Originator Non Agency Disclosure Minnesota InterBank Form

What is the Originator Non Agency Disclosure Minnesota InterBank

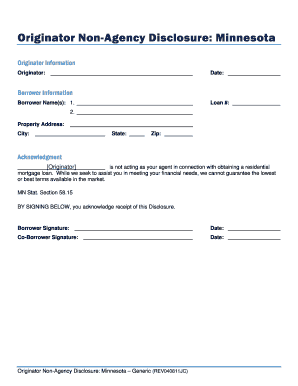

The Originator Non Agency Disclosure Minnesota InterBank form is a legal document that outlines the responsibilities and obligations of financial institutions when dealing with non-agency loans. This form is particularly relevant in the context of Minnesota's lending regulations, ensuring transparency and compliance in financial transactions. It serves to inform borrowers about the terms and conditions associated with their loans, including any potential risks involved. Understanding this form is crucial for both lenders and borrowers to navigate the complexities of non-agency lending effectively.

Steps to complete the Originator Non Agency Disclosure Minnesota InterBank

Completing the Originator Non Agency Disclosure Minnesota InterBank form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including borrower details, loan terms, and any relevant financial disclosures. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. It is essential to review the form for any errors before submission. Finally, sign the document electronically using a secure eSignature solution, which will help maintain the form's legal validity.

Legal use of the Originator Non Agency Disclosure Minnesota InterBank

The legal use of the Originator Non Agency Disclosure Minnesota InterBank form is governed by various state and federal regulations. This form must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA), which establish the legality of electronic signatures in financial transactions. Additionally, adherence to Minnesota's specific lending laws is crucial to ensure that the form is recognized as legally binding. Proper execution of this form helps protect both the lender and the borrower in the event of disputes.

Key elements of the Originator Non Agency Disclosure Minnesota InterBank

Key elements of the Originator Non Agency Disclosure Minnesota InterBank form include detailed information about the loan, such as the interest rate, payment schedule, and any fees associated with the loan. The form also outlines the rights and responsibilities of both parties, including disclosure of any potential risks related to non-agency loans. Furthermore, it provides a clear explanation of the terms under which the loan is being offered, ensuring that borrowers have a comprehensive understanding of their financial commitments.

State-specific rules for the Originator Non Agency Disclosure Minnesota InterBank

State-specific rules for the Originator Non Agency Disclosure Minnesota InterBank form are crucial for compliance with local lending regulations. Minnesota has unique requirements regarding disclosures, including specific language that must be included in the form to protect consumers. Lenders must ensure that they are familiar with these regulations to avoid penalties and ensure that borrowers are adequately informed about their loan terms. Staying updated on any changes in state law is essential for maintaining compliance and protecting both parties in the transaction.

How to use the Originator Non Agency Disclosure Minnesota InterBank

Using the Originator Non Agency Disclosure Minnesota InterBank form involves several straightforward steps. First, financial institutions should provide the form to borrowers during the loan application process. Borrowers should carefully review the document, ensuring they understand all terms and conditions before signing. Utilizing an electronic signature platform can facilitate a smooth signing process, allowing for quick and secure completion. Once signed, the form should be stored securely, as it serves as a vital record of the loan agreement.

Quick guide on how to complete originator non agency disclosure minnesota interbank

Prepare Originator Non Agency Disclosure Minnesota InterBank effortlessly on any device

Web-based document management has become prevalent among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents quickly and without complications. Manage Originator Non Agency Disclosure Minnesota InterBank on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The easiest way to alter and electronically sign Originator Non Agency Disclosure Minnesota InterBank without hassle

- Locate Originator Non Agency Disclosure Minnesota InterBank and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the document or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors requiring the reprinting of new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and eSign Originator Non Agency Disclosure Minnesota InterBank to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the originator non agency disclosure minnesota interbank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Originator Non Agency Disclosure Minnesota InterBank?

The Originator Non Agency Disclosure Minnesota InterBank refers to a specific disclosure required for businesses engaging in non-agency mortgage lending within Minnesota. This document is crucial for compliance and helps inform borrowers about their rights and responsibilities.

-

How does airSlate SignNow facilitate the Originator Non Agency Disclosure Minnesota InterBank process?

airSlate SignNow streamlines the process of creating and signing the Originator Non Agency Disclosure Minnesota InterBank. Its intuitive platform allows users to easily upload, edit, and share necessary documents, ensuring a smooth experience for all parties involved.

-

What are the pricing options for using airSlate SignNow for Originator Non Agency Disclosure Minnesota InterBank?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs, ensuring an affordable option for managing the Originator Non Agency Disclosure Minnesota InterBank. Customers can choose from monthly or annual subscriptions, depending on their usage requirements.

-

What features does airSlate SignNow offer for managing documents like the Originator Non Agency Disclosure Minnesota InterBank?

With airSlate SignNow, users can enjoy features such as customizable templates, secure electronic signatures, document tracking, and integration with other tools. These features enhance the efficiency of handling the Originator Non Agency Disclosure Minnesota InterBank and improve overall workflow.

-

What are the benefits of using airSlate SignNow for the Originator Non Agency Disclosure Minnesota InterBank?

Using airSlate SignNow for the Originator Non Agency Disclosure Minnesota InterBank provides signNow benefits, such as increased efficiency, reduced turnaround time, and enhanced security. It enables seamless collaboration between all parties, making document management easier and more reliable.

-

Are there integrations available for airSlate SignNow that support the Originator Non Agency Disclosure Minnesota InterBank?

Yes, airSlate SignNow seamlessly integrates with various popular applications and software to enhance functionality for managing the Originator Non Agency Disclosure Minnesota InterBank. This ensures that users can streamline their workflows without compromising their existing systems.

-

How secure is airSlate SignNow for handling sensitive documents like the Originator Non Agency Disclosure Minnesota InterBank?

airSlate SignNow prioritizes security with advanced encryption protocols and compliance with industry standards. This ensures that sensitive documents such as the Originator Non Agency Disclosure Minnesota InterBank are protected from unauthorized access and data bsignNowes.

Get more for Originator Non Agency Disclosure Minnesota InterBank

Find out other Originator Non Agency Disclosure Minnesota InterBank

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement