Schedule C Declaration Form

What is the Schedule C Declaration

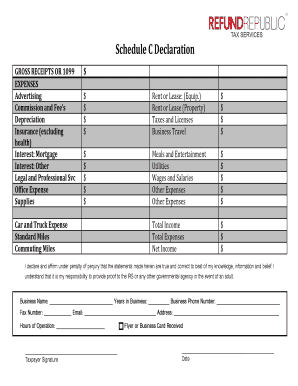

The Schedule C Declaration, also known as Form 1040 Schedule C, is a tax form used by self-employed individuals to report income and expenses from their business activities. This form provides a detailed overview of the financial performance of a business, allowing taxpayers to calculate their net profit or loss. It is essential for freelancers, independent contractors, and small business owners who receive income reported on a 1099 form. Understanding the Schedule C is crucial for accurate tax reporting and compliance with IRS regulations.

Steps to complete the Schedule C Declaration

Filling out the Schedule C Declaration involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including income statements, expense receipts, and prior year tax returns. Next, follow these steps:

- Report your business income in Part I, detailing all earnings received during the tax year.

- List your business expenses in Part II, categorizing them into sections such as advertising, supplies, and travel.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Complete the necessary information regarding your business, including the business name, address, and type of entity.

- Review the form for accuracy and completeness before submission.

IRS Guidelines

Adhering to IRS guidelines is critical when completing the Schedule C Declaration. The IRS provides specific instructions on how to fill out the form, including definitions of allowable business expenses and income reporting requirements. It is important to refer to the latest IRS publications related to Schedule C to ensure compliance with current tax laws. Understanding these guidelines can help avoid errors that may lead to audits or penalties.

Filing Deadlines / Important Dates

Timely filing of the Schedule C Declaration is essential to avoid penalties and interest. Generally, the deadline for filing individual tax returns, including Schedule C, is April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers may also file for an extension, but any taxes owed must still be paid by the original due date to avoid penalties.

Required Documents

To accurately complete the Schedule C Declaration, specific documents are necessary. These include:

- Income statements, such as 1099 forms received from clients.

- Receipts for business expenses, including utilities, supplies, and travel costs.

- Bank statements that reflect business transactions.

- Prior year tax returns for reference and consistency.

Penalties for Non-Compliance

Failing to accurately complete and file the Schedule C Declaration can result in various penalties. Common consequences include fines for late filing, interest on unpaid taxes, and potential audits by the IRS. It is crucial to ensure that all income and expenses are reported correctly to avoid these penalties. Understanding the implications of non-compliance can motivate timely and accurate filing.

Quick guide on how to complete schedule c declaration

Prepare Schedule C Declaration effortlessly on any device

Online document management has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents quickly and without delays. Manage Schedule C Declaration on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest method to modify and electronically sign Schedule C Declaration without difficulty

- Find Schedule C Declaration and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal weight as a handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your selecting. Edit and electronically sign Schedule C Declaration while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule c declaration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Schedule C taxes?

Schedule C taxes refer to the self-employment tax form used by sole proprietors to report income or loss from a business. This form is critical for determining taxable income and calculating self-employment taxes owed to the IRS. Understanding Schedule C taxes is essential for managing your business finances effectively.

-

How can airSlate SignNow help with Schedule C taxes?

airSlate SignNow simplifies document management, allowing you to easily prepare and eSign the necessary tax forms like Schedule C. By streamlining the documentation process, you can focus more on understanding your tax obligations instead of navigating paperwork. This efficiency can contribute to better management of your Schedule C taxes.

-

What features does airSlate SignNow offer for tax professionals handling Schedule C taxes?

With airSlate SignNow, tax professionals can benefit from features like document templates, automatic reminders, and secure eSigning. These features ensure that all necessary documents related to Schedule C taxes are efficiently managed and processed. This saves time and helps in keeping track of important tax filing deadlines.

-

Is there a cost associated with using airSlate SignNow for Schedule C taxes?

airSlate SignNow offers various pricing plans, making it a cost-effective solution for managing Schedule C taxes. By choosing a plan that fits your business needs, you can ensure you only pay for what you need. The investment can signNowly reduce the hassle of tax preparation and document management.

-

Can I integrate airSlate SignNow with accounting software for Schedule C taxes?

Yes, airSlate SignNow allows for integration with various accounting software programs, making it easier to manage your Schedule C taxes. This seamless integration helps in automatic updates and simplifies the process of tracking business expenses and income, which are essential for filling out the Schedule C form.

-

What are the benefits of using eSignatures for Schedule C taxes?

Using eSignatures for Schedule C taxes via airSlate SignNow offers numerous benefits, including speed, security, and convenience. It reduces the time spent on physical signatures and ensures that your documents are signed promptly. Moreover, it keeps all your tax-related documents organized and easily accessible at any time.

-

How can I ensure my data is secure when signing Schedule C taxes with airSlate SignNow?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to keep your data safe while you handle Schedule C taxes. You can sign documents with confidence knowing that your sensitive tax information is protected. Regular audits and compliance with industry standards further enhance our security protocols.

Get more for Schedule C Declaration

Find out other Schedule C Declaration

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application