Transfer Tax in Philadelphia Form

What is the transfer tax in Philadelphia?

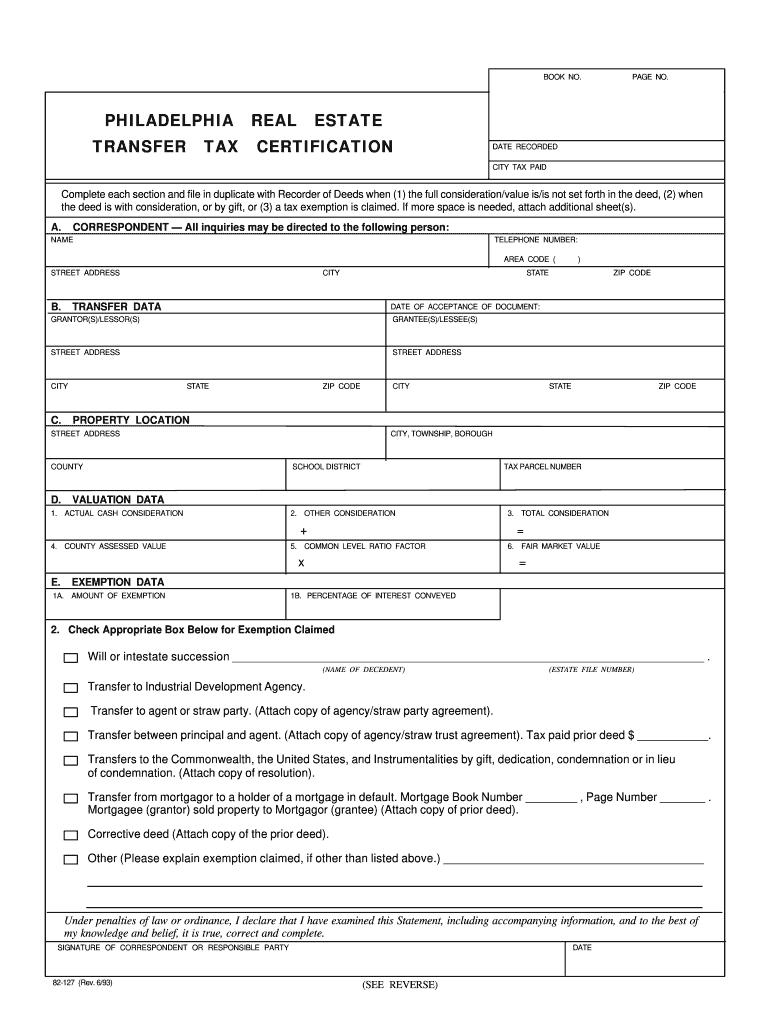

The transfer tax in Philadelphia, often referred to as the Philadelphia realty transfer tax, is a tax imposed on the transfer of real estate property. This tax is calculated as a percentage of the sale price of the property being transferred. In Philadelphia, the rate is typically set at 1.1% for the seller and 1.1% for the buyer, making a total of 2.2%. This tax is applicable to all real estate transactions within the city limits, including residential and commercial properties.

Steps to complete the transfer tax in Philadelphia

Completing the transfer tax form in Philadelphia involves several key steps to ensure compliance with local regulations. First, gather all necessary information, including the sale price of the property and the names of the buyer and seller. Next, fill out the Philadelphia transfer tax form accurately, ensuring all details are correct. Once the form is completed, it must be submitted to the Philadelphia Department of Revenue along with the payment of the transfer tax. This can be done online or in person, depending on your preference.

Legal use of the transfer tax in Philadelphia

The legal framework surrounding the transfer tax in Philadelphia is governed by state and local laws. It is essential to understand that the transfer tax is a legal obligation that must be fulfilled during any real estate transaction. Failure to comply with these laws can result in penalties, including fines or delays in property transfer. Utilizing electronic tools for completing and submitting the transfer tax form can enhance compliance and ensure that all legal requirements are met.

Required documents for the transfer tax in Philadelphia

To successfully complete the transfer tax process in Philadelphia, certain documents are required. These typically include the completed transfer tax form, proof of the sale price (such as a sales agreement), and identification for both the buyer and seller. It is crucial to have all documentation in order to avoid any complications during the submission process.

Form submission methods for the transfer tax in Philadelphia

The Philadelphia transfer tax form can be submitted through various methods. Individuals have the option to submit the form online via the Philadelphia Department of Revenue's website, which is often the most convenient method. Alternatively, the form can be submitted by mail or in person at designated city offices. Each method has its own requirements and processing times, so it is advisable to choose the one that best suits your needs.

Penalties for non-compliance with the transfer tax in Philadelphia

Non-compliance with the transfer tax regulations in Philadelphia can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action to recover owed amounts. It is important for buyers and sellers to be aware of their responsibilities regarding the transfer tax to avoid these consequences. Ensuring timely and accurate submission of the transfer tax form is essential to remain compliant with local laws.

Quick guide on how to complete transfer tax in philadelphia

Accomplish Transfer Tax In Philadelphia effortlessly on any gadget

Digital document management has become increasingly favored by enterprises and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Transfer Tax In Philadelphia on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Transfer Tax In Philadelphia with ease

- Find Transfer Tax In Philadelphia and click Get Form to initiate the process.

- Make use of the tools we provide to complete your document.

- Emphasize important parts of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to apply your changes.

- Select your preferred method to send your form, either via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and eSign Transfer Tax In Philadelphia and ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transfer tax in philadelphia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is transfer tax in Philadelphia?

Transfer tax in Philadelphia is a tax imposed on the transfer of property ownership. It is important for both buyers and sellers to understand this tax as it can signNowly impact the overall cost of a transaction. Being aware of the transfer tax Philadelphia has is crucial for effective financial planning during real estate deals.

-

How is the transfer tax calculated in Philadelphia?

The transfer tax in Philadelphia is calculated based on the sale price of the property. Generally, it's a percentage of this price, and both the buyer and seller may be responsible for paying different portions. Understanding how the transfer tax Philadelphia applies can help you anticipate costs when buying or selling property.

-

Are there any exemptions for the transfer tax in Philadelphia?

Yes, certain exemptions exist for the transfer tax in Philadelphia, such as transfers between family members or certain nonprofit organizations. Identifying whether you qualify for any exemptions can save you money during the transaction process. It's advisable to consult with a real estate professional familiar with the transfer tax Philadelphia regulations.

-

What are the deadlines for paying transfer tax in Philadelphia?

Transfer tax in Philadelphia must be paid at the time of the property transfer, typically during closing. Delays in payment can lead to penalties and interest charges. Being aware of these deadlines is essential to avoid any complications regarding the transfer tax Philadelphia.

-

How can airSlate SignNow help with dealing with transfer tax documents in Philadelphia?

airSlate SignNow simplifies the process of signing and managing documents related to transfer tax in Philadelphia. Our platform allows for easy eSigning and document management, ensuring you can handle necessary paperwork efficiently. Utilizing airSlate SignNow can help you focus on the transaction rather than administrative tasks.

-

What features does airSlate SignNow offer for real estate transactions?

airSlate SignNow provides features tailored for real estate transactions, such as customizable templates, real-time collaboration, and secure storage of essential documents. These tools can enhance your efficiency when dealing with transfer tax Philadelphia and other related paperwork. Our solution makes it easier to manage the complexity of real estate deals.

-

Can airSlate SignNow help teams collaborate on transfer tax-related documents?

Absolutely! airSlate SignNow allows multiple team members to collaborate on transfer tax-related documents seamlessly. This collaboration can expedite the process and ensure everyone is on the same page regarding the transfer tax Philadelphia. Real-time updates and notifications enhance communication and efficiency.

Get more for Transfer Tax In Philadelphia

Find out other Transfer Tax In Philadelphia

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure