Ernst Young Form 8850

What is the Ernst Young Form 8850

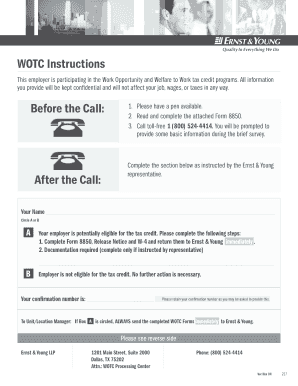

The Ernst Young Form 8850, also known as the Pre-Screening Notice and Certification Request for the Work Opportunity Credit, is a crucial document for employers seeking to claim tax credits for hiring individuals from specific target groups. This form is designed to determine eligibility for the Work Opportunity Tax Credit (WOTC), which incentivizes businesses to hire individuals who may face barriers to employment. The form must be completed accurately to ensure compliance with IRS regulations and to maximize potential tax benefits.

Steps to complete the Ernst Young Form 8850

Completing the Ernst Young Form 8850 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the employee, including their personal details and the specific target group they belong to. Next, fill out the form by providing the required information in each section, ensuring that all fields are completed accurately. Once the form is filled out, review it for any errors or omissions. Finally, submit the completed form to the appropriate state workforce agency within the designated timeframe to ensure eligibility for the tax credit.

Legal use of the Ernst Young Form 8850

The legal use of the Ernst Young Form 8850 is governed by federal and state regulations regarding the Work Opportunity Tax Credit. To be considered valid, the form must be submitted within 28 days of the employee's start date. Additionally, employers must ensure that the information provided is truthful and accurate, as any discrepancies may lead to penalties or disqualification from claiming the tax credit. Adhering to these legal requirements is essential for maintaining compliance and protecting the business from potential audits.

Eligibility Criteria

To qualify for the Work Opportunity Tax Credit using the Ernst Young Form 8850, employers must hire individuals from specific target groups. These groups include veterans, individuals receiving public assistance, and those who have been unemployed for an extended period. Each target group has its own eligibility criteria, which must be met for the employer to claim the tax credit. Understanding these criteria is vital for businesses aiming to benefit from the program.

Form Submission Methods

The Ernst Young Form 8850 can be submitted through various methods, including online, by mail, or in person. Employers should check with their state workforce agency for specific submission guidelines, as these may vary by state. Submitting the form online can expedite the process, while mailing it may take longer due to postal delays. Ensuring timely submission is crucial for maintaining eligibility for the Work Opportunity Tax Credit.

IRS Guidelines

IRS guidelines outline the requirements and procedures for completing and submitting the Ernst Young Form 8850. Employers must familiarize themselves with these guidelines to ensure compliance and to avoid potential issues with their tax filings. The guidelines include information on the types of employees eligible for the tax credit, the necessary documentation, and the deadlines for submission. Adhering to these guidelines helps businesses navigate the complexities of the tax credit process effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Ernst Young Form 8850 are critical for employers looking to claim the Work Opportunity Tax Credit. The form must be submitted to the appropriate state workforce agency within 28 days of the employee's start date. Additionally, employers should be aware of any specific state deadlines that may apply. Keeping track of these important dates ensures that businesses do not miss out on potential tax benefits.

Quick guide on how to complete ernst young form 8850

Complete Ernst Young Form 8850 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Ernst Young Form 8850 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Ernst Young Form 8850 with ease

- Find Ernst Young Form 8850 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to store your amendments.

- Choose how you wish to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Ernst Young Form 8850 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ernst young form 8850

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ernst young form 8850?

The ernst young form 8850 is a document used by employers to apply for the Work Opportunity Tax Credit (WOTC) program. It is essential for businesses looking to claim tax credits for hiring individuals from specific target groups. Understanding this form can signNowly benefit your organization’s financial strategies.

-

How can airSlate SignNow help in managing the ernst young form 8850?

airSlate SignNow provides an efficient platform to manage and eSign the ernst young form 8850 securely. With features like templates and automation, you can ensure timely submissions and traceability for your WOTC applications. This streamlines the paperwork process, allowing you to focus on hiring qualified candidates.

-

Is airSlate SignNow cost-effective for handling the ernst young form 8850?

Yes, airSlate SignNow offers a cost-effective solution for handling the ernst young form 8850 compared to traditional methods. Its pricing plans are designed to fit different business sizes, ensuring that you get maximum value without compromising on features or efficiency. This cost efficiency makes it an excellent choice for businesses looking to save.

-

What features does airSlate SignNow offer for the ernst young form 8850?

airSlate SignNow features a user-friendly interface, customizable templates, and powerful eSigning capabilities designed for the ernst young form 8850. These features facilitate quick document handling, reduce errors, and enhance overall compliance with tax regulations. You can also track the form's status in real-time.

-

Can I integrate airSlate SignNow with other platforms for the ernst young form 8850?

Absolutely! airSlate SignNow offers integrations with various platforms including HR systems and CRMs to ensure an efficient workflow for handling the ernst young form 8850. This connectivity allows you to automate data input and maintain a seamless flow of information across your business systems.

-

What are the benefits of using airSlate SignNow for the ernst young form 8850?

Using airSlate SignNow for the ernst young form 8850 provides numerous benefits, including enhanced security, reduced paper waste, and improved turnaround times. The ability to eSign documents quickly accelerates your application process, enabling quicker access to potential WOTC credits. Overall, it simplifies your administrative workload.

-

Is there a mobile app for airSlate SignNow to manage the ernst young form 8850?

Yes, airSlate SignNow offers a mobile app that allows you to manage the ernst young form 8850 on the go. This means you can send, receive, and eSign documents from your mobile device, increasing flexibility for busy professionals. Stay productive no matter where you are with the convenience of mobile access.

Get more for Ernst Young Form 8850

Find out other Ernst Young Form 8850

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast