Puerto Rico Tax Forms in English 482 2016

What is the Puerto Rico Tax Forms In English 482

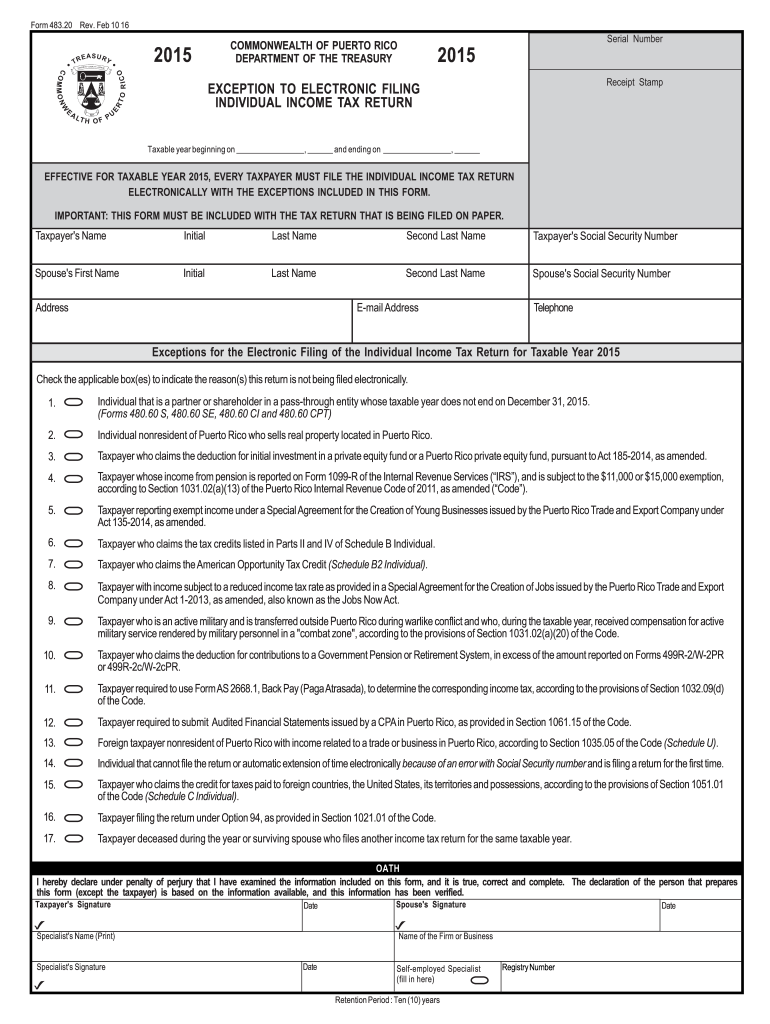

The Puerto Rico Tax Forms In English 482 is a specific tax form used by residents of Puerto Rico to report income and calculate tax obligations. This form is designed to meet the unique tax requirements set forth by the Puerto Rican government while providing an option for English speakers. It includes sections for reporting various types of income, deductions, and credits applicable to taxpayers in Puerto Rico.

How to use the Puerto Rico Tax Forms In English 482

Using the Puerto Rico Tax Forms In English 482 involves several steps. First, gather all necessary financial documents, such as W-2 forms, 1099 forms, and any other relevant income statements. Next, fill out the form accurately, ensuring that all information is complete and correct. Once completed, the form can be signed electronically using a trusted eSignature solution. This allows for secure submission while maintaining compliance with legal requirements.

Steps to complete the Puerto Rico Tax Forms In English 482

Completing the Puerto Rico Tax Forms In English 482 requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary documents, including income statements and deduction records.

- Access the form online through a reliable platform.

- Fill in your personal information, including name, address, and Social Security number.

- Report your income accurately in the designated sections.

- Include any applicable deductions and credits.

- Review the form for accuracy and completeness.

- Sign the form electronically and submit it as instructed.

Legal use of the Puerto Rico Tax Forms In English 482

The Puerto Rico Tax Forms In English 482 is legally valid when completed according to the guidelines set by the Puerto Rican government and the IRS. It is essential to ensure that the form meets all federal requirements, especially if you are using it for tax filing purposes. The form can be signed electronically, which is recognized as a valid signature under the ESIGN Act, facilitating a smooth filing process.

Required Documents

Before filling out the Puerto Rico Tax Forms In English 482, it is important to have the following documents ready:

- W-2 forms from employers

- 1099 forms for other income

- Records of any deductions, such as medical expenses or mortgage interest

- Previous year’s tax return for reference

Form Submission Methods

The Puerto Rico Tax Forms In English 482 can be submitted through various methods, including:

- Online submission via an authorized e-filing platform

- Mailing a printed copy to the appropriate tax office

- In-person submission at designated tax offices

Quick guide on how to complete puerto rico tax forms in english 482

Your assistance manual on how to prepare your Puerto Rico Tax Forms In English 482

If you’re interested in discovering how to finalize and submit your Puerto Rico Tax Forms In English 482, here are some brief guidelines on how to simplify tax filing.

To begin, simply create your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is a highly intuitive and powerful document solution that enables you to modify, generate, and complete your tax forms effortlessly. With its editor, you can alternate between text, checkbox options, and electronic signatures, allowing you to amend information as necessary. Enhance your tax handling with advanced PDF modification, eSigning capability, and a user-friendly sharing experience.

Follow the steps below to complete your Puerto Rico Tax Forms In English 482 in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Get form to access your Puerto Rico Tax Forms In English 482 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-binding electronic signature (if required).

- Examine your document and correct any errors.

- Save your modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically using airSlate SignNow. Keep in mind that paper filing can lead to increased mistakes and delayed refunds. Furthermore, before electronically filing your taxes, verify the IRS website for submission guidelines applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct puerto rico tax forms in english 482

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How difficult is it to live in Puerto Rico if one only knows English?

Language is not an impediment for living in Puerto Rico. English and Spanish are both Official languages for the territory, specially for all state matters. Spanglish (the mixing of Spanish and English words when speaking) is widely used through-out the Island. Both Spanish and English is taught in schools as a requirement.However, as pointed out in another response to this question, the level of practice of the English language by the locals differs in accordance to location, academic achievement and political affiliation. Pro-Independence sponsors will tend to make it a point to speak Spanish only, despite the fact that many dominate the English Language.Business, Banking, Trade and all tourism related activities (Hotels, eateries, attractions, etc.) are in essence bi-lingual. Every now and then one might find an exception to this.It is true that most daily activities are undertaken in Spanish, but one can pick-up quickly on key words and expressions to get by.In the end, communicating is more than mere words. It is a matter of making oneself understood. Eventually one learns the more important aspects of the Spanish language.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can Trump threaten to pull out of Puerto Rico while FEMA is still in New Orleans?

Trump does not think before he speaks. He has a horrible habit of putting his foot in his mouth. I highly doubt he is aware that FEMA is still in New Orleans, or if he really cares.When Trump makes these statements, it is his way of puffing out his chest and demonstrating his authority and power. It’s toxic masculinity at its best, and it’s a power trip that he gets off on.Trump does not react well to criticism of any kind, much like a fifth grader.This statement equivocates to an “Oh yeah? Well if my aide wasn’t fast enough for you I can just take it away. Nah nah nahnahnah.”

Create this form in 5 minutes!

How to create an eSignature for the puerto rico tax forms in english 482

How to generate an electronic signature for your Puerto Rico Tax Forms In English 482 in the online mode

How to make an electronic signature for your Puerto Rico Tax Forms In English 482 in Google Chrome

How to generate an electronic signature for putting it on the Puerto Rico Tax Forms In English 482 in Gmail

How to make an eSignature for the Puerto Rico Tax Forms In English 482 straight from your smart phone

How to make an electronic signature for the Puerto Rico Tax Forms In English 482 on iOS

How to make an eSignature for the Puerto Rico Tax Forms In English 482 on Android devices

People also ask

-

What are Puerto Rico Tax Forms In English 482?

Puerto Rico Tax Forms In English 482 are official documents used for tax reporting in Puerto Rico, made accessible in English for better comprehension. These forms facilitate taxpayers in accurately filing their taxes while adhering to local regulations. Using airSlate SignNow, you can easily fill out and eSign these forms for a seamless filing experience.

-

How can airSlate SignNow help with Puerto Rico Tax Forms In English 482?

airSlate SignNow offers a user-friendly platform where you can fill and eSign Puerto Rico Tax Forms In English 482 quickly and securely. Our solution streamlines the document management process, reducing the time spent on paperwork. With compliance features built-in, you can ensure your forms are submitted correctly.

-

Is there a cost associated with using airSlate SignNow for Puerto Rico Tax Forms In English 482?

Yes, airSlate SignNow offers a cost-effective solution for managing Puerto Rico Tax Forms In English 482. We provide various pricing plans tailored to individual and business needs, enabling you to choose the one that fits your requirements. Clear pricing ensures there are no hidden costs, making it easier to budget for your document management.

-

What features does airSlate SignNow provide for handling Puerto Rico Tax Forms In English 482?

airSlate SignNow includes features like template creation, eSigning, and document tracking specifically for Puerto Rico Tax Forms In English 482. Our platform allows for real-time collaboration, ensuring all parties can access and work on the forms seamlessly. Enhanced security measures also keep your sensitive tax information safe.

-

Are there any integrations available for airSlate SignNow when using Puerto Rico Tax Forms In English 482?

Yes, airSlate SignNow integrates with various third-party applications that can help you manage Puerto Rico Tax Forms In English 482 more efficiently. Popular integrations include cloud storage services and CRM systems, allowing for easy access to your documents. This interoperability enhances your workflow and keeps all your data in sync.

-

Can I save time by using airSlate SignNow for Puerto Rico Tax Forms In English 482?

Absolutely! Using airSlate SignNow for Puerto Rico Tax Forms In English 482 signNowly reduces the time needed to prepare and file your taxes. Our intuitive interface and automation features cut down on manual work, allowing you to focus on more important tasks. Many users report time savings of up to 50%.

-

Is support available if I have questions about Puerto Rico Tax Forms In English 482?

Yes, airSlate SignNow provides robust customer support for any inquiries regarding Puerto Rico Tax Forms In English 482. Our knowledgeable support team is available via chat, email, or phone to assist you with any issues or questions you may have. We are committed to ensuring your experience is smooth and satisfactory.

Get more for Puerto Rico Tax Forms In English 482

- Medipol proficiency exam form

- Schedule worksheet 101161678 form

- Bs5839 certificate template form

- Os ss 135b form

- William penn life insurance company of new york forms

- Dbs bank account opening form

- Hdfc life policy cancellation request letter form

- Gtms yearbook order form 18 georgie tyler middle school

Find out other Puerto Rico Tax Forms In English 482

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer