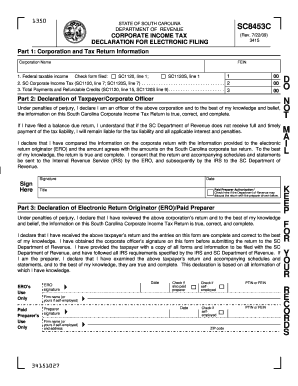

DEPARTMENT of REVENUE SC8453C Form

What is the DEPARTMENT OF REVENUE SC8453C

The DEPARTMENT OF REVENUE SC8453C is a specific form utilized for tax purposes within the state revenue system. It is primarily designed to facilitate the reporting and documentation of certain financial activities, ensuring compliance with state tax regulations. This form is essential for individuals and businesses to accurately convey their tax-related information to the state, helping to maintain transparency and accountability in financial dealings.

How to use the DEPARTMENT OF REVENUE SC8453C

Using the DEPARTMENT OF REVENUE SC8453C involves several straightforward steps. First, gather all necessary financial documents and information required to complete the form. This may include income statements, expense records, and any relevant tax identification numbers. Next, fill out the form accurately, ensuring that all information is complete and correct. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific requirements set by the state’s revenue department.

Steps to complete the DEPARTMENT OF REVENUE SC8453C

Completing the DEPARTMENT OF REVENUE SC8453C requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Review the form instructions carefully to understand the requirements.

- Collect all necessary documentation, including income and expense records.

- Fill out the form, ensuring that all fields are completed accurately.

- Double-check the information for any errors or omissions.

- Submit the form through the designated method, either online or by mail.

Legal use of the DEPARTMENT OF REVENUE SC8453C

The legal use of the DEPARTMENT OF REVENUE SC8453C is governed by state tax laws and regulations. To ensure that the form is considered valid, it must be completed accurately and submitted within the specified deadlines. Additionally, the information provided must be truthful and supported by corresponding documentation. Failure to adhere to these legal requirements may result in penalties or other legal consequences.

Required Documents

When filling out the DEPARTMENT OF REVENUE SC8453C, certain documents are typically required to support the information provided. These may include:

- Income statements, such as W-2s or 1099s.

- Expense records that detail business-related costs.

- Tax identification numbers for individuals or businesses.

- Previous tax returns, if applicable.

Form Submission Methods

The DEPARTMENT OF REVENUE SC8453C can be submitted through various methods, ensuring flexibility for users. Common submission methods include:

- Online submission via the state’s revenue department website.

- Mailing the completed form to the designated address provided in the instructions.

- In-person submission at local revenue department offices, if available.

Quick guide on how to complete department of revenue sc8453c

Complete DEPARTMENT OF REVENUE SC8453C seamlessly on any device

Virtual document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to draft, amend, and electronically sign your documents swiftly without delays. Manage DEPARTMENT OF REVENUE SC8453C on any device with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The most efficient way to modify and eSign DEPARTMENT OF REVENUE SC8453C effortlessly

- Obtain DEPARTMENT OF REVENUE SC8453C and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or mislaid documents, cumbersome form navigation, or mistakes that necessitate reprinting document copies. airSlate SignNow addresses your document management requirements in just a few clicks from your chosen device. Modify and eSign DEPARTMENT OF REVENUE SC8453C while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the department of revenue sc8453c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DEPARTMENT OF REVENUE SC8453C form?

The DEPARTMENT OF REVENUE SC8453C form is a crucial document used for electronic filing and submission of tax returns. It is designed to authenticate the taxpayer's identity and ensure compliance with state regulations. Understanding this form can streamline your tax process signNowly.

-

How can airSlate SignNow help with the DEPARTMENT OF REVENUE SC8453C?

airSlate SignNow simplifies the process of preparing and submitting the DEPARTMENT OF REVENUE SC8453C form. With its easy-to-use interface, you can eSign documents digitally and ensure they are securely submitted. This not only saves time but also enhances the accuracy of your submissions.

-

What is the pricing for using airSlate SignNow for the DEPARTMENT OF REVENUE SC8453C?

airSlate SignNow offers flexible pricing plans to meet your business needs, making it cost-effective for handling the DEPARTMENT OF REVENUE SC8453C form. You can choose a plan based on your usage level, ensuring you get the most value out of its features. Visit our pricing page for detailed options tailored for different users.

-

Are there any integrations available for the DEPARTMENT OF REVENUE SC8453C with airSlate SignNow?

Absolutely! airSlate SignNow integrates with various third-party applications to facilitate the submission of the DEPARTMENT OF REVENUE SC8453C form. This means you can connect it with your existing tools for a seamless workflow that enhances productivity and simplifies document management.

-

What are the key features of airSlate SignNow for handling the DEPARTMENT OF REVENUE SC8453C?

Key features of airSlate SignNow include electronic signatures, secure document storage, and automated workflows. These features make it easier to manage the DEPARTMENT OF REVENUE SC8453C, allowing you to send, sign, and retrieve documents with minimum hassle. The user-friendly platform ensures you can navigate these features effortlessly.

-

What benefits does airSlate SignNow provide for filing the DEPARTMENT OF REVENUE SC8453C?

Using airSlate SignNow for the DEPARTMENT OF REVENUE SC8453C ensures speed and accuracy in your filings. You'll benefit from reduced paper use and improved tracking for your documents. Additionally, the platform helps minimize errors and ensures timely submissions, which can alleviate potential penalties.

-

Is airSlate SignNow secure for processing the DEPARTMENT OF REVENUE SC8453C?

Yes, airSlate SignNow prioritizes security for all documents, including the DEPARTMENT OF REVENUE SC8453C. The platform uses advanced encryption and compliance with industry standards to safeguard your sensitive information. This dedication to security helps build trust as you manage your tax documents.

Get more for DEPARTMENT OF REVENUE SC8453C

Find out other DEPARTMENT OF REVENUE SC8453C

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word