Form 199 Ftb Ca

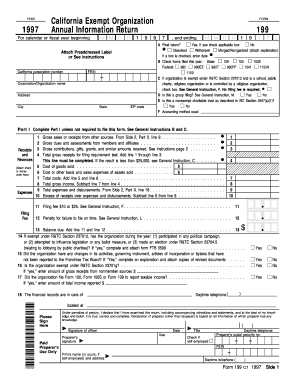

What is the Form 199 Ftb Ca

The Form 199 Ftb Ca is a critical document used by certain California businesses to report their annual income and expenses. This form is specifically designed for exempt organizations, including nonprofit entities, to provide the Franchise Tax Board (FTB) with necessary financial information. By submitting this form, organizations can maintain their tax-exempt status while ensuring compliance with state regulations.

How to use the Form 199 Ftb Ca

To effectively use the Form 199 Ftb Ca, organizations must gather relevant financial data, including income, expenses, and any applicable deductions. The form requires detailed reporting of these figures to accurately reflect the organization's financial position. It is essential to follow the instructions provided with the form closely to ensure that all required information is included and accurately reported.

Steps to complete the Form 199 Ftb Ca

Completing the Form 199 Ftb Ca involves several key steps:

- Gather all necessary financial documents, including income statements and expense reports.

- Fill out the form with accurate figures, ensuring that all sections are completed as required.

- Review the completed form for any errors or omissions before submission.

- Submit the form to the California Franchise Tax Board by the designated deadline.

Legal use of the Form 199 Ftb Ca

The legal use of the Form 199 Ftb Ca is paramount for maintaining compliance with California tax laws. Organizations must ensure that the information provided is truthful and complete, as inaccuracies may lead to penalties or loss of tax-exempt status. Adhering to the guidelines set forth by the FTB ensures that organizations can operate legally and avoid potential legal issues.

Filing Deadlines / Important Dates

Organizations must be aware of specific filing deadlines associated with the Form 199 Ftb Ca. Typically, the form is due on the 15th day of the fifth month after the end of the organization's fiscal year. For example, if the fiscal year ends on December 31, the form would be due by May 15 of the following year. It is crucial to stay informed about these dates to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 199 Ftb Ca can be submitted through various methods, providing flexibility for organizations. Options include:

- Online Submission: Organizations can file electronically through the FTB's online portal, which offers a streamlined process.

- Mail: The form can be printed and mailed to the appropriate FTB address, ensuring that it is postmarked by the deadline.

- In-Person: Organizations may also choose to submit the form in person at designated FTB offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete form 199 ftb ca

Complete Form 199 Ftb Ca effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as a perfect environmentally friendly alternative to usual printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Form 199 Ftb Ca on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Form 199 Ftb Ca with ease

- Locate Form 199 Ftb Ca and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal standing as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 199 Ftb Ca and ensure excellent communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 199 ftb ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to file CA Form 199 online using airSlate SignNow?

To file CA Form 199 online, simply log into your airSlate SignNow account, upload your completed form, and follow the prompts to eSign and submit. The platform streamlines the process, making it quick and efficient. You can track the status of your filing in real-time.

-

Is there a cost associated with filing CA Form 199 online through airSlate SignNow?

Yes, airSlate SignNow offers competitive pricing plans that allow you to file CA Form 199 online. The cost varies based on the features you need, with options for both individual and business users. Contact our sales team for more information on pricing tiers.

-

What features does airSlate SignNow provide for filing CA Form 199 online?

airSlate SignNow includes features like customizable templates, automated workflows, and real-time notifications when you file CA Form 199 online. These tools enhance efficiency and ensure your documents are handled professionally. Additionally, you can store and access your files securely.

-

Can I integrate other applications with airSlate SignNow while filing CA Form 199 online?

Absolutely! airSlate SignNow provides several integrations with popular applications, allowing you to file CA Form 199 online seamlessly. Whether you use CRM systems, cloud storage, or project management tools, you can create a cohesive workflow tailored to your needs.

-

What are the benefits of using airSlate SignNow to file CA Form 199 online?

Using airSlate SignNow to file CA Form 199 online offers key benefits like reduced turnaround time, enhanced security, and streamlined compliance with state regulations. The user-friendly interface simplifies the eSigning process, making document management hassle-free for businesses of all sizes.

-

Is my data secure when I file CA Form 199 online with airSlate SignNow?

Yes, your data is secure when you file CA Form 199 online with airSlate SignNow. We use advanced encryption protocols and comply with industry regulations to protect your information. Our commitment to security ensures that your sensitive data remains confidential.

-

What support options are available for users filing CA Form 199 online?

airSlate SignNow offers comprehensive support options for users filing CA Form 199 online. You can access our extensive knowledge base, contact customer support via email or chat, and join our community forums for peer assistance. Our team is dedicated to helping you every step of the way.

Get more for Form 199 Ftb Ca

Find out other Form 199 Ftb Ca

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself