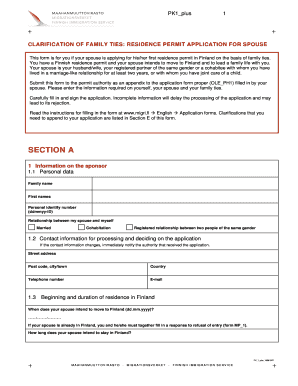

Pk1 Form Finland

What is the Pk1 Form Finland

The Pk1 form is a crucial document used in Finland, primarily for reporting income and tax information. It serves as a declaration for individuals who are employed or self-employed, ensuring that the Finnish Tax Administration receives accurate data regarding earnings. This form is essential for maintaining compliance with Finnish tax laws and is often required during the annual tax return process.

How to obtain the Pk1 Form Finland

To obtain the Pk1 form, individuals can visit the official website of the Finnish Tax Administration. The form is typically available for download in a PDF format, allowing users to print it for completion. Additionally, individuals may request a physical copy through their local tax office if they prefer not to download it online. It is important to ensure that the correct version of the form is used, as different tax years may have specific requirements.

Steps to complete the Pk1 Form Finland

Completing the Pk1 form involves several key steps to ensure accuracy and compliance:

- Gather all necessary financial documents, including payslips and other income statements.

- Fill in personal information, such as your name, address, and social security number.

- Report all sources of income, including salaries, bonuses, and any freelance earnings.

- Double-check all entries for accuracy to avoid potential issues with the tax authorities.

- Submit the completed form by the specified deadline, either online or via mail.

Legal use of the Pk1 Form Finland

The Pk1 form is legally recognized as a valid document for tax reporting in Finland. It must be filled out accurately and submitted within the designated time frame to comply with Finnish tax regulations. Failure to submit the form or providing incorrect information can lead to penalties, including fines or additional tax assessments. Therefore, understanding the legal implications of the Pk1 form is essential for all taxpayers.

Key elements of the Pk1 Form Finland

Key elements of the Pk1 form include:

- Personal Information: Essential details such as name, address, and identification number.

- Income Reporting: A comprehensive list of all income sources, including wages and freelance work.

- Deductions: Information on any applicable tax deductions that may reduce taxable income.

- Signature: A declaration that the information provided is accurate and complete.

Form Submission Methods

The Pk1 form can be submitted through various methods to accommodate different preferences:

- Online Submission: Many taxpayers opt to submit the form electronically through the Finnish Tax Administration's online portal.

- Mail: Individuals can print the completed form and send it via postal service to the appropriate tax office.

- In-Person: Some may choose to deliver the form directly to their local tax office for immediate processing.

Quick guide on how to complete pk1 form finland

Complete Pk1 Form Finland effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without complications. Handle Pk1 Form Finland on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign Pk1 Form Finland with ease

- Find Pk1 Form Finland and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, lengthy form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Pk1 Form Finland and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pk1 form finland

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a pk1 form?

A pk1 form is a specific document utilized for particular legal or administrative purposes, often required in various business processes. With airSlate SignNow, you can easily create, send, and e-sign pk1 forms, streamlining your workflows. This ease of use facilitates faster processing and better compliance.

-

How does airSlate SignNow help with pk1 forms?

airSlate SignNow provides a robust platform that simplifies the creation and management of pk1 forms. Users can customize their pk1 forms, add e-signature fields, and track document status in real-time. This feature not only boosts productivity but also ensures that all your pk1 forms are securely stored and accessible.

-

Is there a cost associated with using airSlate SignNow for pk1 forms?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users. The plans include features for managing pk1 forms, such as unlimited e-signatures and document storage. This cost-effective solution makes it affordable for businesses of all sizes to handle their pk1 forms efficiently.

-

Can I integrate airSlate SignNow with other applications when handling pk1 forms?

Absolutely! airSlate SignNow supports integrations with popular applications like Salesforce, Google Drive, and many more. This allows you to seamlessly manage your pk1 forms alongside your other business tools, enhancing your overall workflow and efficiency.

-

What are the benefits of using airSlate SignNow for pk1 forms?

Using airSlate SignNow for pk1 forms streamlines the document signing process, reducing turnaround time signNowly. Furthermore, it offers increased security, easy tracking, and a user-friendly interface that enhances the overall signing experience. Businesses can focus more on their core operations instead of getting bogged down with paperwork.

-

How secure is the information on my pk1 forms with airSlate SignNow?

Security is a top priority for airSlate SignNow. All pk1 forms are encrypted, and the platform complies with industry-standard security protocols. This ensures that your sensitive data remains secure during the signing process, giving you peace of mind while managing your documents.

-

Can I access my pk1 forms on mobile devices?

Yes, airSlate SignNow is optimized for mobile use, allowing you to access your pk1 forms from any device. This mobile functionality enables users to send and e-sign documents on the go, ensuring that business processes remain uninterrupted. You can efficiently manage your pk1 forms anytime and anywhere.

Get more for Pk1 Form Finland

- Download mba 805 form

- App 031 attached declaration court of appeal editable and saveable california judicial council forms

- Www healthearizonaplus gov form

- Liver failare form

- Aurora il parking card prepaid form

- 1113 0 initial police reports form

- Fillable online request for termination of utility service polk form

- Assignable contract template form

Find out other Pk1 Form Finland

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe