Terminate W 4 Form

What is the Terminate W-4 Form

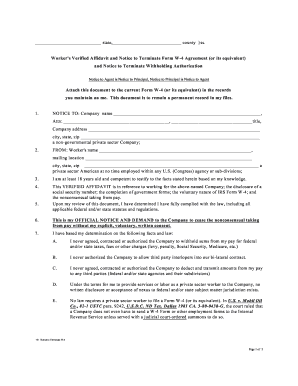

The Terminate W-4 Form is a document used by employees in the United States to notify their employer that they wish to stop withholding federal income tax from their paychecks. This form is essential for individuals who may have changed their tax situation, such as moving to a different state or experiencing changes in income. By submitting this form, employees can ensure that their payroll deductions align with their current financial circumstances.

How to Use the Terminate W-4 Form

Using the Terminate W-4 Form involves a straightforward process. First, employees need to obtain the form, which can typically be found on the IRS website or through their employer's human resources department. After filling out the necessary information, including personal details and the reason for termination, employees should submit the form to their employer's payroll department. This action will initiate the changes in tax withholding as specified in the form.

Steps to Complete the Terminate W-4 Form

Completing the Terminate W-4 Form requires careful attention to detail. Here are the steps to follow:

- Obtain the Terminate W-4 Form from your employer or the IRS website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the reason for terminating the withholding.

- Sign and date the form to validate your request.

- Submit the completed form to your employer's payroll department.

Legal Use of the Terminate W-4 Form

The legal use of the Terminate W-4 Form is governed by IRS regulations. When completed correctly, this form serves as a formal request to modify tax withholding. It is crucial for employees to ensure that the information provided is accurate and up to date, as incorrect submissions may lead to improper tax deductions, resulting in potential penalties during tax filing. Employers are required to process this form in compliance with federal tax laws.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Terminate W-4 Form is vital for effective tax planning. Employees should submit the form as soon as they determine a need to change their withholding status. It is advisable to complete this process before the start of a new pay period to ensure that the changes take effect promptly. Additionally, employees should be aware of any specific state deadlines that may apply, as these can vary by location.

Key Elements of the Terminate W-4 Form

The Terminate W-4 Form contains several key elements that are essential for its proper completion. These include:

- Personal Information: Name, address, and Social Security number.

- Reason for Termination: A brief explanation of why the employee is requesting to stop withholding.

- Signature: The employee's signature and date to validate the request.

Who Issues the Form

The Terminate W-4 Form is issued by the Internal Revenue Service (IRS). Employees can access the form directly from the IRS website or through their employer. It is important for employees to use the most current version of the form to ensure compliance with federal tax regulations.

Quick guide on how to complete terminate w 4 form

Complete Terminate W 4 Form effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Terminate W 4 Form on any platform with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The easiest way to modify and eSign Terminate W 4 Form without hassle

- Find Terminate W 4 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to share your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Terminate W 4 Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the terminate w 4 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W4 termination form?

A W4 termination form is a document used by employees to notify their employer of the end of their employment, allowing for proper tax withholding adjustments. It is essential for ensuring that both parties have clarity on tax obligations and final paychecks. Utilizing airSlate SignNow makes it easy to create and eSign a W4 termination form securely and efficiently.

-

How much does it cost to use airSlate SignNow for W4 termination forms?

airSlate SignNow offers various pricing plans that cater to businesses of all sizes, starting from a basic plan to more advanced features. Each plan provides the necessary tools for creating, sending, and eSigning W4 termination forms. You can choose a plan that best fits your needs and budget.

-

What features does airSlate SignNow offer for W4 termination forms?

airSlate SignNow provides a user-friendly platform that allows you to create reusable templates for W4 termination forms. Features include customizable fields, automated workflows, and the ability to track document status in real-time. This simplifies the process of managing employment termination paperwork.

-

How does eSigning a W4 termination form work?

eSigning a W4 termination form with airSlate SignNow is straightforward. Once the form is created, you can send it electronically to the appropriate parties. They can then eSign it securely, ensuring a legally binding agreement while saving time and resources.

-

Can I integrate airSlate SignNow with other tools for managing W4 termination forms?

Yes, airSlate SignNow offers seamless integrations with various tools like Google Drive, Dropbox, and popular CRM systems. This capability enhances your workflow by allowing easy access to your W4 termination forms across different platforms. Integration helps streamline operations and increases efficiency.

-

Are there any benefits to using airSlate SignNow for W4 termination forms?

Using airSlate SignNow for W4 termination forms provides signNow advantages, including reduced paperwork, faster processing times, and improved compliance. The electronic format ensures that all documents are securely stored and easily accessible. Additionally, it enhances the overall employee experience during the termination process.

-

Is it secure to use airSlate SignNow for W4 termination forms?

Absolutely. AirSlate SignNow employs top-tier security measures, including data encryption and compliance with industry standards, ensuring that your W4 termination forms are protected. You can trust that sensitive information remains confidential while being handled efficiently.

Get more for Terminate W 4 Form

- Use this page to notify the board of your address change after you submit your application form

- Civil case time schedule form

- Attorney for petitioner defendant form

- Affidavit for order for appearance and form

- Verified lockout complaint and application for temporary injunction form

- Transcript or land form

- For ward older than 18 years of age form

- Summary process eviction complaint termination of lease by lapse of time form

Find out other Terminate W 4 Form

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word