Pa Form

What is the Kentucky Medicaid prior authorization form?

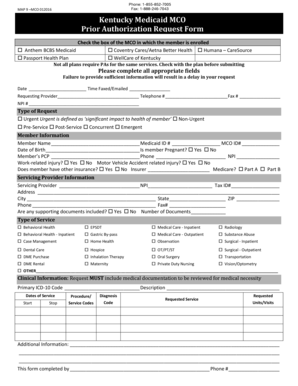

The Kentucky Medicaid prior authorization form is a critical document used to obtain approval for specific medical services, treatments, or medications before they are provided to patients covered under Kentucky Medicaid. This form ensures that the requested services meet the necessary medical criteria and are deemed medically necessary. The prior authorization process helps manage healthcare costs and ensures that patients receive appropriate care based on their individual health needs.

Steps to complete the Kentucky Medicaid prior authorization form

Completing the Kentucky Medicaid prior authorization form involves several key steps to ensure accuracy and compliance. Here’s a structured approach:

- Gather necessary information: Collect patient details, including their Medicaid ID, date of birth, and relevant medical history.

- Identify the service or medication: Clearly specify the treatment, procedure, or medication requiring prior authorization.

- Provide clinical justification: Include supporting documentation that outlines the medical necessity of the requested service.

- Complete the form: Fill out all required fields on the prior authorization form accurately.

- Review the form: Double-check for any errors or missing information before submission.

- Submit the form: Send the completed form to the appropriate Medicaid Managed Care Organization (MCO) or the designated Medicaid office.

How to obtain the Kentucky Medicaid prior authorization form

The Kentucky Medicaid prior authorization form can be obtained through several channels. Typically, healthcare providers can access the form through the Kentucky Medicaid website or directly from the Medicaid Managed Care Organizations. Additionally, providers may receive copies during training sessions or through official communications from Medicaid offices. It is essential to ensure that the most current version of the form is being used to avoid processing delays.

Key elements of the Kentucky Medicaid prior authorization form

Understanding the key elements of the Kentucky Medicaid prior authorization form is crucial for proper completion. The form generally includes:

- Patient information: Full name, Medicaid ID, date of birth, and contact details.

- Provider information: Name, address, and National Provider Identifier (NPI) number of the healthcare provider.

- Requested service: Detailed description of the service, medication, or procedure being requested.

- Clinical rationale: Justification for the request, including relevant medical history and treatment plans.

- Signature: Required signatures from both the provider and the patient or their legal representative.

Form submission methods

Submitting the Kentucky Medicaid prior authorization form can be done through various methods, ensuring flexibility for healthcare providers. The primary submission methods include:

- Online submission: Many Medicaid MCOs offer secure online portals for electronic submission of prior authorization requests.

- Mail: Providers can send the completed form via postal mail to the designated Medicaid office or MCO.

- In-person submission: Some providers may choose to deliver the form directly to their local Medicaid office for processing.

Legal use of the Kentucky Medicaid prior authorization form

The legal use of the Kentucky Medicaid prior authorization form is governed by state regulations and Medicaid policies. It is essential that the form is filled out accurately and submitted in accordance with the guidelines set forth by Kentucky Medicaid. Failure to comply with these regulations may result in delays in service approval or denial of coverage. Additionally, the form must be signed by authorized individuals to ensure its validity.

Quick guide on how to complete pa form

Complete Pa Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Pa Form across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The most effective way to modify and electronically sign Pa Form without hassle

- Locate Pa Form and click on Get Form to commence.

- Employ the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using features that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate issues with lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Pa Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kentucky Medicaid MCO prior authorization request form?

The Kentucky Medicaid MCO prior authorization request form is a document required for obtaining prior authorization for certain medical services. It must be completed accurately to ensure that the necessary approval is granted by the Managed Care Organization (MCO). Understanding how to fill it out is crucial for healthcare providers and patients alike.

-

How do I complete the Kentucky Medicaid MCO prior authorization request form?

To complete the Kentucky Medicaid MCO prior authorization request form, gather all necessary patient information, treatment details, and relevant medical records. Then, accurately fill out the form, ensuring all fields are completed to avoid delays. airSlate SignNow offers templates to simplify this process, making it easier to send and eSign.

-

What are the benefits of using airSlate SignNow for the Kentucky Medicaid MCO prior authorization request form?

Using airSlate SignNow for the Kentucky Medicaid MCO prior authorization request form provides several benefits, including ease of use, secure storage, and the ability to track document status. This streamlines the submission process and helps prevent missing crucial information. Additionally, you can easily share completed forms with other healthcare professionals and patients.

-

Can I integrate airSlate SignNow with other healthcare applications for the Kentucky Medicaid MCO prior authorization request form?

Yes, airSlate SignNow can be integrated with various healthcare applications to facilitate the Kentucky Medicaid MCO prior authorization request form process. These integrations can enhance workflow efficiency by allowing for seamless data transfer and processing. This means you can manage documentation directly within your existing software ecosystem.

-

Is there a cost associated with using airSlate SignNow for Kentucky Medicaid MCO prior authorization request forms?

While airSlate SignNow offers flexible pricing plans, the costs can vary based on your specific needs, features, and the number of users. It's important to evaluate your usage requirements, as investing in this service can save time and resources when handling Kentucky Medicaid MCO prior authorization request forms. A free trial is also available to help you assess the platform.

-

How fast can I expect to receive approval after submitting the Kentucky Medicaid MCO prior authorization request form?

The approval time for the Kentucky Medicaid MCO prior authorization request form can vary based on the MCO and the specifics of the request submitted. Typically, you may receive a response within a few days, but it is advisable to follow up using airSlate SignNow’s tracking feature once the form is submitted. This helps ensure timely communication regarding any additional information required.

-

What types of services require a Kentucky Medicaid MCO prior authorization request form?

Various services may require a Kentucky Medicaid MCO prior authorization request form, including certain medical procedures, diagnostic tests, and specialty medications. It's essential to verify with the specific MCO for detailed information on which services necessitate prior authorization. Properly submitting the request form helps prevent service denials and ensures necessary care is received.

Get more for Pa Form

Find out other Pa Form

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile