Denver Sales Tax Login 2012

What is the Denver Sales Tax Login

The Denver Sales Tax Login is an online portal designed for businesses and individuals to manage their sales tax obligations within the city of Denver. This platform allows users to access their tax accounts, file sales tax returns, and make payments electronically. By using the Denver ebiz login, users can streamline their tax processes, ensuring compliance with local regulations while saving time and resources.

How to use the Denver Sales Tax Login

To effectively use the Denver Sales Tax Login, follow these steps:

- Visit the official Denver ebiz login page.

- Enter your username and password to access your account. If you do not have an account, you will need to register.

- Once logged in, navigate to the sales tax section to view your account details.

- From here, you can file returns, check payment status, and manage your tax information.

Steps to complete the Denver Sales Tax Login

Completing the login process involves several straightforward steps:

- Go to the Denver ebiz login page.

- Input your registered email address and password.

- Click on the login button to access your account.

- If you forget your password, use the recovery option to reset it.

Legal use of the Denver Sales Tax Login

The Denver Sales Tax Login is legally recognized for managing sales tax obligations. When used correctly, it provides a secure method for filing returns and making payments. Compliance with local tax laws is critical, and the platform ensures that all transactions are conducted in accordance with the applicable regulations. Users should keep their login credentials confidential to maintain the integrity of their accounts.

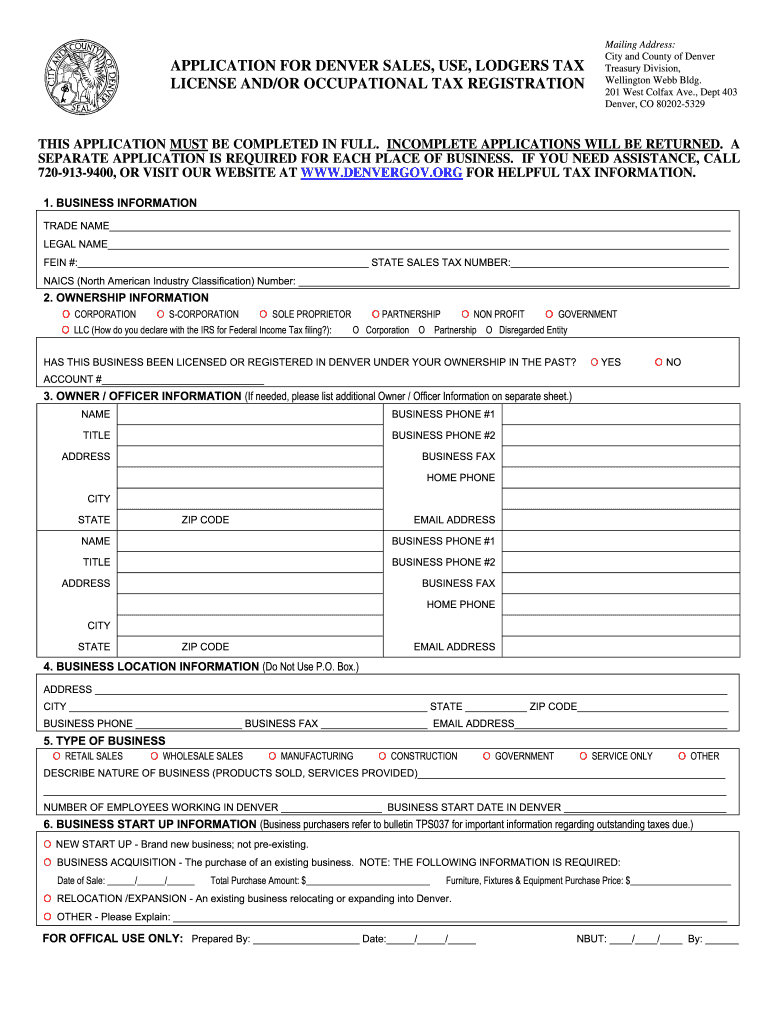

Required Documents

When using the Denver Sales Tax Login, certain documents may be required to complete transactions. These include:

- Your sales tax license number.

- Financial records related to sales and tax collected.

- Any previous tax returns filed with the city.

- Identification documents if registering for the first time.

Penalties for Non-Compliance

Failing to comply with sales tax regulations can result in significant penalties. Common consequences include:

- Fines for late payments or filings.

- Interest on unpaid taxes.

- Potential legal action for prolonged non-compliance.

It is crucial for users to stay informed about their tax obligations to avoid these penalties.

Quick guide on how to complete denver sales tax login

Complete Denver Sales Tax Login effortlessly on any device

Online document management has gained signNow popularity among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Denver Sales Tax Login on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Denver Sales Tax Login with ease

- Locate Denver Sales Tax Login and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive data using tools specifically provided by airSlate SignNow for those tasks.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or mislaid files, tiresome form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and eSign Denver Sales Tax Login and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct denver sales tax login

Create this form in 5 minutes!

How to create an eSignature for the denver sales tax login

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is denver ebiz login and how does it work?

The denver ebiz login is a secure portal for businesses in Denver to access airSlate SignNow's document signing and management features. By logging in, users can easily send, sign, and manage documents from anywhere, ensuring a streamlined workflow. It's designed to be user-friendly, making it accessible for all team members.

-

Is there a cost associated with denver ebiz login?

While the denver ebiz login itself is free, airSlate SignNow offers various pricing plans based on the features and services you need. These plans are designed to be cost-effective for businesses of all sizes. You can choose a plan that best fits your needs and budget.

-

What features are available with denver ebiz login?

With the denver ebiz login, users can access features such as document editing, eSigning, template creation, and team collaboration tools. Additionally, you have the ability to track document status and automate workflows to enhance productivity. The platform is fully equipped to meet diverse business requirements.

-

How do I reset my denver ebiz login password?

If you need to reset your denver ebiz login password, simply visit the login page and click on the 'Forgot Password?' link. You will receive an email with instructions on how to create a new password. This process ensures that your account remains secure while allowing you to regain access quickly.

-

Can I integrate denver ebiz login with other tools?

Yes, denver ebiz login allows integrations with various popular tools such as CRM systems, cloud storage services, and project management software. This flexibility helps streamline your processes and enhances collaboration across your team. The integration capabilities make it an adaptable solution for modern businesses.

-

What are the benefits of using airSlate SignNow with denver ebiz login?

Using airSlate SignNow with denver ebiz login provides signNow benefits like increased efficiency, reduced paper waste, and improved document security. It allows teams to complete transactions quickly and securely, ultimately enhancing customer satisfaction. The platform supports both in-office and remote work environments seamlessly.

-

Is support available for denver ebiz login users?

Absolutely! Users of denver ebiz login have access to customer support via multiple channels, including email, live chat, and an extensive knowledge base. Whether you have a technical question or need assistance navigating the platform, the support team is ready to help ensure a smooth experience.

Get more for Denver Sales Tax Login

- Does chaco credit union does direct deposit form

- Bionic gear bag pdf form

- Richard leider calling cards form

- Ncnd real estate form

- Bop form

- Ifc recruitment team application university of cincinnati form

- Variance application request form city of port aransas cityofportaransas

- Installation agreement template form

Find out other Denver Sales Tax Login

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document