How to Fill 4506t Form

What is the 4506-T Form?

The 4506-T form, officially known as the Request for Transcript of Tax Return, is a document used by taxpayers to request a transcript of their tax returns from the Internal Revenue Service (IRS). This form is essential for various purposes, including verifying income for loan applications, obtaining financial aid, or ensuring accurate tax records. The form allows individuals to request information for various tax years, making it a versatile tool for both personal and business needs.

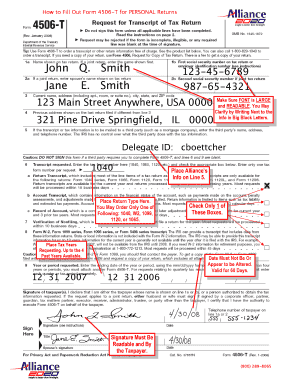

Steps to Complete the 4506-T Form

Completing the 4506-T form involves several straightforward steps:

- Download the form: Access the 4506-T form from the IRS website or other reliable sources.

- Fill in personal information: Provide your name, address, and Social Security number. Ensure that the information matches what the IRS has on file.

- Select the type of transcript: Indicate whether you need a tax return transcript, account transcript, or other specific documents.

- Specify the tax years: Clearly list the years for which you are requesting transcripts.

- Sign and date the form: Your signature is required to authorize the IRS to release your information.

- Submit the form: Send the completed form to the appropriate address listed in the instructions.

Legal Use of the 4506-T Form

The 4506-T form is legally recognized by the IRS as a valid request for tax information. It is crucial for individuals and businesses to understand that submitting this form authorizes the IRS to release sensitive information to third parties, such as lenders or financial institutions. Therefore, it should be used responsibly and only when necessary. Compliance with the IRS guidelines ensures that the information is used appropriately and protects the taxpayer's rights.

Required Documents for Submitting the 4506-T Form

When submitting the 4506-T form, there are no additional documents required; however, it is important to ensure that all information provided is accurate and complete. If you are submitting the form on behalf of someone else, you may need to include a power of attorney or other legal documentation to verify your authority to request the information. This helps to prevent identity theft and ensures that the IRS can process your request without delays.

IRS Guidelines for the 4506-T Form

The IRS has established specific guidelines for completing and submitting the 4506-T form. It is essential to adhere to these guidelines to avoid processing delays. Key points include:

- Ensure that all personal information is accurate and matches IRS records.

- Double-check the selected transcript types and tax years.

- Submit the form to the correct address based on your location.

- Keep a copy of the completed form for your records.

Form Submission Methods

The 4506-T form can be submitted to the IRS through various methods. These include:

- By Mail: Print and send the completed form to the address specified in the instructions.

- Online: Some taxpayers may be eligible to request transcripts online through the IRS website, which can be a faster option.

- In-Person: Certain IRS offices may accept submissions in person, but this option is limited and may require an appointment.

Quick guide on how to complete how to fill 4506t form

Effortlessly Prepare How To Fill 4506t Form on Any Device

Digital document management has become increasingly popular among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the essential tools to create, modify, and electronically sign your documents swiftly and without holdups. Handle How To Fill 4506t Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The easiest way to modify and eSign How To Fill 4506t Form effortlessly

- Obtain How To Fill 4506t Form and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes just moments and carries the same legal validity as a traditional signature made with ink.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your device of choice. Modify and eSign How To Fill 4506t Form and ensure excellent communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to fill 4506t form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to download trusts using airSlate SignNow?

Downloading trusts with airSlate SignNow refers to the seamless process of retrieving trust documents in a digital format. This feature allows users to easily manage their trust agreements and ensures they have quick access whenever needed. With airSlate SignNow, you can securely download trusts directly from the platform.

-

How does airSlate SignNow simplify the process to download trusts?

airSlate SignNow simplifies the process to download trusts by providing a user-friendly interface that streamlines document management. Once your trust documents are completed and signed, you can easily download them with just a few clicks. This efficiency helps businesses save time and resources.

-

Is there a fee to download trusts with airSlate SignNow?

Downloading trusts with airSlate SignNow is included in our cost-effective pricing plans. There are no additional fees for downloading your signed documents, ensuring you have access to your legal paperwork without extra charges. This transparency supports budget-friendly business operations.

-

Can I integrate airSlate SignNow with other platforms to manage my trusts?

Yes, airSlate SignNow offers integrations with various platforms that can enhance your ability to manage trusts efficiently. By integrating with tools like cloud storage services and CRM systems, you can streamline the way you download trusts and keep all related documents organized in one place.

-

What are the security features for downloading trusts with airSlate SignNow?

When you download trusts with airSlate SignNow, you can trust that your documents are protected by robust security measures. We utilize encryption protocols and secure access controls to ensure that your sensitive information remains confidential. Your peace of mind is our top priority.

-

Can I download trusts on my mobile device using airSlate SignNow?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to download trusts wherever you are. Whether you’re using a smartphone or a tablet, you can easily access your signed trust documents, making it convenient for busy professionals on the go.

-

What types of trusts can I download with airSlate SignNow?

With airSlate SignNow, you can download various types of trusts, including living trusts, revocable trusts, and irrevocable trusts. Our platform is versatile and designed to accommodate multiple types of legal documents. This flexibility makes it easier for users to manage their diverse trust requirements.

Get more for How To Fill 4506t Form

- Com to submit your claim electronically with uploaded documentation form

- Application for residence permit for citizens of switzerland and their family members form

- Archives records transfer sheet form

- Can i drive in california with an out of state drivers license form

- Ampquotpesticide apprentice license apl application formampquot oregon

- Home benefits kansas department of laborhome kansas department of laborhome kansas department of laborkansas department of labor form

- United states district court dc attorney general form

- Surprise police department request for official police report form

Find out other How To Fill 4506t Form

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF