed document designed to facilitate electronic tax payments. It allows users to efficiently organize and submit tax-related information directly to the IRS, simplifying the payment process for businesses.

-

How can I access the EFTPS direct payment worksheet long form PDF?

You can easily access the EFTPS direct payment worksheet long form PDF through the official IRS website or by using our airSlate SignNow platform, which provides convenient forms and templates for eSigning and document management.

-

Is there a cost associated with using the EFTPS direct payment worksheet long form PDF through airSlate SignNow?

While the EFTPS direct payment worksheet long form PDF itself is free from the IRS, using airSlate SignNow for electronic signatures and document management is a cost-effective solution. Check our pricing plans for options that best suit your business needs.

-

What features does airSlate SignNow offer for the EFTPS direct payment worksheet long form PDF?

airSlate SignNow offers features such as eSigning, document sharing, cloud storage, and template management for the EFTPS direct payment worksheet long form PDF. This makes it easy for businesses to handle their tax payments and compliance efficiently.

-

How does using the EFTPS direct payment worksheet long form PDF improve my business processes?

Using the EFTPS direct payment worksheet long form PDF streamlines your tax payment process, reduces paperwork, and minimizes errors. It allows businesses to focus on core activities while ensuring compliance with tax regulations.

-

Can I integrate airSlate SignNow with other tools while using the EFTPS direct payment worksheet long form PDF?

Yes, airSlate SignNow integrates with various tools and platforms, enhancing your experience with the EFTPS direct payment worksheet long form PDF. This allows for seamless communication and collaboration across your business applications.

-

What are the benefits of eSigning the EFTPS direct payment worksheet long form PDF?

eSigning the EFTPS direct payment worksheet long form PDF via airSlate SignNow provides security, speed, and convenience. It ensures that your documents are legally binding while allowing for quick turnaround times for tax payments.

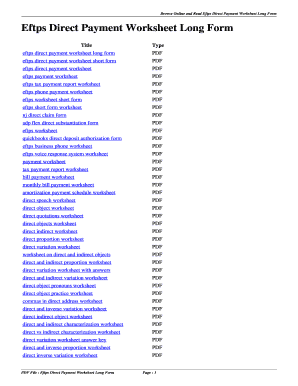

Get more for Eftps Direct Payment Worksheet Long Form

- Last will testament document form

- Wisconsin legal last will and testament form for a single person with minor children

- Alabama deed form

- Al widow form

- Arkansas legal last will and testament form for divorced person not remarried with adult children

- Arizona legal last will and testament form for married person with adult children from prior marriage

- California marital legal separation and property settlement agreement no children parties may have joint property or debts form

- California last will template form

Find out other Eftps Direct Payment Worksheet Long Form

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure