Form 14653

What is the Form 14653

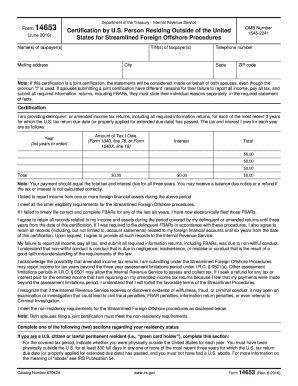

The Form 14653 is a document used primarily for tax purposes, specifically related to the IRS. This form is often utilized by taxpayers who need to report certain tax-related information or claim relief under specific circumstances. Understanding the purpose and requirements of Form 14653 is crucial for ensuring compliance with IRS regulations.

How to use the Form 14653

Using Form 14653 involves several steps to ensure accurate completion and submission. First, gather all necessary information related to your tax situation that the form requires. Next, carefully fill out each section of the form, ensuring that all details are correct. After completing the form, review it for any errors before submission. Depending on your situation, you may need to attach additional documentation to support your claims.

Steps to complete the Form 14653

Completing Form 14653 involves a systematic approach:

- Begin by downloading the Form 14653 PDF from a reliable source.

- Read the instructions carefully to understand what information is required.

- Fill in your personal details, including your name, address, and taxpayer identification number.

- Provide any additional information requested, ensuring accuracy.

- Review the completed form for correctness and completeness.

- Sign and date the form where indicated.

Legal use of the Form 14653

The legal use of Form 14653 is governed by IRS regulations. To ensure that the form is legally binding, it must be completed accurately and submitted according to IRS guidelines. Electronic signatures may be acceptable, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant laws. Ensuring compliance with these regulations is essential for the form to be considered valid.

How to obtain the Form 14653

Obtaining Form 14653 is straightforward. Taxpayers can download the form directly from the IRS website or other official tax resources. It is essential to ensure that you are using the most current version of the form to avoid any issues during the filing process. If you prefer a physical copy, you may also request one through the IRS or obtain it at local tax offices.

Filing Deadlines / Important Dates

Filing deadlines for Form 14653 can vary based on individual circumstances. Generally, taxpayers should be aware of the annual tax filing deadline, which is typically April 15. However, if you are claiming specific relief or adjustments, additional deadlines may apply. It is important to stay informed about these dates to ensure timely submission and avoid penalties.

Quick guide on how to complete form 14653

Prepare Form 14653 seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can obtain the correct document and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without interruptions. Manage Form 14653 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Form 14653 effortlessly

- Obtain Form 14653 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your document, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Form 14653 while ensuring outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14653

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 14653 and why is it important?

Form 14653 is a crucial document for tax purposes, specifically for individuals looking to streamline their foreign asset reporting. Understanding how to complete this form can save signNow time and effort in compliance and ensures that your financial records are accurate.

-

How can airSlate SignNow help with completing form 14653?

airSlate SignNow provides an easy-to-use platform to create, edit, and eSign form 14653. With customizable templates, users can efficiently fill out the necessary information and securely send documents for signatures, making the process straightforward.

-

What features of airSlate SignNow are beneficial for processing form 14653?

AirSlate SignNow offers features such as document sharing, secure eSigning, and real-time tracking, which are particularly beneficial for managing form 14653. These tools help ensure that your documents are signed promptly and efficiently, reducing administrative burdens.

-

Is there a cost associated with using airSlate SignNow for form 14653?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses handling form 14653 and similar documents. Each plan provides essential features that simplify document management, making it a cost-effective choice for any organization.

-

Can I integrate airSlate SignNow with other applications while handling form 14653?

Absolutely! airSlate SignNow seamlessly integrates with popular applications allowing for efficient handling of form 14653 alongside your existing workflows. This compatibility enhances productivity and ensures you can manage your documents from a centralized system.

-

What benefits does airSlate SignNow offer for businesses using form 14653?

Using airSlate SignNow for form 14653 brings numerous benefits, including improved security, faster processing, and easier collaboration among team members. These advantages ensure that your documentation process is both efficient and compliant with legal standards.

-

How does airSlate SignNow ensure compliance when processing form 14653?

AirSlate SignNow adheres to industry standards of security and compliance, ensuring that the handling of form 14653 meets all regulatory requirements. This commitment helps protect your sensitive information and gives you peace of mind throughout the signing process.

Get more for Form 14653

Find out other Form 14653

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later