It40x Form

What is the It40x

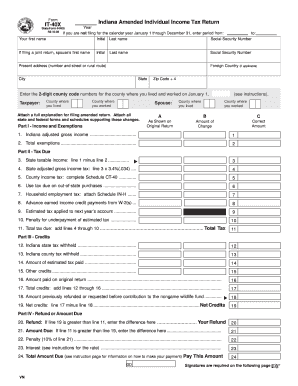

The Indiana tax form It40x is an amended individual income tax return used by residents of Indiana to correct errors or make changes to their original tax returns. This form allows taxpayers to report additional income, claim missed deductions, or adjust credits that were not included in the initial filing. It is essential for ensuring that taxpayers meet their obligations accurately and can reclaim any overpaid taxes or correct underreported income.

How to use the It40x

To use the It40x, taxpayers should first gather all relevant documentation, including their original tax return and any supporting documents that justify the changes being made. The form must be filled out carefully, ensuring that all new information is accurate. After completing the It40x, it should be submitted to the Indiana Department of Revenue, either electronically or by mail, depending on the taxpayer's preference. It is important to keep a copy of the amended return for personal records.

Steps to complete the It40x

Completing the It40x involves several key steps:

- Obtain the It40x form from the Indiana Department of Revenue website or through authorized tax preparation software.

- Review the original tax return to identify the specific areas that require amendments.

- Fill out the It40x form, ensuring to provide accurate information and explanations for each change.

- Attach any necessary documentation that supports the amendments being made.

- Submit the completed form to the Indiana Department of Revenue, either electronically or by mail.

Legal use of the It40x

The It40x is legally binding when completed and submitted according to Indiana tax laws. Taxpayers must ensure that all information provided is truthful and accurate, as submitting false information can lead to penalties. The form must be filed within a specific timeframe to be considered valid, typically within three years of the original filing date. Compliance with these legal requirements ensures that any amendments made are recognized and processed by the state.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the It40x. Generally, the amended return should be filed within three years from the original due date of the tax return. Additionally, if a refund is being claimed through the It40x, it is crucial to file within the same three-year period to avoid losing the right to receive the refund. Keeping track of these deadlines helps ensure compliance and maximizes potential tax benefits.

Required Documents

When filing the It40x, certain documents are required to support the amendments being made. These include:

- The original Indiana tax return (It40) that is being amended.

- Documentation for any additional income or deductions being claimed, such as W-2s, 1099s, or receipts.

- Any correspondence from the Indiana Department of Revenue regarding previous filings.

Having these documents on hand will facilitate a smoother filing process and help substantiate the changes made on the It40x.

Quick guide on how to complete it40x

Prepare It40x effortlessly on any device

Web-based document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documentation, enabling you to find the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without issues. Manage It40x across any platform with the airSlate SignNow applications for Android or iOS and simplify any document-driven procedure today.

How to modify and electronically sign It40x with ease

- Find It40x and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Alter and electronically sign It40x to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it40x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 40x?

airSlate SignNow is an innovative solution that allows businesses to electronically sign and manage documents efficiently. By using airSlate SignNow, companies can enhance their productivity, often achieving improvements up to it 40x compared to traditional methods. This makes document management faster and more convenient.

-

How does airSlate SignNow's pricing structure support it 40x efficiency?

The pricing structure of airSlate SignNow is designed to be cost-effective, enabling businesses to maximize their return on investment. By opting for airSlate SignNow, you can streamline your document processes and potentially boost efficiency to achieve it 40x, making it a financially savvy decision.

-

What features of airSlate SignNow contribute to achieving it 40x results?

Key features of airSlate SignNow, such as automated workflows, templates, and real-time analytics, support businesses in optimizing their document flow. These features can collectively enhance productivity and efficiency, allowing users to signNow it 40x improvements in their operations.

-

How can integrations with other apps enhance the it 40x experience?

airSlate SignNow offers seamless integrations with various applications, which enhances its functionality and helps to streamline your workflow. These integrations can enable teams to manage documents and signatures more effectively, pushing your efficiency towards the targeted it 40x mark.

-

What are the benefits of using airSlate SignNow for small businesses aiming for it 40x performance?

For small businesses, airSlate SignNow provides an affordable and intuitive solution to manage documents electronically. By implementing airSlate SignNow, small enterprises can simplify their processes and signNowly increase their operational efficiency, striving towards achieving it 40x performance.

-

Is airSlate SignNow secure enough for sensitive documents when aiming for it 40x efficiency?

Yes, airSlate SignNow employs advanced security measures, including encryption and compliance with industry standards, to ensure the protection of sensitive documents. Businesses can confidently utilize airSlate SignNow to achieve it 40x efficiency without compromising their data security.

-

Can airSlate SignNow help my team collaborate more effectively and achieve it 40x improvements?

Absolutely! airSlate SignNow facilitates real-time collaboration among team members, allowing multiple users to work on documents simultaneously. This collaboration capability not only speeds up the signing process but also drives performance, helping your team signNow it 40x efficiency gains.

Get more for It40x

Find out other It40x

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now