Ri Unemployment 1099 Form

What is the RI Unemployment 1099?

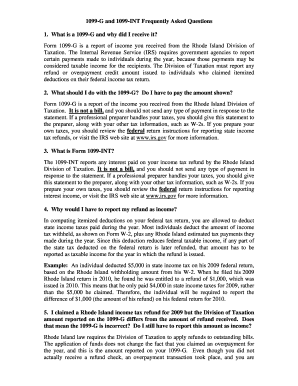

The RI Unemployment 1099, formally known as the 1099-G form, is a tax document issued by the Rhode Island Department of Labor and Training. It reports the total amount of unemployment benefits received during the tax year. This form is essential for individuals who have received unemployment compensation, as it helps them accurately report their income to the Internal Revenue Service (IRS). The 1099-G form also includes information regarding any state tax withheld from the benefits, which can affect the overall tax liability of the recipient.

How to Obtain the RI Unemployment 1099

To obtain the RI Unemployment 1099, individuals can access their forms online through the Rhode Island Department of Labor and Training's website. Typically, the forms are made available by the end of January each year, reflecting the benefits received in the previous calendar year. Recipients may also receive a physical copy of the form in the mail if they have opted for that delivery method. It is important to ensure that the personal information on the form is accurate to avoid any issues with tax filing.

Steps to Complete the RI Unemployment 1099

Completing the RI Unemployment 1099 involves several steps to ensure that all information is accurately reported. First, gather all relevant documents, including the 1099-G form itself and any additional income statements. Next, review the form for accuracy, checking the reported unemployment benefits and any state taxes withheld. Once verified, input the information into the appropriate sections of your tax return. If filing electronically, ensure that the software used is compatible with the 1099-G form to avoid errors. Finally, keep a copy of the completed form for your records.

Legal Use of the RI Unemployment 1099

The RI Unemployment 1099 is legally binding and must be used in compliance with IRS regulations. Recipients are required to report the income from the benefits on their federal tax returns. Failure to report this income can result in penalties and interest charges from the IRS. Additionally, the form serves as proof of income when applying for loans, mortgages, or other financial assistance, making its accurate completion and submission crucial for financial transparency.

Key Elements of the RI Unemployment 1099

Several key elements are included on the RI Unemployment 1099 that recipients should be aware of. These include:

- Recipient's Information: Name, address, and Social Security number of the individual receiving the benefits.

- Employer Information: Details of the employer or agency that issued the unemployment benefits.

- Total Benefits Paid: The total amount of unemployment compensation received during the year.

- State Tax Withheld: Any state income tax that has been withheld from the unemployment benefits.

Filing Deadlines / Important Dates

Filing deadlines for the RI Unemployment 1099 align with federal tax deadlines. Typically, individuals must file their federal tax returns by April fifteenth of each year. The Rhode Island Department of Labor and Training usually issues the 1099-G forms by the end of January, allowing recipients ample time to prepare their tax returns. It is advisable to keep track of any changes in deadlines to ensure timely filing and avoid penalties.

Quick guide on how to complete ri unemployment 1099

Effortlessly Prepare Ri Unemployment 1099 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow offers you all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Ri Unemployment 1099 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to Edit and Electronically Sign Ri Unemployment 1099 with Ease

- Locate Ri Unemployment 1099 and click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Make your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Forget about lost or displaced files, tedious form searches, or mistakes that need you to print new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you choose. Modify and electronically sign Ri Unemployment 1099 and ensure seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri unemployment 1099

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1099 G form RI?

The 1099 G form RI is a tax document used in Rhode Island to report certain government payments, such as unemployment benefits. It's essential for individuals receiving these payments to properly file this form during tax season to ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the 1099 G form RI?

airSlate SignNow simplifies the process of signing and sending the 1099 G form RI. With our electronic signature capabilities, you can easily fill out and submit this form without the hassle of paper documents.

-

Is airSlate SignNow affordable for small businesses needing the 1099 G form RI?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to small businesses. Our service allows small businesses to efficiently manage their tax forms like the 1099 G form RI without breaking the bank.

-

What features does airSlate SignNow provide for managing the 1099 G form RI?

airSlate SignNow includes features like customizable templates, secure cloud storage, and easy sharing options. These features enable users to manage the 1099 G form RI effectively and ensure timely submissions.

-

Can airSlate SignNow integrate with other software for handling the 1099 G form RI?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax software, making it easy to handle the 1099 G form RI. This seamless integration enhances your document workflow and ensures accuracy in your filings.

-

What are the benefits of using airSlate SignNow for the 1099 G form RI?

Using airSlate SignNow for the 1099 G form RI offers benefits such as reduced processing time, enhanced security, and a more organized document management system. This translates to less stress during tax season for individuals and businesses alike.

-

How secure is the 1099 G form RI when using airSlate SignNow?

airSlate SignNow prioritizes security, utilizing encryption and bank-level protection for the 1099 G form RI and all documents. Users can confidently send and sign their forms, knowing their information is safe and secure.

Get more for Ri Unemployment 1099

Find out other Ri Unemployment 1099

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online