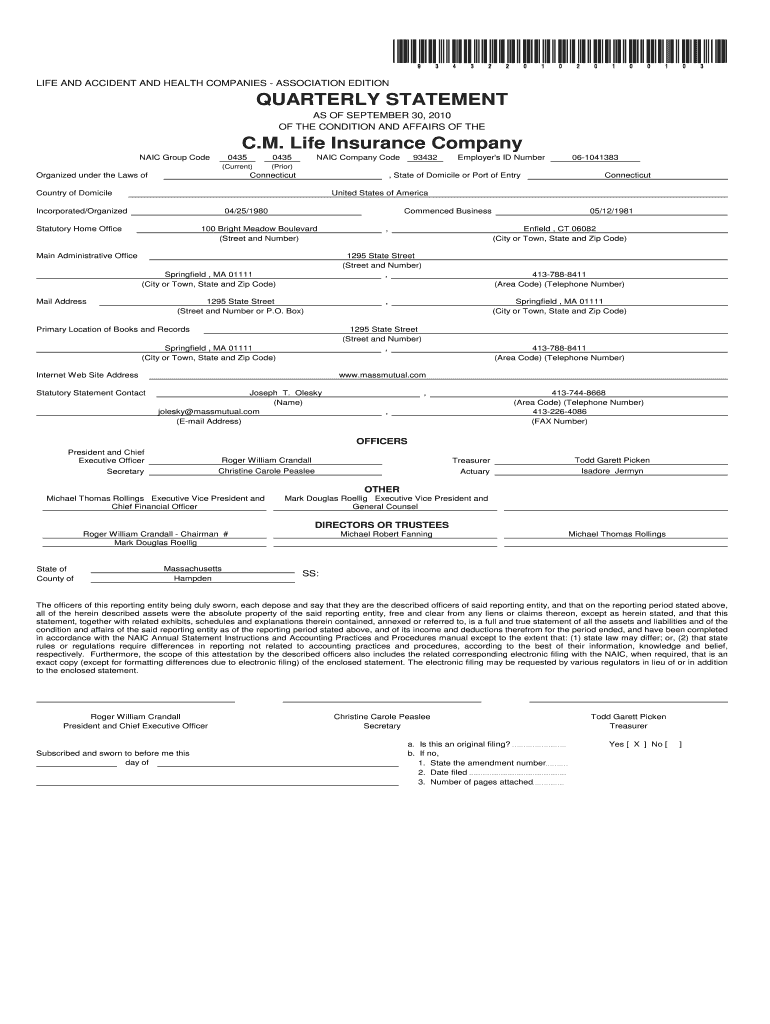

93432 C M Life Insurance Company PrintBooks **** Internal Use Only Quarter 3 Print Books # 3 Form

Understanding the 93432 C M Life Insurance Company PrintBooks

The 93432 C M Life Insurance Company PrintBooks serve as essential documents for internal use, specifically designed for the third quarter. These print books contain vital information and guidelines related to life insurance policies, claims, and customer service protocols. They are structured to assist agents in navigating the complexities of life insurance transactions and ensuring compliance with company standards.

Steps to Complete the 93432 C M Life Insurance Company PrintBooks

Completing the 93432 C M Life Insurance Company PrintBooks involves several key steps:

- Review the contents of the print books to understand the guidelines and requirements.

- Fill out the necessary forms as indicated, ensuring all information is accurate and complete.

- Verify that all signatures and approvals are obtained where required.

- Submit the completed documents to the appropriate department for processing.

Legal Use of the 93432 C M Life Insurance Company PrintBooks

The legal use of the 93432 C M Life Insurance Company PrintBooks is crucial for maintaining compliance with industry regulations. These documents must be utilized in accordance with federal and state laws governing life insurance practices. Proper use ensures that the information contained within is recognized as valid and enforceable in legal contexts.

Obtaining the 93432 C M Life Insurance Company PrintBooks

To obtain the 93432 C M Life Insurance Company PrintBooks, agents should follow these procedures:

- Contact the C M Life Insurance Company customer service for access to the latest print books.

- Request the documents through the company’s internal portal, if available.

- Ensure you have the necessary permissions to access these internal documents.

Key Elements of the 93432 C M Life Insurance Company PrintBooks

Key elements of the 93432 C M Life Insurance Company PrintBooks include:

- Detailed instructions on policy issuance and management.

- Information on claims processing and customer service protocols.

- Compliance guidelines with applicable laws and regulations.

- Templates for various forms related to life insurance transactions.

Examples of Using the 93432 C M Life Insurance Company PrintBooks

Examples of how agents can effectively use the 93432 C M Life Insurance Company PrintBooks include:

- Utilizing templates for policy applications to streamline the submission process.

- Referencing guidelines for handling customer inquiries and claims efficiently.

- Ensuring compliance with regulatory requirements by following outlined procedures.

Quick guide on how to complete 93432 cm life insurance company printbooks internal use only quarter 3 print books 3

Effortlessly Prepare 93432 C M Life Insurance Company PrintBooks **** Internal Use Only Quarter 3 Print Books # 3 on Any Device

The management of online documents has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle 93432 C M Life Insurance Company PrintBooks **** Internal Use Only Quarter 3 Print Books # 3 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

How to Edit and Electronically Sign 93432 C M Life Insurance Company PrintBooks **** Internal Use Only Quarter 3 Print Books # 3 with Ease

- Find 93432 C M Life Insurance Company PrintBooks **** Internal Use Only Quarter 3 Print Books # 3 and click Get Form to begin.

- Employ the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details carefully and click the Done button to save your updates.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require new copies to be printed. airSlate SignNow fulfills your document management needs with just a few clicks from your device of choice. Modify and electronically sign 93432 C M Life Insurance Company PrintBooks **** Internal Use Only Quarter 3 Print Books # 3 and assure clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can an insurance company afford to pay out hundreds of thousands of dollars for a life insurance policy that only cost $50 a month?

==== This Answer May Disturb Some ====Look at a mortality table. Created and updated by actuaries every ten or twenty years(+/-), it shows the number of deaths per 1,000 at any given age.There's a table for males, females, smokers, non-smokers, fat people, skinny people, sky divers, race car drivers, mountain climbers, you name it. Let's take it a step further:Let's say you’re a male age 30 and you don’t smoke, drink or do anything hazardous. Let's say you're a teacher who walks two miles to work every day and two miles back home at the end of the day. You're 5′ 8″ and weigh 138 pounds, not 198. Translation: you’ll probably live a long time. But on any given day a dumb drunk or a jerk on opium could run into you and WHAM, you're dead! So your question is:“How can an insurance company afford to pay out hundreds of thousands of dollars for a life insurance policy that only costs $50 a month?”HERE’S THE ANSWER—The life insurance company insures many Many MANY males age 30 who, just like you, are “good risks.” That means the premium you pay ($600 this year) is enough to pay a big Big BIG amount if . . . this year . . . you do like the frogs do and croak! How much can the company pay? Again, look at a mortality table. The number of deaths per thousand for healthy males age 30 is only about one (1.00). So that means by insuring a thousand, the company will have $600 X 1,000 = $600,000 in the pot which is enough to pay a check in the amount of six hundred thousand dollars to your family . . . $600,000 . . . and that's good!But if you’re 40 and deaths per thousand are 2.00, your premium will have to be double what it was at 30. So that means that your premium will be $100 per mo. / $1,200 per yr.At age 50 it'll cost $2,400. At age 60 it'll cost $4,800. At age 70 it'll be based on deaths per thousand at 23. At age 80 it'll be based on deaths per thousand at 64. At age 90 it'll be based on 172. At age 100 it'll be based on 324. At age 110 it'll be based on 570. And at age 120 it'll be based on 1,000 deaths per thousand!What I just described is “Annually Renewable Term (“ART” for short) . . . and there are idiots out there who will tell you that, “You don’t need life insurance if your kids are grown up and your mortgage is paid off.” When you hear that, think of them as Idiots, Creeps, Jerks, Morons, Cretins, S - - theads and Imbiciles who also say truly stupid things like,==== ==== “Don't Buy Whole Life” ==== =======“Buy Term and Invest the Difference!”===As a Chartered Life Underwriter (CLU) with forty nine (49) years experience selling and servicing life insurance, my opinion about them is very Very VERY simply stated. Stay away from them! Think for yourself! As a 78 year old healthy male with dreams to fulfill, there’s no one, and I mean THERE IS NO ONE who can get away with that crap when I'm in the room listening because I will raise my hand, get recognized, stand up and ask a tough, insightful, pain-in-the-ass question:=== “Do you own Term or Whole Life?” ===Imbiciles cannot handle truth! And what's really Really REALLY sad is that they own Whole Life on their lives but, not being able to explain life's realities including the reasons why Whole Life is truly one of the greatest inventions ever created . . . not being able to do that . . . they make money by duping the public with their idiotic nonsense about term!I'm not saying term is bad. It has its place. And that’s good. But those who lie / those who can't speak the truth / they confuse the public!Worse than sad / in fact tragic / is the death of Life Insurance Selling in America.When I was a rookie in the fall of 1969, the LIMRA (Life Insurance Management Research Association) Four-Year New Agent Retention Rate was 15%. Today it's 8%.That’s bad!Back then we had 142,000 members of NALU (the National Association of Life Underwriters) (renamed in the early 1990′s to the National Association of Insurance & Financial Advisors) (NAIFA). Today, it's less than 20,000. In just one generation we lost 122,000 members!When I was a rookie, Met-Life (The Metropoli-tan Life Insurance Company of New York) (“Mother Met”) was the largest life insurance company IN THE WORLD! Today—2019—they're out of business for new life insurance sales here in America. Met-Life moved its sales operation to Japan . . . to JAPAN!I’m telling you something—Met-Life’s Senior Management is made up of freakin’ MORONS! (You can quote me on that . . . to them!)When I was a rookie, the Million Dollar Round Table (The MDRT) (the greatest sales organ-ization in the world) had 25,000 members here in America and 10,000 overseas. But today we have 10,000 here and 25,000 overseas!LIFE here in America is DYING!SO TELL ME, HOW CAN WE REMAIN FREE if we can’t insure our lives for the benefit of our loved ones? The truth is this—WE CAN’T! And THAT’S the most tragic thing that could ever happen to a free society / to America!I'M TELLING YOU SOMETHING—Those who DON’T understand / who WON’T understand / who REFUSE to understand will destroy our nation in a heartbeat!OBAMA SAID, QUOTE: “Globalization is here; it's now!” PsignNowing that crap (just before HRC lost to DJT), when he was POTUS he absolutely REFUSED to release his transcript of grades from Columbia University. Why? Do you think he studied, “The American Political Tradition” by Richard Hofstadter? Or do you think he studied Karl Marx and Friedrich Engel's “The Communist Manifesto?” Ask Professor Drew!I know you don’t know, so READ and THINK!JOHN C. DREW, Ph.D., a former liberal, wrote an article, “Even Republicans Rejected Info About Obama’s Past” which appeared in the “American Thinker” of September 23rd, 2011 (about a year before the end of Obama’s first term). And so I contend that whether a citizen is Independent, Democrat or Republican, that article is important reading!So FIND and READ it!The AMERICAN THINKER is a conservative daily online magazine dealing with American politics, foreign policy, national security, Israel, economics, diplomacy, culture and military strategy—very important subjects!BACK TO THE QUESTION—It's about value for money spent / Term Life Insurance (ulti-mately a waste of money for those who live a long time) and Whole Life designed for level premiums . . . and IT LASTS FOR LIFE!IN POLITICAL ECONOMIC MATTERS—How do we determine VALUE? What's VALUE if the American economy falls apart?NOT BUILDING VALUE—Near the end of his first term, Obama was interviewed in the Oval Office by a TV Journalist who posed a very important question. She asked, “Mr. President, what will you do about the National Debt?” [As a percent of GDP, it was rapidly approaching the level we had at the end of WWII]. Obama said he would do something about it. HE DID NOTHING. And our debt went up / and up / and up to the point where it exceeded our debt as a % of GDP as of the end of WWII — 121%.THIS QUESTION IS ABOUT VALUE—money is 100% wasted when people buy term and live a long time, which is what most people do!AMERICA IS ABOUT VALUE—we built an economy that’s so strong we can help other nations. That’s a true measure of greatness! From an economics point of view, it's like Whole Life because it has VALUE!ARE WE STRONG NOW?—Do we not have both National Debt and Consumer Debt at record high levels? We do, and no, we most definitely are NOT strong!THE WAY TO DESTROY A NATION—to des-troy America, let it crumble from the weight of an absolutely absurd level of debt.I hate that!“GLOBALIZATION IS HERE, IT'S NOW!”—Hearing that and with ten years in the United States Army, as a patriot I feel the despicable arrogance of a destructive creep who wants to destroy America! Join me, please, to prevent it.WHAT CAN YOU DO TO HELP?—Simple. “Get Out of Debt, $ave Money, and Properly Insure Your Life and Your Income(TM).” Attend one of our training events and learn how to do that.RC

-

How do life insurance companies stay in business? Don’t they have to pay out claims to 100% of insureds?

That’s one way to look at it. However, keep in mind they have many people paying premiums every year. The amount they pay out on a policy will (hopefully for the insurance company) likely be less than the total of money they take in on premiums. This is similar to other insurances. They know they will have to pay out to policyholders for insured incidents (fire, hurricane, car accident) but hope that all the incoming premiums more than offset their loses. If someone signs up for a new auto policy with a new insurer and totals their brand new car a week later, the insurance company may be out a lot of money, despite not taking in much in the way of premiums from the newly insured client. That’s made up for by the person who has paid 200,000 dollars over a long driving career with zero claims. With life insurance, some will die relatively young, and some will die relatively old, but the basic principal is the same (and why if you are a smoker or obese your policy may cost more as they figure you’ll be paying in for a shorter period of time…) Same with pensions…Some will pay in for many years, retire, and die a year after they retire, never coming close to re-cooping all the money they put into the retirement system (or social security perhaps). Others will retire and live long enough to cost the pensions system more money than they contributed.

-

How do life insurance companies afford to pay out life insurance amounts when they insured person likely won’t ever pay in the amount they have set to collect?

The majority of term policies never collect. Roughly 2% are paid out, so 98% of the premiums are paying for those claims. However, it does’t mean Term Life Insurance is bad. The entire point is to transfer that “risk” that you can’t see in your life, to the company. You are essentially hoping you never use your Term Policy, but while having it you pay a specific dollar amount to give the risk of dying early to the company, instead of having that on your shoulders.Permanent products require a large amount of premium over the course of your life. The insurance company invests these funds aiming to gain a return large enough to pay the policy out and have a profit.Over $1 billion of death benefit has gone unclaimed. Sometimes the beneficiary cannot be found. This is a crazy concept to me, but also a good reminder to update your information on your policy.

-

Life insurance payouts are normally quite high, higher than most other insurance types, and are guaranteed to eventually be paid out, as everyone eventually dies. How does the insurance company make their money?

Most life insurance policies do not pay out. Many are ten year term policies. That means that they only pay if you die within the ten year term. Another large portion of policies are employer sponsored. That means that they only pay if you die while you are still employed. There is another entire group of policies called accidental death policies, They only pay if you die in an accident. Almost nobody dies in an accident, unless they are decapitated. People die from trauma induced by the accident. So the official cause of death may be kidney or heart failure. Often the cause is infection brought on by the injuries. Many insurance companies will not pay an accidental death policy in those cases.As far as these term policies go, I have read figures from 95% for solid companies and 99%+ for questionable companies as far as numbers that expire before being paid. The truth is that the vast majority of people are not going to die in the next ten years and the odds are even lower if the person is young and healthy.That does not mean you should not buy one of these policies. You do not want to be the person who dies of a freak circumstance and leaves your family destitute. Competition in the marketplace has brought down the cost of these policies to their relative risk. I have seen good sized policies for young, healthy people for a cost of $100 per year, less than $10 per month. The insurance company can make money from that because the person is not likely to die. That is the true goal of insurance. Spreading the risk of something that is financially devastating but not likely to happen over a large population so that everyone pays a tiny amount and hopes they are not the one that needs it.Lifetime policies are a whole different set of calculations. In that case, the insurance company invests the money and returns some of that back to the policy holder. They make money by keeping the difference in the investment results and charging fees to keep the money safe and to manage the investments. Even not all lifetime policies pay, even though everybody dies. As people get older, their children grow up and they pay off their mortgages. Maybe they have a lot of extra money in the bank or investments. They become self-insured and no longer need the life insurance. So they terminate the policy before they die and take the cash value that has accrued. The insurance company did not pay the death benefit and for decades made money from the fees and investments of that money. I am not sure of what percentage of the time this happens, but have seen it happen plenty of times.

-

I found a life insurance policy from 1968 for my parent who died four years ago. The company Prudent American Life Assurance Company of Cleveland, Ohio no longer exists. How do I find out what happened to this policy?

Call your state insurance department. You can find the contact information at www.naic.org. Your state insurance department consumer services department will help you find out if another company took over your parent’s insurance company and if the policy is still valid.

-

How do you fight with a life insurance company that has not paid anything out (we have the contract binder and contacted them over 10 times and went to the DA's office)?

Hire a lawyer to pursue the insurance claim for you. You might choose to see if one will take the claim for a moderate percentage of the payout. Depending on the size of the claim, you might find you get a good idea of the chances of winning from whether a lawyer specializing in insurance claims will take the claim on a success fee basis. If you can get an offer to pursue the claim on a success fee basis then you should think hard about whether you would prefer to do it on a hourly fee basis rather than success fee basis.

-

How do I deal with having to switch therapists due to a change in insurance companies? I’m very attached to my therapist but just found out my insurance plan will be through a different company next year. I’m really upset and anxious about this.

Maybe you have answered your own question by saying, ’I’m very attached to my therapist.’ Being attached to a therapist is not always healthy. I do not know how long you have been with the therapist, or the reasons why but even though you are anxious about leaving the therapist perhaps changing to another therapist you don’t feel attached to, might be healthier. Therapists are aware if a client has formed an attachment so work with your therapist. Perhaps they can help with a referal to another therapist.

Create this form in 5 minutes!

How to create an eSignature for the 93432 cm life insurance company printbooks internal use only quarter 3 print books 3

How to make an eSignature for the 93432 Cm Life Insurance Company Printbooks Internal Use Only Quarter 3 Print Books 3 in the online mode

How to create an electronic signature for your 93432 Cm Life Insurance Company Printbooks Internal Use Only Quarter 3 Print Books 3 in Google Chrome

How to create an electronic signature for putting it on the 93432 Cm Life Insurance Company Printbooks Internal Use Only Quarter 3 Print Books 3 in Gmail

How to make an eSignature for the 93432 Cm Life Insurance Company Printbooks Internal Use Only Quarter 3 Print Books 3 straight from your smart phone

How to create an eSignature for the 93432 Cm Life Insurance Company Printbooks Internal Use Only Quarter 3 Print Books 3 on iOS devices

How to make an eSignature for the 93432 Cm Life Insurance Company Printbooks Internal Use Only Quarter 3 Print Books 3 on Android OS

People also ask

-

What are agent printable transcripts life insurance?

Agent printable transcripts life insurance are documents that summarize the details of an insurance policy, including coverage options and benefits. These transcripts can be easily printed and shared with clients, ensuring they have access to important information at their fingertips. By utilizing airSlate SignNow, agents can streamline this process and enhance client communication.

-

How can I access agent printable transcripts life insurance through airSlate SignNow?

To access agent printable transcripts life insurance, simply log in to your airSlate SignNow account and navigate to the document section. You can create, customize, and generate transcripts for various life insurance policies effortlessly. The platform is user-friendly, allowing for easy retrieval and sharing of these important documents.

-

What pricing options does airSlate SignNow offer for managing agent printable transcripts life insurance?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Depending on your needs, you can choose a plan that allows for unlimited eSigning and document management, including agent printable transcripts life insurance. This cost-effective solution ensures you get maximum value while managing your insurance documents.

-

What features assist in creating agent printable transcripts life insurance on airSlate SignNow?

airSlate SignNow provides a variety of features to support the creation of agent printable transcripts life insurance. With customizable templates, automated workflows, and secure eSigning options, you can create professional-looking transcripts efficiently. These features enhance productivity and simplify the documentation process for both agents and clients.

-

Can I integrate other tools with airSlate SignNow for managing agent printable transcripts life insurance?

Yes, airSlate SignNow supports integrations with various tools that can streamline your workflow for agent printable transcripts life insurance. You can connect with CRM platforms, cloud storage services, and other document management systems to enhance your efficiency. This integration capability allows for a seamless document management experience.

-

What are the benefits of using airSlate SignNow for agent printable transcripts life insurance?

Using airSlate SignNow for agent printable transcripts life insurance provides numerous benefits, including faster document turnaround and enhanced compliance. The platform also ensures that important information is securely stored and easy to access for both agents and clients. Additionally, the any-device accessibility enhances flexibility for all users.

-

Is training available for using airSlate SignNow for agent printable transcripts life insurance?

Yes, airSlate SignNow offers training resources and support to help users efficiently utilize the platform for agent printable transcripts life insurance. You can access tutorials, webinars, and one-on-one support to familiarize yourself with the features and best practices. This training ensures you get the most out of the platform.

Get more for 93432 C M Life Insurance Company PrintBooks **** Internal Use Only Quarter 3 Print Books # 3

- Dd form 2883 credit worthiness evaluation july 2004 dtic

- Isp 3026 formpdffillercom 2015 2019

- Canada pension plan credit split sc isp 1901 e servicecanada gc form

- Where to send sc isp 1200 form

- Penndot form p 329

- Medication consent form 606 cmr 7112b

- Surelc setup packet download jurs montgomery form

- Sgi code of conduct form

Find out other 93432 C M Life Insurance Company PrintBooks **** Internal Use Only Quarter 3 Print Books # 3

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word