M1pr Form

What is the M1PR Form

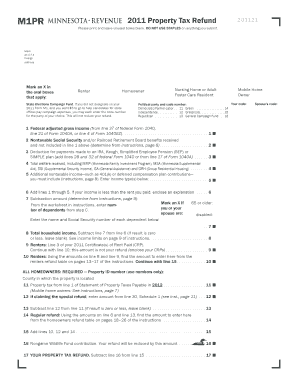

The M1PR form is a Minnesota property tax refund application. This form allows eligible individuals to claim a refund on property taxes paid on their homestead. The M1PR form is specifically designed for residents of Minnesota who meet certain income and residency requirements. By completing this form, taxpayers can receive financial relief, helping to ease the burden of property taxes.

Steps to complete the M1PR Form

Filling out the M1PR form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including your property tax statement and income information. Next, follow these steps:

- Provide your personal information, including your name, address, and Social Security number.

- Indicate the year for which you are claiming the refund.

- Detail your income, including wages, pensions, and any other sources of income.

- Enter the amount of property taxes paid on your homestead.

- Review the completed form for accuracy before submission.

How to obtain the M1PR Form

The M1PR form can be easily obtained through several methods. You can access the form online via the Minnesota Department of Revenue website, where you can download and print it. Alternatively, you may request a paper copy by contacting your local county office or the Minnesota Department of Revenue directly. Ensure you have the most current version of the form to avoid any issues during submission.

Legal use of the M1PR Form

To legally use the M1PR form, it is essential to comply with state regulations regarding property tax refunds. This includes ensuring that you meet the eligibility criteria, such as residency and income limits. The information provided on the form must be accurate and truthful, as any discrepancies could lead to penalties or denial of the refund. It is advisable to keep a copy of the submitted form and any supporting documents for your records.

Filing Deadlines / Important Dates

Timely submission of the M1PR form is crucial for receiving your property tax refund. The filing deadline for the M1PR form is typically August 15 of the year following the tax year for which you are claiming a refund. It is important to stay informed about any changes to deadlines or requirements, as these can vary from year to year. Mark your calendar to ensure you do not miss this important date.

Form Submission Methods (Online / Mail / In-Person)

The M1PR form can be submitted through various methods to accommodate different preferences. You can file the form online using the Minnesota Department of Revenue's e-file system, which offers a convenient and secure option. Alternatively, you may choose to mail the completed form to the appropriate address listed on the form or deliver it in person to your local county office. Each method has its own processing times, so consider your timeline when choosing how to submit.

Quick guide on how to complete m1pr form 100061237

Effortlessly Prepare M1pr Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly option to conventional printed and signed papers, as you can easily access the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle M1pr Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The Easiest Method to Modify and Electronically Sign M1pr Form with Ease

- Find M1pr Form and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the information carefully and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Revise and electronically sign M1pr Form to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m1pr form 100061237

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M1PR form and why do I need to fill it out?

The M1PR form is a tax-related document used in certain jurisdictions to report property tax refunds. Understanding how to fill out the M1PR form accurately is essential to ensure you receive the benefits you are entitled to. Using airSlate SignNow's platform simplifies this process and allows you to complete and eSign the form efficiently.

-

How can airSlate SignNow help me with the M1PR form?

airSlate SignNow offers an intuitive platform for filling out the M1PR form, making the process straightforward and stress-free. With features such as templates and guided workflows, you can learn how to fill out the M1PR form with ease. Our solution also provides eSignature capabilities for a fully digital experience.

-

Is there a cost associated with using airSlate SignNow for the M1PR form?

airSlate SignNow provides cost-effective solutions for all your document signing and eSigning needs, including for the M1PR form. We offer various pricing plans tailored to different needs, ensuring that you can choose a suitable option that fits your budget. Please check our pricing page for more details.

-

Are there specific features in airSlate SignNow for filling out tax forms like M1PR?

Yes, airSlate SignNow offers unique features like form templates, data entry assistance, and easy document sharing to streamline filling out the M1PR form. These tools help users generate accurate forms quickly and reduce the likelihood of errors. Learning how to fill out the M1PR form has never been easier with our software.

-

Can I use airSlate SignNow on my mobile device for the M1PR form?

Absolutely! airSlate SignNow's platform is mobile-friendly, allowing you to fill out the M1PR form from your smartphone or tablet. This flexibility ensures that you can manage your tax documents on the go, making it convenient to learn how to fill out the M1PR form whenever and wherever you need.

-

Does airSlate SignNow integrate with accounting software for M1PR form completion?

Yes, airSlate SignNow integrates seamlessly with various accounting software tools, making it simpler to manage your financial documents, including the M1PR form. This integration allows you to import relevant data directly into your forms, ensuring accuracy and saving you time. This streamlines the process of how to fill out the M1PR form effectively.

-

What benefits can I expect when using airSlate SignNow for forms like M1PR?

Using airSlate SignNow for forms like the M1PR brings numerous benefits including faster turnaround times, enhanced accuracy, and secure eSigning capabilities. Our user-friendly interface ensures a smooth experience, allowing you to focus on what matters most. Discover how to fill out the M1PR form effortlessly while taking advantage of all these benefits.

Get more for M1pr Form

Find out other M1pr Form

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure