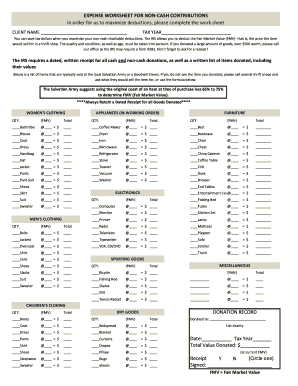

EXPENSE WORKSHEET for NON CASH CONTRIBUTIONS Form

What is the expense worksheet for non cash contributions

The expense worksheet for non cash contributions is a crucial document used primarily for reporting non-cash donations made to charitable organizations. This form allows individuals and businesses to itemize and evaluate the value of goods, services, or property donated, which can be essential for tax deduction purposes. Accurately completing this worksheet ensures compliance with IRS regulations and helps in maintaining proper records for both the donor and the recipient organization.

How to use the expense worksheet for non cash contributions

Using the expense worksheet for non cash contributions involves several straightforward steps. Begin by gathering all relevant information about the non-cash contributions you intend to report. This includes a description of the items donated, their fair market value, and the date of the contribution. Next, fill out the worksheet by entering the required details in the designated fields. Ensure that all values are accurately assessed to reflect the true worth of the contributions. Finally, retain a copy of the completed worksheet for your records and submit it as part of your tax return if applicable.

Steps to complete the expense worksheet for non cash contributions

Completing the expense worksheet for non cash contributions requires careful attention to detail. Follow these steps:

- Gather documentation for each non-cash contribution, including receipts and appraisals if necessary.

- List each item donated, providing a clear description and the date of donation.

- Determine the fair market value of each item, which is the price it would sell for on the open market.

- Enter the information into the worksheet, ensuring accuracy in all entries.

- Review the completed worksheet for any errors or omissions before finalizing it.

Legal use of the expense worksheet for non cash contributions

The legal use of the expense worksheet for non cash contributions is governed by IRS regulations. To ensure that the worksheet is legally binding, it must be filled out accurately and submitted in conjunction with your tax return. Non-compliance with these regulations can result in penalties or disallowance of the claimed deductions. It is essential to keep thorough records of all contributions and related documents to substantiate your claims in case of an audit.

IRS Guidelines

The IRS provides specific guidelines regarding the reporting of non-cash contributions. Donors must ensure that they adhere to these guidelines to qualify for tax deductions. Key points include:

- Donations must be made to qualified charitable organizations.

- Donors must obtain written acknowledgment from the charity for contributions exceeding a certain value.

- Fair market value must be determined based on the condition and marketability of the items donated.

Examples of using the expense worksheet for non cash contributions

Examples of using the expense worksheet for non cash contributions include various scenarios such as:

- A business donating office furniture to a local non-profit organization.

- An individual donating clothing and household items to a charity thrift store.

- A family contributing a vehicle to a charitable cause.

In each case, the worksheet helps document the value of the contributions for tax purposes, ensuring that donors can claim appropriate deductions.

Quick guide on how to complete expense worksheet for non cash contributions

Effortlessly Prepare EXPENSE WORKSHEET FOR NON CASH CONTRIBUTIONS on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, edit, and eSign your documents without delays. Handle EXPENSE WORKSHEET FOR NON CASH CONTRIBUTIONS on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The Easiest Way to Edit and eSign EXPENSE WORKSHEET FOR NON CASH CONTRIBUTIONS with Ease

- Obtain EXPENSE WORKSHEET FOR NON CASH CONTRIBUTIONS and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, burdensome form searches, or errors that necessitate printing new document copies. airSlate SignNow manages your document requirements in just a few clicks from any device of your choice. Edit and eSign EXPENSE WORKSHEET FOR NON CASH CONTRIBUTIONS to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the expense worksheet for non cash contributions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an expense worksheet for non cash contributions?

An expense worksheet for non cash contributions is a tool that helps businesses track and report non-cash donations accurately. This worksheet enables organizations to assess the value of donated goods and services, ensuring compliance with IRS regulations and proper financial reporting.

-

How can I create an expense worksheet for non cash contributions?

Creating an expense worksheet for non cash contributions can be easily done using templates or spreadsheet software. However, airSlate SignNow offers an intuitive platform that allows you to customize and automate your worksheets, making the process faster and more efficient.

-

What features does airSlate SignNow offer for the expense worksheet for non cash contributions?

airSlate SignNow provides features such as eSigning, document sharing, and robust collaboration tools. With these capabilities, you can create, manage, and securely send your expense worksheet for non cash contributions, ensuring all stakeholders can easily access the necessary documents.

-

Is airSlate SignNow cost-effective for small businesses managing non cash contributions?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. With flexible pricing plans, it accommodates small businesses looking to manage their expense worksheet for non cash contributions without straining their budget.

-

Can I integrate airSlate SignNow with other software for tracking non cash contributions?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and project management software. This allows you to streamline your workflow when creating and managing your expense worksheet for non cash contributions and keep all your financial records in sync.

-

What are the benefits of using airSlate SignNow for my expense worksheet for non cash contributions?

Using airSlate SignNow for your expense worksheet for non cash contributions provides enhanced accuracy, security, and efficiency. It allows you to retain a digital record of all contributions, ensuring that you comply with tax obligations and maintain transparency in your financial reporting.

-

Can airSlate SignNow help in audits related to non cash contributions?

Yes, airSlate SignNow can be an invaluable resource during audits relating to non cash contributions. By maintaining well-documented and organized expense worksheets, you can easily retrieve necessary documents and prove compliance with your financial practices.

Get more for EXPENSE WORKSHEET FOR NON CASH CONTRIBUTIONS

- Bennett mechanical comprehension test pdf download form

- Exam 718 computer skills test form

- Request for dental records template form

- Firehouse subs application pdf form

- Mathematics n5 pdf download form

- Medcamps of louisiana volunteer application medcamps form

- Certificate of service of financial declaration utah state courts utcourts form

- Superseded 510 78b 6 1303 lis pendens notice 1 either le utah form

Find out other EXPENSE WORKSHEET FOR NON CASH CONTRIBUTIONS

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF