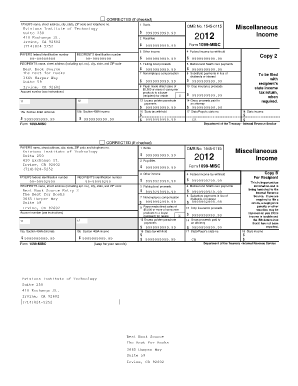

Tax Form for Royalities

What is the Tax Form For Royalities

The tax form for royalties is a specific document used to report income earned from royalties. This income may come from various sources, such as intellectual property, patents, copyrights, or natural resources. In the United States, the most common form associated with reporting royalty income is the Schedule E (Form 1040), which is used by individuals to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and more. Understanding this form is crucial for ensuring compliance with tax regulations and accurately reporting earnings.

How to use the Tax Form For Royalities

Using the tax form for royalties involves several steps to ensure accurate reporting of income. First, gather all relevant information regarding the royalties received, including the amount and source. Next, fill out the form by entering the income in the appropriate sections, typically on Schedule E. It is important to provide details such as the payer's name and the total amount received. After completing the form, review it for accuracy before submitting it with your tax return. Keeping copies of all documents related to royalty income is advisable for future reference and verification.

Steps to complete the Tax Form For Royalities

Completing the tax form for royalties requires careful attention to detail. Follow these steps:

- Gather all documentation related to royalty income, including statements from payers.

- Obtain the appropriate tax form, typically Schedule E (Form 1040).

- Fill in your personal information, including your name and Social Security number.

- Report the total royalty income in the designated section of the form.

- Include any related expenses that can be deducted, such as legal fees or production costs.

- Review the completed form for accuracy and completeness.

- Submit the form along with your tax return by the designated deadline.

Legal use of the Tax Form For Royalities

The legal use of the tax form for royalties is governed by IRS regulations. It is essential to report all royalty income accurately to avoid penalties and ensure compliance with tax laws. Misreporting or failing to report royalty income can lead to audits and potential fines. The IRS requires individuals to maintain accurate records of all royalty payments received, as well as any related expenses. Understanding the legal implications of royalty income reporting is crucial for taxpayers to protect themselves from legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the tax form for royalties align with the general tax return deadlines in the United States. Typically, individual tax returns are due on April 15th of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file but not to pay any taxes owed. Keeping track of these important dates ensures timely compliance with tax obligations.

Who Issues the Form

The tax form for royalties is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the necessary forms and instructions for taxpayers to report various types of income, including royalties. Taxpayers can access these forms through the IRS website or by requesting them directly from the agency. Understanding the source of the form is important for ensuring that taxpayers are using the most current and accurate version.

Quick guide on how to complete tax form for royalities

Execute Tax Form For Royalities effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It presents an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage Tax Form For Royalities on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Tax Form For Royalities effortlessly

- Find Tax Form For Royalities and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to deliver your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your preference. Modify and eSign Tax Form For Royalities and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax form for royalities

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Tax Form For Royalties?

A Tax Form For Royalties is a specific document used for reporting income received from royalties, such as from artistic works or copyrights. It is essential for proper income reporting and tax compliance. Using airSlate SignNow, you can streamline the process of signing and sending these forms efficiently.

-

How can airSlate SignNow help with Tax Form For Royalties?

airSlate SignNow simplifies the management of Tax Form For Royalties by allowing users to easily create, send, and eSign documents online. With its intuitive platform, signing forms becomes hassle-free, ensuring quick turnaround times and better record-keeping for your royalty income.

-

Is there a cost associated with using airSlate SignNow for Tax Form For Royalties?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes features that assist with Tax Form For Royalties, ensuring that you can find a cost-effective solution that works for your budget without compromising on quality.

-

What features does airSlate SignNow offer for handling Tax Form For Royalties?

airSlate SignNow includes features like customizable templates, reusable forms, and advanced security options, all designed to enhance the management of Tax Form For Royalties. These features ensure that your documents are professionally handled and securely signed, minimizing the risk of errors.

-

Can I integrate airSlate SignNow with other financial software for Tax Form For Royalties?

Yes, airSlate SignNow can be easily integrated with various financial and accounting software, making it a versatile solution for handling Tax Form For Royalties. This integration ensures that your documents align seamlessly with your existing workflows, enhancing overall efficiency.

-

What benefits does eSigning Tax Form For Royalties provide?

eSigning Tax Form For Royalties provides several benefits, including faster processing times and reduced paperwork. By using airSlate SignNow, you ensure that your documents are legally binding and secure, allowing for quick compliance with tax requirements while saving time and resources.

-

Are there templates available for Tax Form For Royalties on airSlate SignNow?

Yes, airSlate SignNow offers a variety of templates for Tax Form For Royalties. These templates are designed to simplify documentation, allowing users to focus on filling out necessary information rather than formatting, thus improving efficiency in the signing process.

Get more for Tax Form For Royalities

Find out other Tax Form For Royalities

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast