Form C 3

What is the Form C 3

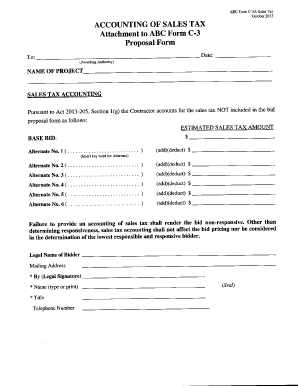

The Form C 3 is a specific document used primarily for reporting sales tax in the United States. This form is essential for businesses that need to account for sales tax collected during a specific period. It ensures compliance with state tax regulations and helps maintain accurate financial records. The information provided in the Form C 3 is crucial for both the business and tax authorities to verify tax obligations and ensure proper remittance of collected sales tax.

Steps to complete the Form C 3

Completing the Form C 3 involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records, including invoices and receipts, to determine the total sales tax collected. Next, accurately fill in the required fields, including business information and sales figures. It is important to double-check all calculations and ensure that the totals match the sales records. Once completed, the form should be signed and dated to validate the submission.

Legal use of the Form C 3

The legal use of the Form C 3 is governed by state tax laws, which outline the requirements for reporting sales tax. To be considered valid, the form must be filled out accurately and submitted by the designated deadline. Compliance with these regulations is essential to avoid penalties and ensure that the business remains in good standing with tax authorities. Additionally, the use of electronic signatures can enhance the validity of the form when submitting it digitally.

How to obtain the Form C 3

The Form C 3 can typically be obtained through the state’s tax authority website or office. Many states provide downloadable versions of the form in PDF format, allowing for easy access and printing. Alternatively, businesses can request a physical copy by contacting their state tax office directly. It is important to ensure that the most current version of the form is used to comply with any recent updates or changes in tax regulations.

Form Submission Methods

The Form C 3 can be submitted through various methods, depending on state regulations. Common submission methods include online filing through the state tax authority's website, mailing a physical copy to the appropriate tax office, or delivering it in person. Each method may have specific requirements regarding signatures and documentation, so it is essential to follow the guidelines provided by the state to ensure successful submission.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form C 3 can result in significant penalties. These may include fines, interest on unpaid taxes, or even legal action in severe cases. It is crucial for businesses to adhere to filing deadlines and ensure the accuracy of the information provided to avoid these penalties. Regular audits and reviews of sales tax records can help maintain compliance and mitigate risks associated with non-compliance.

Quick guide on how to complete form c 3

Effortlessly Prepare Form C 3 on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed papers, allowing you to easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form C 3 on any platform using the airSlate SignNow Android or iOS applications and streamline your document-centered operations today.

Easily Modify and eSign Form C 3 Without Hassle

- Obtain Form C 3 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign feature, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form C 3 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form c 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form C 3 and how does it relate to airSlate SignNow?

Form C 3 is a specific type of document that can be efficiently processed using airSlate SignNow. Our solution streamlines the eSigning and submission of Form C 3, ensuring a seamless experience for all users.

-

How much does it cost to use airSlate SignNow for Form C 3?

airSlate SignNow offers a variety of pricing plans designed to fit different business needs, starting as low as $8 per month. With our service, you gain access to powerful features that simplify the management of Form C 3 and other documents.

-

What features does airSlate SignNow offer for handling Form C 3?

Our platform provides numerous features tailored for Form C 3, including customizable templates, automated workflows, and advanced tracking capabilities. These tools help streamline the signing process and improve efficiency for your team.

-

Can I integrate airSlate SignNow with other applications for Form C 3 management?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow for Form C 3. Whether you use CRM software or cloud storage solutions, our platform allows for easy integration to keep your processes organized.

-

What are the benefits of using airSlate SignNow for Form C 3?

By using airSlate SignNow for Form C 3, you benefit from enhanced security, reduced processing time, and improved accuracy. Our solution minimizes errors associated with manual handling, giving you peace of mind while managing important documents.

-

Is there a mobile app available for signing Form C 3 with airSlate SignNow?

Yes, airSlate SignNow has a mobile app that allows users to eSign Form C 3 on-the-go. This flexibility ensures that documents can be signed anytime and anywhere, making it convenient for busy professionals.

-

What support options are available if I need help with Form C 3 on airSlate SignNow?

Our customer support team is available to assist you with any issues related to Form C 3 on airSlate SignNow. You can access support through email, live chat, or our extensive knowledge base for quick solutions.

Get more for Form C 3

- Adams state university athletics pre participation medical packet form

- Emergency withdrawal uco form

- Application for admission touro university nevada form

- Tulane university secondary school reportinsrucionsscorheuden form

- Position transfer request form anselm

- Invoice for payment temple university temple form

- Semi annual fertilizer tonnage report for period form

- Youth transportation permission form

Find out other Form C 3

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now