BUSINESS DEBT SCHEDULE ALB Commercial Capital Form

What is the BUSINESS DEBT SCHEDULE ALB Commercial Capital

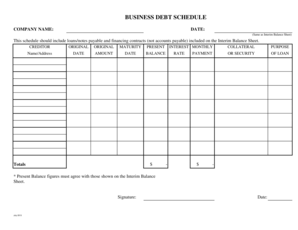

The BUSINESS DEBT SCHEDULE ALB Commercial Capital is a financial document that outlines the debts and obligations of a business. This schedule provides a comprehensive view of all outstanding loans, credit lines, and other forms of debt that the business is responsible for. It is essential for assessing the financial health of a company, aiding in decision-making processes regarding financing, and ensuring compliance with lender requirements. The schedule typically includes details such as the creditor's name, loan amounts, interest rates, payment terms, and the current status of each debt.

How to use the BUSINESS DEBT SCHEDULE ALB Commercial Capital

Using the BUSINESS DEBT SCHEDULE ALB Commercial Capital involves several steps to ensure accurate representation of a business's financial obligations. First, gather all relevant financial documents, including loan agreements and statements. Next, list each debt, providing necessary details such as the creditor's name, the total amount owed, interest rates, and repayment schedules. This information should be organized in a clear format, making it easy to review and analyze. Regular updates to the schedule are crucial, especially after making payments or acquiring new debts, to maintain an accurate financial overview.

Steps to complete the BUSINESS DEBT SCHEDULE ALB Commercial Capital

Completing the BUSINESS DEBT SCHEDULE ALB Commercial Capital requires careful attention to detail. Follow these steps:

- Collect all financial documents related to business debts.

- Identify each creditor and the corresponding debt amount.

- Record the interest rates and payment terms for each debt.

- Include the current status of each debt, such as paid, outstanding, or in default.

- Review the completed schedule for accuracy and completeness.

- Update the schedule regularly to reflect any changes in debt status.

Key elements of the BUSINESS DEBT SCHEDULE ALB Commercial Capital

The key elements of the BUSINESS DEBT SCHEDULE ALB Commercial Capital include:

- Creditor Information: Name and contact details of each lender.

- Loan Amount: The total amount borrowed for each debt.

- Interest Rate: The percentage charged on the outstanding balance.

- Payment Terms: The schedule of payments, including frequency and due dates.

- Status: Current standing of the debt, indicating whether it is current, late, or in default.

Legal use of the BUSINESS DEBT SCHEDULE ALB Commercial Capital

The BUSINESS DEBT SCHEDULE ALB Commercial Capital serves a legal purpose by providing a formal record of a business's debts. This document is often required by lenders during loan applications, mergers, or acquisitions. It can also be essential in legal proceedings, such as bankruptcy filings or disputes over debts. Maintaining an accurate and up-to-date schedule helps ensure compliance with financial regulations and can protect the business's interests in legal matters.

Examples of using the BUSINESS DEBT SCHEDULE ALB Commercial Capital

Examples of using the BUSINESS DEBT SCHEDULE ALB Commercial Capital include:

- Applying for a business loan, where lenders require a detailed debt schedule to assess risk.

- Conducting financial audits, allowing auditors to verify the accuracy of reported debts.

- Preparing for business sales or mergers, providing potential buyers with a clear view of liabilities.

- Managing cash flow by tracking payment schedules and ensuring timely payments to creditors.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business debt schedule alb commercial capital

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a BUSINESS DEBT SCHEDULE ALB Commercial Capital?

A BUSINESS DEBT SCHEDULE ALB Commercial Capital is a detailed document that outlines all of a business's debts, including terms, interest rates, and payment schedules. This schedule helps businesses manage their financial obligations effectively and is crucial for securing financing or refinancing options.

-

How can airSlate SignNow help with creating a BUSINESS DEBT SCHEDULE ALB Commercial Capital?

airSlate SignNow provides an easy-to-use platform for creating and managing your BUSINESS DEBT SCHEDULE ALB Commercial Capital. With customizable templates and eSignature capabilities, you can efficiently draft, send, and sign your debt schedules, ensuring all parties are aligned and informed.

-

What are the pricing options for using airSlate SignNow for my BUSINESS DEBT SCHEDULE ALB Commercial Capital?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you need basic features or advanced functionalities for your BUSINESS DEBT SCHEDULE ALB Commercial Capital, you can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing a BUSINESS DEBT SCHEDULE ALB Commercial Capital?

Key features of airSlate SignNow include document templates, eSignature capabilities, and secure cloud storage. These features streamline the process of managing your BUSINESS DEBT SCHEDULE ALB Commercial Capital, making it easier to track and update your financial obligations.

-

Can I integrate airSlate SignNow with other financial tools for my BUSINESS DEBT SCHEDULE ALB Commercial Capital?

Yes, airSlate SignNow offers integrations with various financial tools and software, allowing you to seamlessly manage your BUSINESS DEBT SCHEDULE ALB Commercial Capital alongside your existing systems. This integration enhances efficiency and ensures that all your financial data is synchronized.

-

What are the benefits of using airSlate SignNow for my BUSINESS DEBT SCHEDULE ALB Commercial Capital?

Using airSlate SignNow for your BUSINESS DEBT SCHEDULE ALB Commercial Capital provides numerous benefits, including time savings, improved accuracy, and enhanced collaboration. The platform simplifies the document management process, allowing you to focus on your business's financial health.

-

Is airSlate SignNow secure for handling my BUSINESS DEBT SCHEDULE ALB Commercial Capital?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your BUSINESS DEBT SCHEDULE ALB Commercial Capital is protected with advanced encryption and secure access controls. You can trust that your sensitive financial information is safe with us.

Get more for BUSINESS DEBT SCHEDULE ALB Commercial Capital

- Swim lesson enrollment form read only ymca central florida

- Commonwealth of virginia department of taxation w 9 form

- Affidavit of fraud and forgery forum credit union form

- 203 k homeowner contractor agreement doc form

- Ncis forms

- Pc 180 connecticut probate courts form

- Custody conciliation orderdoc form

- Study certificate jawahar navodaya vidyalaya form

Find out other BUSINESS DEBT SCHEDULE ALB Commercial Capital

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation