Form 2368

What is the Form 2368

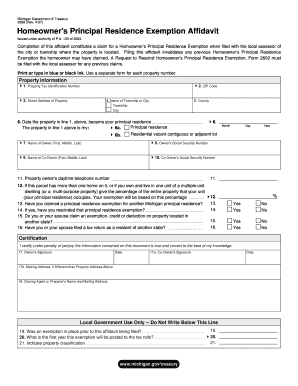

The Form 2368 is a document used in specific legal and administrative contexts within the United States. It serves various purposes depending on the requirements of the issuing authority. Typically, this form is utilized to collect essential information from individuals or entities, ensuring compliance with relevant regulations. Understanding the nature of Form 2368 is crucial for anyone who needs to complete it accurately.

How to use the Form 2368

Using the Form 2368 involves several steps to ensure that all required information is provided correctly. First, gather all necessary documentation that supports the information you will enter. Next, carefully read the instructions accompanying the form. This will help you understand what specific information is required and how to format your responses. Once the form is completed, review it for accuracy before submission.

Steps to complete the Form 2368

Completing the Form 2368 requires attention to detail. Here are the steps to follow:

- Obtain a copy of the Form 2368 from a reliable source.

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal or business information as required.

- Provide any additional information requested, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission method.

Legal use of the Form 2368

The legal validity of the Form 2368 hinges on its proper completion and submission. To ensure it is legally binding, all parties involved must adhere to the relevant regulations governing the use of such forms. This includes ensuring that signatures are obtained where required and that the form is submitted within any specified deadlines. Compliance with these legal standards is essential for the document to be recognized by authorities.

Key elements of the Form 2368

Several key elements must be included in the Form 2368 to ensure its validity. These elements typically include:

- Identifying information of the individual or entity completing the form.

- Specific details relevant to the purpose of the form.

- Signatures of the parties involved, if applicable.

- Date of completion and submission.

Ensuring that these elements are accurately filled out is critical for the form's acceptance.

Form Submission Methods

The Form 2368 can be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online submission through a designated portal.

- Mailing the completed form to the appropriate office.

- In-person submission at a specified location.

Choosing the correct submission method is important to ensure timely processing.

Quick guide on how to complete form 2368

Complete Form 2368 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed forms, allowing you to locate the necessary document and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your files quickly without delays. Manage Form 2368 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 2368 effortlessly

- Obtain Form 2368 and then click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 2368 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2368

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2368 and how can airSlate SignNow help with it?

Form 2368 is a document that requires electronic signatures for efficient processing. airSlate SignNow enables you to easily send, receive, and eSign form 2368, streamlining your workflow while ensuring compliance and security.

-

What features does airSlate SignNow offer for handling form 2368?

airSlate SignNow offers features such as customizable templates, automatic reminders, and real-time tracking specifically for form 2368. These tools help ensure that the signing process is efficient and organized, so you never miss a deadline.

-

Is there a pricing plan for using airSlate SignNow with form 2368?

Yes, airSlate SignNow provides several pricing plans tailored to different business needs for handling form 2368. Whether you are a small business or a large corporation, we offer affordable options that ensure you can manage documents without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for form 2368 management?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage form 2368 alongside your existing tools. Popular integrations include Google Drive, Salesforce, and others to optimize your document workflow.

-

What are the benefits of using airSlate SignNow for form 2368?

Using airSlate SignNow for form 2368 offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. It enables businesses to automate their signing processes and improve overall productivity.

-

Can I track the status of form 2368 sent through airSlate SignNow?

Yes, you can easily track the status of form 2368 sent via airSlate SignNow. The platform provides real-time updates, allowing you to see when your document has been viewed, signed, or if any action is required.

-

Is airSlate SignNow secure for sending sensitive form 2368 documents?

Definitely! airSlate SignNow prioritizes security with features such as encrypted signatures and secure cloud storage. This ensures that your sensitive form 2368 documents are protected at all times during the signing process.

Get more for Form 2368

Find out other Form 2368

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word