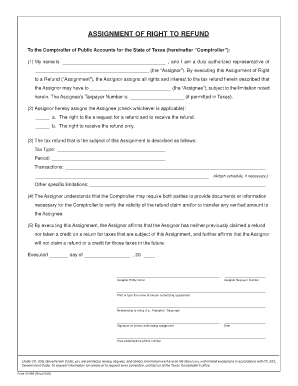

Assignment of Right to Refund Form

What is the assignment of right to refund?

The assignment of right to refund is a legal document that allows an individual or entity to transfer their right to receive a refund from a specific transaction to another party. This form is commonly used in various scenarios, such as tax refunds, insurance claims, or any situation where a refund is anticipated. By completing this document, the original claimant relinquishes their right to the refund, enabling the assignee to claim it directly. Understanding the implications of this assignment is crucial, as it involves legal rights and responsibilities that must be clearly outlined in the document.

How to use the assignment of right to refund

Using the assignment of right to refund involves several key steps to ensure the process is legally binding and effective. First, identify the specific refund that is being assigned. Next, both parties—the assignor (the person giving up the right) and the assignee (the person receiving the right)—must complete the form accurately. This includes providing necessary details such as names, addresses, and the amount of the refund. After filling out the form, both parties should sign it, ideally in the presence of a witness or notary, to enhance its legal standing. Finally, submit the completed assignment to the relevant institution or agency handling the refund.

Steps to complete the assignment of right to refund

Completing the assignment of right to refund involves a series of straightforward steps:

- Gather necessary information about the refund, including the amount and the entity responsible for issuing it.

- Obtain the assignment form, which can often be found through the relevant agency or institution.

- Fill out the form with accurate details, including both parties' information and the specifics of the refund.

- Ensure both parties sign the document, preferably in front of a witness or notary.

- Submit the completed form to the appropriate agency or institution for processing.

Legal use of the assignment of right to refund

The legal use of the assignment of right to refund is governed by specific laws that vary by state and context. This document must meet certain criteria to be considered valid, including clear identification of the refund and the parties involved. Additionally, it should be executed in compliance with any applicable state laws regarding assignments. Failure to adhere to these legal requirements may result in the assignment being deemed invalid, which could lead to complications in claiming the refund. It is advisable to consult legal counsel if there are uncertainties regarding the legal implications of the assignment.

Key elements of the assignment of right to refund

When drafting an assignment of right to refund, several key elements must be included to ensure its validity:

- Identifying Information: Full names and addresses of both the assignor and assignee.

- Description of the Refund: Clear details about the refund being assigned, including the amount and the source.

- Signatures: Signatures of both parties, indicating their consent to the assignment.

- Date: The date when the assignment is executed, which is important for record-keeping.

- Witness or Notary Signature: Optional but recommended for added legal protection.

Examples of using the assignment of right to refund

There are various scenarios where the assignment of right to refund may be applicable:

- A taxpayer assigning their tax refund to a financial institution to cover a loan.

- An insurance policyholder transferring their right to a claim refund to a third-party service provider.

- A business assigning the right to receive a refund from a vendor to a partner for financial management purposes.

Each example illustrates how the assignment of right to refund can facilitate financial transactions and obligations between parties, ensuring clarity and legal compliance in the process.

Quick guide on how to complete assignment of right to refund

Effortlessly Prepare Assignment Of Right To Refund on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and store it securely online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without delays. Manage Assignment Of Right To Refund on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The Easiest Method to Edit and eSign Assignment Of Right To Refund with Minimal Effort

- Obtain Assignment Of Right To Refund and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information thoroughly and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Assignment Of Right To Refund and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the assignment of right to refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an 'assignment of right to refund'?

An assignment of right to refund is a legal document that enables an individual or business to transfer their entitlement to a refund to another party. This can streamline transactions and ensure that refunds are processed efficiently. Using airSlate SignNow, you can easily prepare and eSign this document, making the process seamless.

-

How does airSlate SignNow simplify the assignment of right to refund process?

airSlate SignNow provides an intuitive platform for drafting and signing the assignment of right to refund documents. With user-friendly templates and eSignature capabilities, you can complete the process quickly and securely, eliminating delays associated with paper documentation. This efficiency helps you manage refunds more effectively.

-

What are the costs associated with using airSlate SignNow for signing documents?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for managing an assignment of right to refund and other documents. Plans often include features like unlimited signing, team collaboration, and integrations. By choosing the right plan, you can optimize your spending while enjoying comprehensive document solutions.

-

Are there any key features specifically related to the assignment of right to refund?

Yes, airSlate SignNow includes powerful features tailored for handling assignments of right to refund, such as customizable templates, audit trails, and automatic notifications. These features ensure accuracy and compliance while easing the signing process. You'll have peace of mind knowing that each document is tracked throughout its lifecycle.

-

Can I integrate airSlate SignNow with other tools I use?

airSlate SignNow supports various integrations with popular tools such as CRM systems and payment processors. This allows you to seamlessly incorporate the assignment of right to refund into your existing workflows. Such integrations enhance productivity and streamline the document management process.

-

Is my data safe when using airSlate SignNow for important documents?

Absolutely. airSlate SignNow prioritizes security through advanced encryption and compliance with data protection regulations. Your assignment of right to refund and other sensitive documents are safeguarded, allowing you to eSign with confidence and ensuring your data remains confidential.

-

How can businesses benefit from using airSlate SignNow for assignments of right to refund?

Businesses can save time and resources by using airSlate SignNow for assignments of right to refund, as it eliminates the need for physical document exchanges and accelerates the signing process. This leads to faster refunds and improved customer satisfaction. The easy-to-use platform empowers teams to focus on their core activities rather than get bogged down by paperwork.

Get more for Assignment Of Right To Refund

- Hcr 20 pdf form

- Barclays bank statement template 448364855 form

- Upstream c1 workbook answers pdf form

- Engine parts names and pictures pdf download form

- Vsnip application form

- Rya bill of sale form

- St cyprians schoolsport scholarship application fo form

- Town of east hampton ct police department easthamptonct form

Find out other Assignment Of Right To Refund

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter