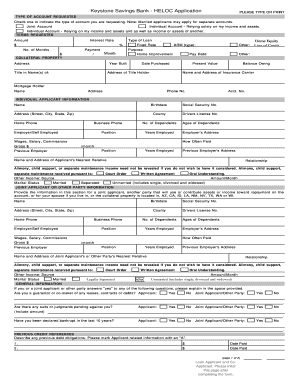

HELOC Application Keystone Savings Bank Form

What is the HELOC Application Keystone Savings Bank

The HELOC application for Keystone Savings Bank is a formal request for a Home Equity Line of Credit. This type of loan allows homeowners to borrow against the equity in their property, providing flexible access to funds for various needs, such as home improvements, education expenses, or debt consolidation. The application process typically requires personal and financial information to assess eligibility and determine the credit limit.

Steps to complete the HELOC Application Keystone Savings Bank

Completing the HELOC application involves several key steps:

- Gather necessary documents: Collect financial statements, proof of income, and information about your property.

- Fill out the application form: Provide accurate details about your financial situation and the purpose of the loan.

- Submit the application: Send the completed form along with the required documents to Keystone Savings Bank.

- Await approval: The bank will review your application and may request additional information before making a decision.

Legal use of the HELOC Application Keystone Savings Bank

The HELOC application must comply with federal and state regulations to be considered legally valid. This includes adherence to the Truth in Lending Act, which mandates clear disclosure of loan terms, and the Equal Credit Opportunity Act, which prohibits discrimination in lending practices. Ensuring compliance with these laws protects both the lender and the borrower during the application process.

Eligibility Criteria

To qualify for a HELOC through Keystone Savings Bank, applicants typically need to meet certain criteria, including:

- Ownership of a primary residence with sufficient equity.

- A credit score that meets the bank's minimum requirements.

- Stable income and employment history.

- A debt-to-income ratio that falls within acceptable limits.

Required Documents

Applicants should prepare the following documents to support their HELOC application:

- Proof of identity, such as a driver's license or passport.

- Recent pay stubs or tax returns to verify income.

- Statements for existing mortgages or loans.

- Documentation of property ownership, including the deed.

Form Submission Methods

The HELOC application can be submitted through various methods, depending on the preferences of the applicant:

- Online: Many banks, including Keystone Savings Bank, offer an online portal for easy submission.

- By mail: Applicants can print the completed form and send it to the bank's designated address.

- In-person: Visiting a local branch allows applicants to submit their application directly and ask questions.

Quick guide on how to complete heloc application keystone savings bank

Complete HELOC Application Keystone Savings Bank seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle HELOC Application Keystone Savings Bank on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign HELOC Application Keystone Savings Bank effortlessly

- Find HELOC Application Keystone Savings Bank and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign HELOC Application Keystone Savings Bank to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the heloc application keystone savings bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does Keystone Savings Bank offer?

Keystone Savings Bank provides a range of banking services, including personal and business accounts, loans, and investment options. With a focus on customer service, they aim to meet the financial needs of both individuals and businesses. Partnering with airSlate SignNow can further enhance these services by streamlining document signing processes.

-

How does airSlate SignNow integrate with Keystone Savings Bank?

airSlate SignNow easily integrates with Keystone Savings Bank to allow clients to eSign documents directly through the bank's platform. This integration improves efficiency and fosters seamless collaboration for businesses. By utilizing airSlate SignNow, customers can securely manage their documents with Keystone Savings Bank.

-

What are the pricing options for using airSlate SignNow with Keystone Savings Bank?

The pricing for airSlate SignNow is competitive and offers various plans to suit different needs, whether you are an individual or a business customer of Keystone Savings Bank. This cost-effective solution ensures you only pay for the features you need. You can contact Keystone Savings Bank for specific pricing details related to this integration.

-

What benefits does eSigning with airSlate SignNow provide for Keystone Savings Bank customers?

eSigning with airSlate SignNow offers numerous benefits for Keystone Savings Bank customers, such as increased efficiency, reduced paperwork, and enhanced security. Customers can sign documents from any device, which saves time and simplifies transactions. This leads to a better overall banking experience with Keystone Savings Bank.

-

Is it safe to use airSlate SignNow for documents related to Keystone Savings Bank?

Yes, using airSlate SignNow for documents linked to Keystone Savings Bank is safe and secure. The platform employs advanced encryption and authentication methods to protect customer data. By utilizing airSlate SignNow, Keystone Savings Bank customers can have peace of mind knowing their documents are secure.

-

Can I track my documents once I'm using airSlate SignNow with Keystone Savings Bank?

Absolutely! airSlate SignNow provides tracking features that allow Keystone Savings Bank customers to see the status of their documents in real-time. This transparency ensures that all parties are informed throughout the signing process. It's an essential feature for efficient communication and transaction management.

-

What types of documents can I eSign with airSlate SignNow at Keystone Savings Bank?

With airSlate SignNow, Keystone Savings Bank customers can eSign a variety of documents including loan agreements, account applications, and compliance forms. This flexibility supports a range of banking transactions that require signatures. It's a comprehensive solution for all your document signing needs.

Get more for HELOC Application Keystone Savings Bank

- Fillable online privacy release housegov fax email print form

- Labor condition application for nonimmigrant workers form eta

- Fillable online resources and handouts international form

- Ri 101 request for public records foi state of michigan michigan form

- Additional copies to all attorneys of record form

- Uscis privacy release form sample

- Inz 1200 form

- Manualsdshswagovsitesdefaultchild support worksheet csf 020910 washington form

Find out other HELOC Application Keystone Savings Bank

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement