Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc 2015

What is the Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc

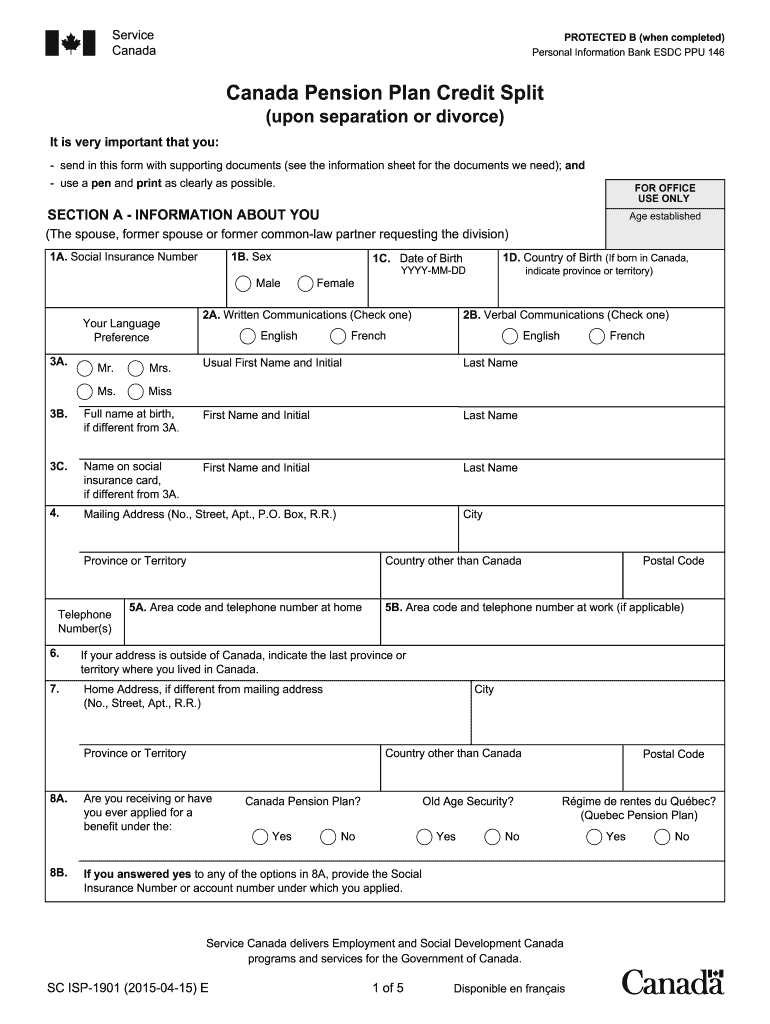

The Canada Pension Plan Credit Split SC ISP 1901 E is a form used to request a division of Canada Pension Plan (CPP) credits between two individuals, typically following a separation or divorce. This form is essential for ensuring that both parties receive fair recognition of their contributions to the CPP, which can affect their retirement benefits. The form is issued by Service Canada and is crucial for individuals who have shared pension credits during their relationship.

How to use the Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc

To use the Canada Pension Plan Credit Split SC ISP 1901 E, individuals must complete the form accurately, providing all required information about their CPP contributions and personal details. The form requires both parties to agree on the split of credits, and it must be signed by both individuals to be valid. After filling out the form, it should be submitted to Service Canada for processing. It is advisable to keep a copy for personal records.

Steps to complete the Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc

Completing the Canada Pension Plan Credit Split SC ISP 1901 E involves several steps:

- Gather necessary personal information, including Social Insurance Numbers and details about CPP contributions.

- Fill out the form, ensuring that all sections are completed accurately.

- Both parties must review the information and agree on the credit split.

- Sign the form to validate the request.

- Submit the completed form to Service Canada via mail or in person.

Legal use of the Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc

The Canada Pension Plan Credit Split SC ISP 1901 E is legally recognized when completed correctly and submitted to Service Canada. It is important to ensure that the information provided is accurate and truthful, as any discrepancies can lead to delays or rejections. The form serves as a legal document that can affect future pension benefits, making it essential to adhere to all legal requirements during the completion process.

Eligibility Criteria

To be eligible to use the Canada Pension Plan Credit Split SC ISP 1901 E, both parties must have contributed to the CPP during their relationship. Typically, this form is used by individuals who are separating or divorcing and wish to divide their pension credits fairly. It is important for both parties to agree on the split of credits, as the form requires mutual consent for processing.

Required Documents

When completing the Canada Pension Plan Credit Split SC ISP 1901 E, individuals may need to provide additional documentation, including:

- Proof of identity, such as a driver's license or passport.

- Documentation of CPP contributions, which may include statements from Service Canada.

- Any legal documents related to the separation or divorce, if applicable.

Quick guide on how to complete canada pension plan credit split sc isp 1901 e servicecanada gc

A concise guide on how to prepare your Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc

Finding the right template can be difficult when you need to supply official international documents. Even if you possess the needed form, it can be cumbersome to efficiently complete it according to all the specifications if you utilize printed copies instead of handling everything online. airSlate SignNow is the web-based electronic signature solution that assists you in navigating all of that. It enables you to obtain your Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc and swiftly fill it out and sign it on-site without needing to reprint documents if you make an error.

Here are the actions you must take to prepare your Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc with airSlate SignNow:

- Press the Get Form button to instantly add your document to our editor.

- Begin with the initial empty section, enter details, and proceed with the Next option.

- Complete the empty fields using the Cross and Check tools from the toolbar above.

- Choose the Highlight or Line features to mark the most signNow information.

- Select Image to upload one if your Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc requires it.

- Make use of the right-side panel to add extra fields for yourself or others to fill in if needed.

- Review your responses and approve the form by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the editing by clicking the Done button and choosing your file-sharing options.

Once your Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc is ready, you can share it in any way you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely keep all your completed documents in your account, organized in folders based on your preferences. Don’t spend time on manual document completion; give airSlate SignNow a try!

Create this form in 5 minutes or less

Find and fill out the correct canada pension plan credit split sc isp 1901 e servicecanada gc

Create this form in 5 minutes!

How to create an eSignature for the canada pension plan credit split sc isp 1901 e servicecanada gc

How to create an electronic signature for the Canada Pension Plan Credit Split Sc Isp 1901 E Servicecanada Gc in the online mode

How to generate an eSignature for the Canada Pension Plan Credit Split Sc Isp 1901 E Servicecanada Gc in Google Chrome

How to create an eSignature for signing the Canada Pension Plan Credit Split Sc Isp 1901 E Servicecanada Gc in Gmail

How to make an eSignature for the Canada Pension Plan Credit Split Sc Isp 1901 E Servicecanada Gc from your mobile device

How to create an electronic signature for the Canada Pension Plan Credit Split Sc Isp 1901 E Servicecanada Gc on iOS

How to generate an electronic signature for the Canada Pension Plan Credit Split Sc Isp 1901 E Servicecanada Gc on Android OS

People also ask

-

What is the Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc?

The Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc is a form used to request a division of Canada Pension Plan benefits between spouses or common-law partners. This form is essential for ensuring fair distribution of retirement benefits during a separation or divorce. Understanding this process helps you secure your financial future.

-

How can I apply for the Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc?

To apply for the Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc, you need to complete the form and submit it to Service Canada. Ensure that all required information is accurate and complete to avoid delays in processing. You can find the form on the Service Canada website or through local Service Canada offices.

-

What are the benefits of using airSlate SignNow for the Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc?

Using airSlate SignNow to manage your Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc form allows for easy eSigning and secure document management. This platform simplifies the process, enabling you to send and receive signed documents quickly and efficiently. With its user-friendly interface, you can keep track of your application status seamlessly.

-

Are there any fees associated with the Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc application?

There are no fees for submitting the Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc application itself; however, you may incur costs related to legal assistance or document preparation. It's wise to consult with a professional if you have complex financial situations. This ensures that your application is filed correctly and expediently.

-

How long does it take to process the Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc?

The processing time for the Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc can vary, but typically it takes several weeks. Factors like the completeness of your application and current workload at Service Canada can affect timing. Using airSlate SignNow can help speed up the process with instant notifications once your documents are signed.

-

Can I track the status of my Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc application?

Yes, you can track the status of your Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc application by contacting Service Canada directly or checking through their online services. Make sure to keep your application number handy for faster inquiries. With airSlate SignNow, you also get updates when your documents are processed.

-

What documents do I need to submit with the Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc?

When submitting the Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc application, you'll need to provide identification documents and any relevant financial records. This may include proof of your CPP contributions and other personal details. Ensure all documents are prepared before submission to avoid delays.

Get more for Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc

- Pan card format in word

- Vulnerable child declaration form

- Kssl ztbl form

- Pdf to fillable form pdf to fillable form

- Piktochart create infographics presentations amp reports form

- Directed study registration formhawaii pacific un

- Submit this form to kent state university health services

- Immunization form valdosta state university valdosta

Find out other Canada Pension Plan Credit Split SC ISP 1901 E Servicecanada Gc

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form