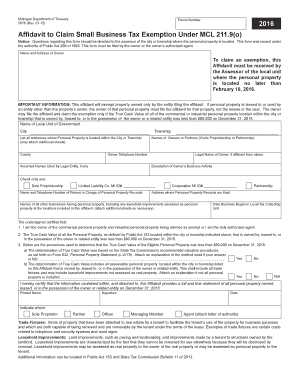

Affidavit to Claim Small Business Tax Exemption Form

What is the affidavit to claim small business tax exemption?

The affidavit to claim small business tax exemption is a legal document that allows eligible businesses to declare their status for tax exemption purposes. This form is essential for businesses seeking to reduce their tax liabilities by proving that they meet specific criteria set by state or federal tax authorities. It typically includes information about the business, such as its name, address, and the nature of its operations, along with a declaration of eligibility for the exemption.

Steps to complete the affidavit to claim small business tax exemption

Completing the affidavit to claim small business tax exemption involves several key steps:

- Gather necessary information about your business, including its legal structure and tax identification number.

- Review the specific eligibility criteria for tax exemption in your state or locality.

- Fill out the affidavit form accurately, ensuring all required fields are completed.

- Sign the affidavit, either digitally or in print, depending on the submission method.

- Submit the completed affidavit to the appropriate tax authority, either online or via mail.

Legal use of the affidavit to claim small business tax exemption

The affidavit to claim small business tax exemption is legally binding when completed correctly. It must comply with relevant laws and regulations governing tax exemptions. This includes adhering to the requirements set forth by the IRS and state tax agencies. A properly executed affidavit can serve as a valid defense in case of audits or disputes regarding tax status.

Eligibility criteria for the affidavit to claim small business tax exemption

Eligibility for the affidavit to claim small business tax exemption varies by state, but common criteria include:

- The business must be registered and in good standing with state authorities.

- The business must operate within a specific industry or meet revenue thresholds.

- The business must not have any outstanding tax liabilities.

It is important to review local regulations to ensure compliance with all eligibility requirements.

Required documents for the affidavit to claim small business tax exemption

When preparing the affidavit to claim small business tax exemption, you may need to provide supporting documentation, such as:

- Proof of business registration and legal structure.

- Financial statements demonstrating eligibility for the exemption.

- Any previous tax returns that may be relevant to the exemption claim.

Having these documents ready can facilitate a smoother application process.

Form submission methods for the affidavit to claim small business tax exemption

The affidavit to claim small business tax exemption can typically be submitted through various methods, including:

- Online submission via the state tax authority's website.

- Mailing a physical copy of the affidavit to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can depend on local regulations and personal preference.

Quick guide on how to complete affidavit to claim small business tax exemption

Complete Affidavit To Claim Small Business Tax Exemption seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any delays. Handle Affidavit To Claim Small Business Tax Exemption on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Affidavit To Claim Small Business Tax Exemption effortlessly

- Locate Affidavit To Claim Small Business Tax Exemption and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over missing or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Affidavit To Claim Small Business Tax Exemption while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the affidavit to claim small business tax exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the affidavit to claim small business tax exemption?

An affidavit to claim small business tax exemption is a legal document that certifies a business's eligibility for tax exemption status. It provides necessary declarations and evidence required by tax authorities. By using this affidavit, businesses can effectively reduce their tax burden and ensure compliance with local laws.

-

How does airSlate SignNow help with creating an affidavit to claim small business tax exemption?

airSlate SignNow offers an intuitive platform for creating and signing your affidavit to claim small business tax exemption quickly. The easy-to-use interface allows you to customize the document to fit your specific needs. Additionally, our platform ensures that your documents are securely signed and stored.

-

Is there a cost associated with using airSlate SignNow for my affidavit to claim small business tax exemption?

Yes, airSlate SignNow provides several pricing plans to suit different business needs, including features for creating an affidavit to claim small business tax exemption. Our plans are designed to be cost-effective, ensuring you only pay for the features you require. You can explore our options on the pricing page.

-

What features are included in airSlate SignNow for preparing an affidavit to claim small business tax exemption?

airSlate SignNow includes features such as customizable templates, electronic signature capabilities, and document tracking. These tools streamline the process of preparing your affidavit to claim small business tax exemption, making document management efficient and straightforward. You can also integrate with other applications to enhance functionality.

-

Can I integrate airSlate SignNow with other software for my business needs?

Absolutely! airSlate SignNow can be integrated with a variety of software applications, which can help streamline the process of managing your affidavit to claim small business tax exemption. This integration allows you to enhance your workflow and ensure that all your business processes are connected seamlessly.

-

What are the benefits of using airSlate SignNow for my affidavit to claim small business tax exemption?

Using airSlate SignNow for your affidavit to claim small business tax exemption provides numerous benefits, including improved efficiency, enhanced security, and easier compliance with regulations. The platform simplifies the signing process, allowing you to focus on running your business while we handle the documentation. Additionally, you can access your documents anytime, anywhere.

-

How secure is my affidavit to claim small business tax exemption with airSlate SignNow?

Security is a top priority for airSlate SignNow. We employ advanced encryption and strict data protection policies to ensure your affidavit to claim small business tax exemption is secure. Our platform complies with industry standards, giving you peace of mind that your sensitive business documents are protected.

Get more for Affidavit To Claim Small Business Tax Exemption

Find out other Affidavit To Claim Small Business Tax Exemption

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter