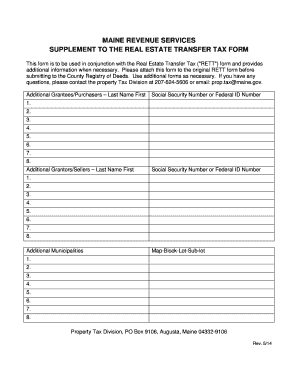

Maine Revenue Services Supplement to the Real Estate Transfer Tax Form Maine

What is the Maine Revenue Services Supplement to the Real Estate Transfer Tax Form?

The Maine Revenue Services Supplement to the Real Estate Transfer Tax Form is a crucial document used in real estate transactions within the state of Maine. This form is designed to report the transfer of real property and calculate the associated transfer tax. It is essential for both buyers and sellers to understand this form, as it ensures compliance with state tax regulations and facilitates the proper assessment of taxes owed during property transfers.

Steps to Complete the Maine Revenue Services Supplement to the Real Estate Transfer Tax Form

Completing the Maine Revenue Services Supplement to the Real Estate Transfer Tax Form involves several key steps:

- Gather necessary information, including property details, buyer and seller information, and the sale price.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the transfer tax based on the sale price and any applicable exemptions.

- Review the completed form for accuracy before submission.

- Submit the form along with any required payments to the appropriate state agency.

How to Obtain the Maine Revenue Services Supplement to the Real Estate Transfer Tax Form

The Maine Revenue Services Supplement to the Real Estate Transfer Tax Form can be obtained through various channels:

- Visit the official Maine Revenue Services website to download the form directly.

- Request a physical copy from your local municipal office or county government.

- Consult with a real estate professional who can provide the form and assist with its completion.

Legal Use of the Maine Revenue Services Supplement to the Real Estate Transfer Tax Form

Using the Maine Revenue Services Supplement to the Real Estate Transfer Tax Form is legally mandated for all real estate transactions in Maine. Failure to complete and submit this form can result in penalties, including fines and delays in property transfers. It is important to ensure that the form is filled out correctly and submitted on time to comply with state laws.

Key Elements of the Maine Revenue Services Supplement to the Real Estate Transfer Tax Form

The key elements of the Maine Revenue Services Supplement to the Real Estate Transfer Tax Form include:

- Property description, including address and legal description.

- Information about the buyer and seller, including names and addresses.

- Sale price of the property and any adjustments or exemptions applicable.

- Signature of both parties, confirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Maine Revenue Services Supplement to the Real Estate Transfer Tax Form is essential for timely compliance. Typically, the form must be submitted at the time of the property transfer, often coinciding with the closing date. It is advisable to check for any specific deadlines related to your transaction to avoid potential penalties.

Quick guide on how to complete maine revenue services supplement to the real estate transfer tax form maine

Effortlessly Prepare Maine Revenue Services Supplement To The Real Estate Transfer Tax Form Maine on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Maine Revenue Services Supplement To The Real Estate Transfer Tax Form Maine on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign Maine Revenue Services Supplement To The Real Estate Transfer Tax Form Maine with Ease

- Find Maine Revenue Services Supplement To The Real Estate Transfer Tax Form Maine and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Maine Revenue Services Supplement To The Real Estate Transfer Tax Form Maine and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maine revenue services supplement to the real estate transfer tax form maine

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maine transfer tax and how does it affect my documents?

The Maine transfer tax is a fee imposed on the transfer of real estate and certain other properties within the state. When dealing with document signing and eSigning services like airSlate SignNow, it's vital to understand this tax as it may affect how you prepare your documents. Knowing the tax implications can help ensure compliance and avoid unexpected costs during real estate transactions.

-

How can airSlate SignNow help me manage Maine transfer tax documentation?

airSlate SignNow provides an efficient platform for managing documents related to the Maine transfer tax. Our intuitive eSigning solution allows you to create, send, and store legally binding documents while ensuring that all necessary tax-related information is accurately captured. This streamlines your compliance processes and saves you valuable time.

-

What are the pricing options for using airSlate SignNow for Maine transfer tax forms?

airSlate SignNow offers competitive pricing plans designed to fit various business needs, including those handling Maine transfer tax forms. Our subscription options come with a range of features, making it cost-effective for businesses of all sizes. You can select a plan that aligns with your budget while accessing essential tools for managing transfer tax documentation.

-

Does airSlate SignNow provide templates for Maine transfer tax documents?

Yes, airSlate SignNow offers a selection of customizable templates for Maine transfer tax documents. These templates simplify the eSigning process, ensuring that all necessary sections are addressed without missing crucial information. Utilizing our templates allows you to maintain compliance with Maine transfer tax regulations easily.

-

Can I integrate airSlate SignNow with other software for Maine transfer tax management?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, enhancing your ability to manage Maine transfer tax documents effectively. Whether you use CRM systems or document management tools, our integrations facilitate smooth workflows and improve document handling related to transfer tax compliance.

-

What benefits does airSlate SignNow offer for handling Maine transfer tax eSignatures?

By using airSlate SignNow for Maine transfer tax eSignatures, you gain a user-friendly platform that speeds up document signing while ensuring compliance. The benefits include reduced turnaround times, enhanced tracking capabilities, and secure storage of signed documents. Our solution helps businesses minimize delays often associated with traditional signing processes.

-

Is airSlate SignNow secure for managing documents related to Maine transfer tax?

Yes, airSlate SignNow employs industry-leading security measures to protect your documents, including those related to Maine transfer tax. Our platform uses encryption and secure data storage to ensure that your sensitive information is safeguarded from unauthorized access. You can confidently eSign and manage transfer tax documents with peace of mind.

Get more for Maine Revenue Services Supplement To The Real Estate Transfer Tax Form Maine

Find out other Maine Revenue Services Supplement To The Real Estate Transfer Tax Form Maine

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free