Sc1040 Fillable Form

What is the SC 1040 Fillable Form

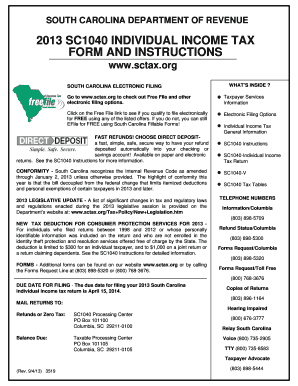

The SC 1040 fillable form is a simplified version of the South Carolina individual income tax return. It is designed for eligible taxpayers who meet specific criteria, allowing them to file their taxes efficiently. This form is particularly useful for individuals with straightforward tax situations, such as those who do not have complex deductions or multiple sources of income. By using the SC 1040EZ, taxpayers can streamline their filing process while ensuring compliance with state tax regulations.

How to Use the SC 1040 Fillable Form

Using the SC 1040 fillable form is straightforward. Taxpayers can access the form online, fill it out digitally, and submit it electronically or print it for mailing. To begin, gather all necessary information, including income details, deductions, and personal identification data. As you fill out the form, ensure that all entries are accurate and complete. Once finished, review the form for any errors before submitting it to the South Carolina Department of Revenue.

Steps to Complete the SC 1040 Fillable Form

Completing the SC 1040 fillable form involves several key steps:

- Gather necessary documents, such as W-2s and 1099s.

- Access the SC 1040 fillable form online.

- Input personal information, including your name, address, and Social Security number.

- Report all sources of income accurately.

- Claim any eligible deductions and credits.

- Review the completed form for accuracy.

- Submit the form electronically or print it for mailing.

Legal Use of the SC 1040 Fillable Form

The SC 1040 fillable form is legally recognized as a valid tax return when completed and submitted according to South Carolina tax laws. To ensure its legality, taxpayers must adhere to the guidelines set forth by the South Carolina Department of Revenue. This includes providing accurate information and maintaining compliance with all relevant tax regulations. Submitting the form electronically through a secure platform further enhances its legal standing.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the SC 1040 fillable form. Generally, the deadline for submitting the form coincides with the federal tax filing deadline, which is typically April 15. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is essential to check for any updates or changes to deadlines each tax year to avoid penalties.

Required Documents

To complete the SC 1040 fillable form, taxpayers need to gather several important documents:

- W-2 forms from employers

- 1099 forms for additional income

- Records of any tax deductions or credits

- Social Security numbers for dependents

- Bank account information for direct deposit of refunds

Form Submission Methods

The SC 1040 fillable form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Electronic filing through authorized e-filing services

- Mailing a printed copy to the South Carolina Department of Revenue

- In-person submission at designated tax offices

Quick guide on how to complete sc1040ez

Accomplish sc1040ez effortlessly on any gadget

Web-based document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage sc 1040ez on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to adjust and eSign sc 1040ez form with ease

- Obtain sc gov tax forms 1040ez and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign sc tax forms 1040ez and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to sc form 1040

Create this form in 5 minutes!

How to create an eSignature for the sc1040ez form 2021 printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask sc1040 fillable form

-

What is the SC 1040EZ form and how can airSlate SignNow assist with it?

The SC 1040EZ form is a simplified tax return that can be used by individuals with straightforward financial situations. airSlate SignNow streamlines the eSigning process for the SC 1040EZ, ensuring you can quickly fill out and submit your form with ease, saving you valuable time.

-

Is airSlate SignNow a cost-effective solution for eSigning the SC 1040EZ?

Yes, airSlate SignNow offers competitive pricing plans that cater to various budgets, making it a cost-effective choice for eSigning the SC 1040EZ. By using our platform, you can eliminate traditional printing and mailing costs, enhancing your overall efficiency.

-

What features does airSlate SignNow provide for completing the SC 1040EZ?

airSlate SignNow provides a range of features for completing the SC 1040EZ form, including easy document editing, secure eSigning, and real-time tracking of document status. These features are designed to simplify the tax preparation and submission process.

-

How secure is the process of signing my SC 1040EZ with airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption technologies and secure cloud storage to ensure your SC 1040EZ and other sensitive documents are protected throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for managing my SC 1040EZ?

Yes, airSlate SignNow easily integrates with various applications such as CRMs and document management systems, allowing for seamless management of your SC 1040EZ and other documents. This integration enhances your workflow and reduces the need for manual data entry.

-

What benefits can I expect from using airSlate SignNow for the SC 1040EZ?

By using airSlate SignNow for the SC 1040EZ, you can expect faster processing times, increased accuracy in document completion, and greater convenience overall. These benefits not only save time but also help avoid errors that could lead to tax-related issues.

-

Is it easy to use airSlate SignNow for someone unfamiliar with digital signing of the SC 1040EZ?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible even for those unfamiliar with digital signing processes. Our intuitive interface helps users navigate through the SC 1040EZ quickly and efficiently.

Get more for sc 1040ez

Find out other sc 1040ez form

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now