Charles Schwab Tax Forms

Understanding the Charles Schwab Tax Forms

The Charles Schwab Tax Forms, including the Schwab Form 5498, are essential documents for reporting contributions to individual retirement accounts (IRAs) and other tax-advantaged accounts. These forms provide the IRS with information regarding the amounts contributed, the type of account, and the account holder's details. Understanding these forms is crucial for accurate tax reporting and compliance with IRS regulations.

Steps to Complete the Charles Schwab Tax Forms

Completing the Charles Schwab Tax Forms involves several straightforward steps:

- Gather necessary information, including your Social Security number, account number, and contribution details.

- Access the Schwab Form 5498 through your Schwab account online or request a paper form if needed.

- Fill out the form accurately, ensuring all contributions and relevant information are reported.

- Review the completed form for accuracy to avoid potential issues with the IRS.

- Submit the form according to the instructions provided, either electronically or via mail.

Legal Use of the Charles Schwab Tax Forms

The legal use of the Charles Schwab Tax Forms is governed by IRS guidelines. These forms must be filled out correctly to ensure compliance with tax laws. The information reported on these forms is used by the IRS to verify contributions and distributions from tax-advantaged accounts. Failing to accurately complete and submit these forms can result in penalties or issues with your tax return.

Key Elements of the Charles Schwab Tax Forms

Key elements of the Charles Schwab Tax Forms include:

- Account Holder Information: Name, address, and Social Security number.

- Account Type: Specifies whether the account is a traditional IRA, Roth IRA, or another type.

- Contribution Amounts: Total contributions made during the tax year.

- Fair Market Value: The value of the account at the end of the tax year.

Obtaining the Charles Schwab Tax Forms

To obtain the Charles Schwab Tax Forms, you can log into your Schwab account online. The forms are typically available in the tax documents section. If you prefer a paper version, you can contact Schwab customer service to request that the forms be mailed to you. It is advisable to obtain these forms as soon as they are available to ensure timely filing.

Filing Deadlines / Important Dates

Filing deadlines for the Charles Schwab Tax Forms align with IRS requirements. Typically, the Form 5498 must be filed by May 31 of the year following the tax year. It is important to keep track of these dates to ensure compliance and avoid any penalties associated with late submissions.

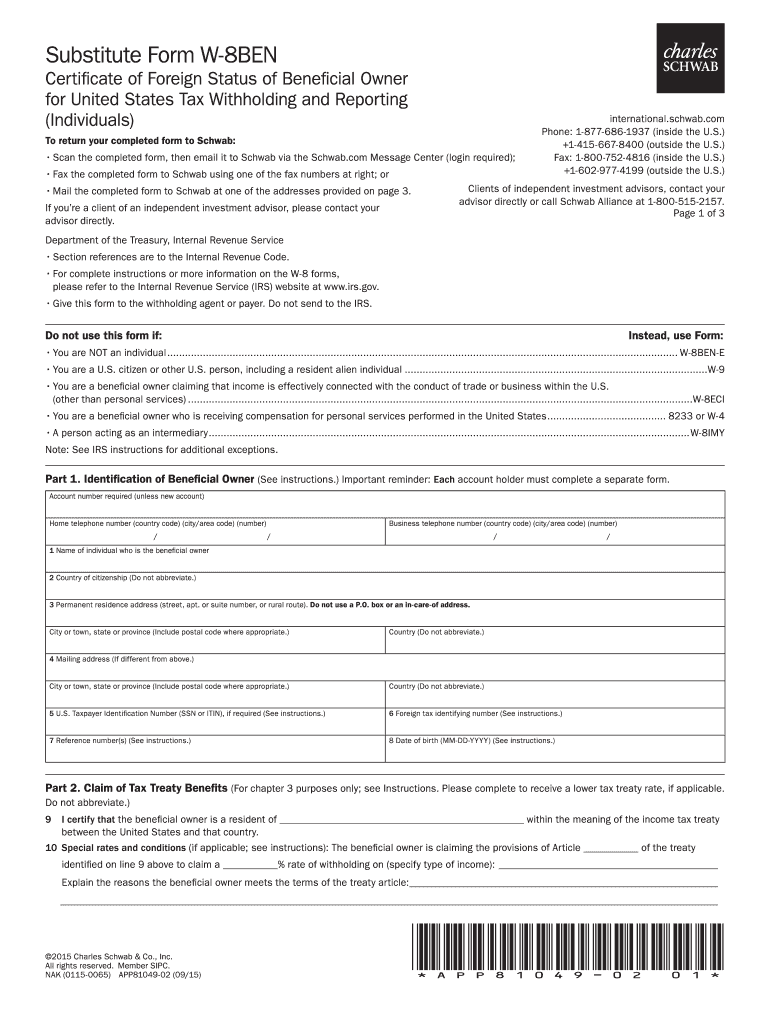

Quick guide on how to complete substitute form w 8ben charles schwab corporation

Access Charles Schwab Tax Forms effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documentation, allowing you to obtain the correct template and securely store it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Manage Charles Schwab Tax Forms on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to alter and electronically sign Charles Schwab Tax Forms with ease

- Obtain Charles Schwab Tax Forms and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools available through airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign Charles Schwab Tax Forms and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can you fill out the W-8BEN form (no tax treaty)?

A payer of a reportable payment may treat a payee as foreign if the payer receives an applicable Form W-8 from the payee. Provide this Form W-8BEN to the requestor if you are a foreign individual that is a participating payee receiving payments in settlement of payment card transactions that are not effectively connected with a U.S. trade or business of the payee.As stated by Mr. Ivanov below, Since Jordan is not one of the countries listed as a tax treaty country, it appears that you would only complete Part I of the Form W-8BEN, Sign your name and date the Certification in Part III.http://www.irs.gov/pub/irs-pdf/i...Hope this is helpful.

-

Why do I have to fill out a W-8BEN form, sent by TD Bank, if I am an F1-student (from Canada) that is not working?

Of course you are not working. But the bank needs to notify the IRS of the account and it using the W-8BEN for to get the info it needs about you.

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

Create this form in 5 minutes!

How to create an eSignature for the substitute form w 8ben charles schwab corporation

How to create an eSignature for the Substitute Form W 8ben Charles Schwab Corporation in the online mode

How to create an eSignature for your Substitute Form W 8ben Charles Schwab Corporation in Chrome

How to make an eSignature for signing the Substitute Form W 8ben Charles Schwab Corporation in Gmail

How to create an electronic signature for the Substitute Form W 8ben Charles Schwab Corporation straight from your smartphone

How to make an eSignature for the Substitute Form W 8ben Charles Schwab Corporation on iOS devices

How to generate an eSignature for the Substitute Form W 8ben Charles Schwab Corporation on Android devices

People also ask

-

What is the schwab form 5498 and why is it important?

The schwab form 5498 is a tax form used to report contributions to IRAs, including traditional, Roth, and SEP IRAs. It's important for both individuals and tax professionals as it helps in accurately reporting contributions to the IRS, ensuring compliance and maximizing tax benefits.

-

How can airSlate SignNow help with schwab form 5498?

airSlate SignNow streamlines the process of sending and eSigning the schwab form 5498, making it easy for you to manage your documents electronically. With its user-friendly interface, you can fill out, send, and securely sign this important tax form without hassle.

-

Is there a cost associated with using airSlate SignNow for schwab form 5498?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to different business needs. You can choose a plan that suits your volume of documents, ensuring that you can manage schwab form 5498 and other forms efficiently without breaking the bank.

-

What features does airSlate SignNow offer for managing schwab form 5498?

airSlate SignNow includes features such as customizable templates, bulk sending, and automated reminders, which are particularly helpful when managing schwab form 5498. These features allow you to save time, reduce errors, and enhance the overall signing experience for all parties involved.

-

Can I integrate airSlate SignNow with other software for schwab form 5498?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enabling you to easily incorporate it into your existing workflows for managing schwab form 5498. Popular integrations include platforms like Salesforce, Google Workspace, and more, enhancing your overall productivity.

-

What are the benefits of using airSlate SignNow for schwab form 5498?

Using airSlate SignNow for schwab form 5498 provides numerous benefits, including increased efficiency, reduced paper usage, and faster turnaround times. Additionally, the security features of airSlate SignNow ensure that your sensitive information is well-protected during the signing process.

-

How secure is the process of sending schwab form 5498 with airSlate SignNow?

Security is a top priority for airSlate SignNow. When sending schwab form 5498, your documents are protected with advanced encryption methods, ensuring that your data remains confidential and secure throughout the signing process.

Get more for Charles Schwab Tax Forms

- Pps heur1 form

- How does a beauty pageant form looks like

- Gtti application form

- Five guys w2 forms

- Hub at tucson lease relet process form

- Cancellation request form email

- Notice of inability to locate or communicate with service member notice of inability to locate or communicate with service form

- Southwest gas deposit refund form

Find out other Charles Schwab Tax Forms

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form