Coal Tax Return, Form 55A100 Kentucky Department of Revenue Revenue Ky

What is the Coal Tax Return, Form 55A100 Kentucky Department Of Revenue Revenue Ky

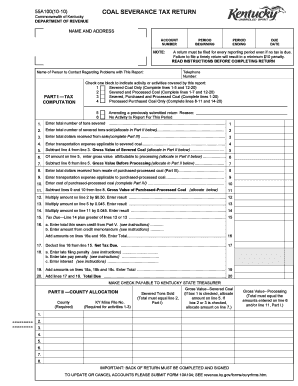

The Coal Tax Return, Form 55A100, is a specific tax form used by coal producers in Kentucky to report their coal production and calculate the associated tax obligations. This form is essential for ensuring compliance with state tax regulations and is required to be filed with the Kentucky Department of Revenue. The data collected through this form helps the state assess the amount of coal produced and the corresponding tax owed, which supports various public services and infrastructure projects within the state.

Steps to Complete the Coal Tax Return, Form 55A100 Kentucky Department Of Revenue Revenue Ky

Completing the Coal Tax Return, Form 55A100, involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including production records and sales data.

- Fill out the form with accurate information regarding coal production volumes and sales.

- Calculate the total tax owed based on the production figures reported.

- Review the completed form for any errors or omissions.

- Submit the form to the Kentucky Department of Revenue by the specified deadline.

How to Obtain the Coal Tax Return, Form 55A100 Kentucky Department Of Revenue Revenue Ky

The Coal Tax Return, Form 55A100, can be obtained directly from the Kentucky Department of Revenue's official website or by contacting their office. It is typically available in a downloadable format, allowing users to print and fill it out manually. Additionally, some tax software programs may offer the form as part of their services, facilitating easier completion and submission.

Legal Use of the Coal Tax Return, Form 55A100 Kentucky Department Of Revenue Revenue Ky

The legal use of the Coal Tax Return, Form 55A100, is governed by Kentucky state tax laws. It is crucial for coal producers to file this form accurately and on time to avoid penalties. The form serves as a legal document that demonstrates compliance with tax obligations and provides a record of coal production for regulatory purposes. Properly executed, this form can protect producers from legal issues related to tax evasion or non-compliance.

Filing Deadlines / Important Dates for the Coal Tax Return, Form 55A100 Kentucky Department Of Revenue Revenue Ky

Filing deadlines for the Coal Tax Return, Form 55A100, are typically set by the Kentucky Department of Revenue. Producers should be aware of these deadlines to ensure timely submission. Late filings may incur penalties or interest on unpaid taxes. It is advisable to check the department's official announcements or website for the most current deadlines and any updates regarding changes in filing requirements.

Penalties for Non-Compliance with the Coal Tax Return, Form 55A100 Kentucky Department Of Revenue Revenue Ky

Failure to comply with the filing requirements for the Coal Tax Return, Form 55A100, can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is important for coal producers to understand the implications of non-compliance and to take proactive measures to ensure that their filings are accurate and submitted on time.

Quick guide on how to complete coal tax return form 55a100 kentucky department of revenue revenue ky

Complete Coal Tax Return, Form 55A100 Kentucky Department Of Revenue Revenue Ky effortlessly on any gadget

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, alter, and eSign your documents quickly without delays. Manage Coal Tax Return, Form 55A100 Kentucky Department Of Revenue Revenue Ky on any gadget with airSlate SignNow Android or iOS apps and simplify any document-related task today.

How to alter and eSign Coal Tax Return, Form 55A100 Kentucky Department Of Revenue Revenue Ky with ease

- Find Coal Tax Return, Form 55A100 Kentucky Department Of Revenue Revenue Ky and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign Coal Tax Return, Form 55A100 Kentucky Department Of Revenue Revenue Ky and ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the coal tax return form 55a100 kentucky department of revenue revenue ky

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Coal Tax Return, Form 55A100 from the Kentucky Department Of Revenue?

The Coal Tax Return, Form 55A100 is a document required by the Kentucky Department Of Revenue for reporting coal severance and processing taxes. This form is essential for businesses involved in the coal industry to ensure compliance with state tax regulations and to avoid penalties.

-

How do I obtain the Coal Tax Return, Form 55A100?

You can obtain the Coal Tax Return, Form 55A100 through the official website of the Kentucky Department Of Revenue or by visiting a local revenue office. It's important to ensure you are using the most recent version of the form to avoid any complications in your submission.

-

What features does airSlate SignNow offer for the Coal Tax Return, Form 55A100?

airSlate SignNow offers features like eSigning, document storage, and in-app collaboration that make completing the Coal Tax Return, Form 55A100 simple and efficient. Our platform allows multiple users to review and sign documents, ensuring that your form is processed smoothly and on time.

-

Is there a cost associated with using airSlate SignNow for the Coal Tax Return, Form 55A100?

Yes, while airSlate SignNow provides a cost-effective solution for eSigning and document management, specific pricing will depend on your business needs and the volume of documents you handle. However, investing in airSlate SignNow can streamline your process for handling the Coal Tax Return, Form 55A100 and potentially save you money by reducing processing time.

-

What are the benefits of using airSlate SignNow for tax document submissions?

Using airSlate SignNow for your Coal Tax Return, Form 55A100 offers numerous benefits, including increased efficiency, reduced errors, and faster turnaround times. The platform ensures that all signatures and approvals are securely stored, giving you peace of mind that your submissions are compliant and readily accessible.

-

Can airSlate SignNow help with integration into existing accounting software for the Coal Tax Return?

Absolutely! airSlate SignNow is designed to integrate seamlessly with various accounting and tax software solutions, making it easy to manage your Coal Tax Return, Form 55A100 within your existing workflows. This integration helps streamline data entry and reduces the risk of discrepancies.

-

How does airSlate SignNow ensure the security of my Coal Tax Return, Form 55A100?

airSlate SignNow takes security very seriously with features like end-to-end encryption and secure cloud storage. We ensure that your Coal Tax Return, Form 55A100 is safe from unauthorized access while providing all necessary security protocols to protect sensitive information.

Get more for Coal Tax Return, Form 55A100 Kentucky Department Of Revenue Revenue Ky

- International financial questionnaire form

- Rewards check up after lesson 4 voyager sopris learning form

- Quadrilateral quiz answer key form

- Lra 39 form

- Ukg syllabus month wise form

- Epworth sleepiness scale pdf form

- Community christian school planned absence form no

- Project compliance certificate division of fire safety firesafety vermont form

Find out other Coal Tax Return, Form 55A100 Kentucky Department Of Revenue Revenue Ky

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter