Federal Tax Exempt Certificate for Mississippi Form

What is the Federal Tax Exempt Certificate For Mississippi

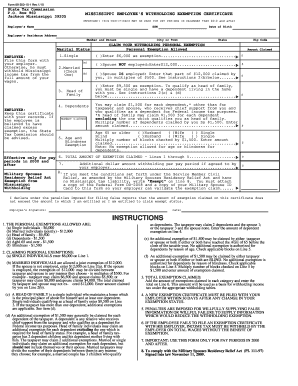

The Federal Tax Exempt Certificate for Mississippi is a document that allows qualifying organizations to make purchases without paying sales tax. This certificate is typically used by non-profit entities, government agencies, and certain educational institutions. By presenting this certificate, these organizations can demonstrate their tax-exempt status, which is recognized under federal and state tax laws.

How to use the Federal Tax Exempt Certificate For Mississippi

To use the Federal Tax Exempt Certificate for Mississippi, an organization must present the certificate to vendors at the time of purchase. This document serves as proof of the organization’s tax-exempt status. Vendors are required to accept the certificate and should keep a copy for their records. It is essential that the certificate is filled out correctly, including the organization’s name, address, and the specific purpose for which the exemption is claimed.

Steps to complete the Federal Tax Exempt Certificate For Mississippi

Completing the Federal Tax Exempt Certificate for Mississippi involves several steps:

- Obtain the certificate form from the appropriate state department or organization.

- Fill in the name and address of the tax-exempt organization.

- Specify the reason for the tax exemption, such as non-profit status or educational purpose.

- Include the signature of an authorized representative of the organization.

- Provide the date of completion.

Key elements of the Federal Tax Exempt Certificate For Mississippi

Important elements of the Federal Tax Exempt Certificate for Mississippi include:

- The name and address of the exempt organization.

- The specific tax-exempt status under which the organization qualifies.

- The signature of an authorized individual within the organization.

- The date the certificate is issued.

Legal use of the Federal Tax Exempt Certificate For Mississippi

The legal use of the Federal Tax Exempt Certificate for Mississippi is governed by both federal and state tax regulations. Organizations must ensure that they are eligible for tax exemption and that the certificate is used solely for qualifying purchases. Misuse of the certificate can lead to penalties, including fines and loss of tax-exempt status.

Eligibility Criteria

To be eligible for the Federal Tax Exempt Certificate for Mississippi, an organization must meet specific criteria, such as:

- Being a recognized non-profit organization, government entity, or educational institution.

- Having a valid Employer Identification Number (EIN) from the IRS.

- Engaging in activities that align with the purpose of tax exemption, such as charitable, educational, or religious activities.

Quick guide on how to complete federal tax exempt certificate for mississippi

Effortlessly Prepare Federal Tax Exempt Certificate For Mississippi on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Federal Tax Exempt Certificate For Mississippi on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

How to Modify and eSign Federal Tax Exempt Certificate For Mississippi with Ease

- Find Federal Tax Exempt Certificate For Mississippi and click Get Form to initiate.

- Use the tools we offer to complete your document.

- Highlight key sections of the documents or mask sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Federal Tax Exempt Certificate For Mississippi and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the federal tax exempt certificate for mississippi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Mississippi tax exempt form pdf?

The Mississippi tax exempt form pdf is an official document that businesses can use to claim exemption from sales tax in the state of Mississippi. This form is essential for organizations that qualify for tax-exempt status and need to make tax-exempt purchases legally. By using the airSlate SignNow platform, you can easily fill out and eSign the Mississippi tax exempt form pdf.

-

How can I obtain the Mississippi tax exempt form pdf?

You can obtain the Mississippi tax exempt form pdf directly from the Mississippi Department of Revenue's website or through various online resources. Additionally, airSlate SignNow allows you to create, customize, and share this form seamlessly for your business needs, all while ensuring compliance with local laws.

-

Is there a cost to use airSlate SignNow for the Mississippi tax exempt form pdf?

AirSlate SignNow offers a cost-effective solution for businesses looking to manage documents like the Mississippi tax exempt form pdf. With competitive pricing plans, you can enjoy features like unlimited document signing and secure storage at an affordable rate. It's a smart investment for both small and large organizations.

-

What features does airSlate SignNow offer for managing the Mississippi tax exempt form pdf?

AirSlate SignNow includes features such as document templates, customizable fields, and real-time tracking for the Mississippi tax exempt form pdf. These functionalities streamline the signing process and enhance collaboration among team members. Plus, you can access an intuitive dashboard to monitor all your documents easily.

-

Can I integrate airSlate SignNow with other applications for the Mississippi tax exempt form pdf?

Yes, airSlate SignNow easily integrates with a variety of applications, enhancing how you manage the Mississippi tax exempt form pdf. You can connect it with CRM systems, cloud storage services, and other productivity tools to create a seamless workflow. This integration capability helps in efficiently managing your entire tax-exempt documentation process.

-

How does airSlate SignNow enhance the process of eSigning the Mississippi tax exempt form pdf?

AirSlate SignNow enhances the eSigning process for the Mississippi tax exempt form pdf by offering a user-friendly interface and secure signing options. Signers can quickly and easily sign documents from any device, whether at the office or on the go. This convenience saves time and boosts productivity for all involved parties.

-

What are the benefits of using the Mississippi tax exempt form pdf with airSlate SignNow?

Using the Mississippi tax exempt form pdf with airSlate SignNow offers numerous benefits, including ease of use and improved compliance with tax regulations. The platform provides a secure way to eSign and store documents, ensuring that your sensitive information remains protected. It also helps reduce paperwork, making your tax exemption process more efficient.

Get more for Federal Tax Exempt Certificate For Mississippi

Find out other Federal Tax Exempt Certificate For Mississippi

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors