Cele Charity Form

What is the Cele Charity Form

The Cele Charity Form is a document used by nonprofit organizations to apply for tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This form is essential for charities seeking to operate legally and receive tax-deductible donations. Understanding its purpose and requirements is crucial for organizations aiming to serve the public while maintaining compliance with federal regulations.

How to use the Cele Charity Form

To effectively use the Cele Charity Form, organizations must gather necessary information about their structure, mission, and activities. This includes details about the board of directors, financial projections, and a description of the charitable purpose. Once completed, the form must be submitted to the Internal Revenue Service (IRS) for review. Organizations should ensure all information is accurate and complete to avoid delays in processing.

Steps to complete the Cele Charity Form

Completing the Cele Charity Form involves several key steps:

- Gather Information: Collect all required details about the organization, including its mission and financial data.

- Fill Out the Form: Carefully complete each section of the form, ensuring clarity and accuracy.

- Review for Accuracy: Double-check all entries to confirm that no information is missing or incorrect.

- Submit the Form: Send the completed Cele Charity Form to the IRS, either electronically or via mail.

Legal use of the Cele Charity Form

The Cele Charity Form must be used in accordance with federal laws governing nonprofit organizations. This includes adhering to the requirements set forth by the IRS for tax-exempt status. Proper use ensures that the organization can operate legally and maintain its tax-exempt status, which is vital for receiving donations and grants.

Key elements of the Cele Charity Form

Key elements of the Cele Charity Form include:

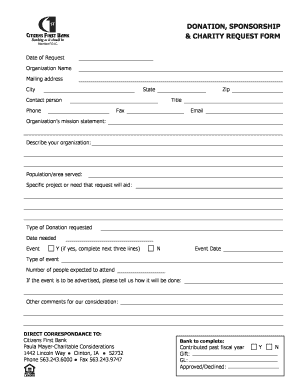

- Organization Information: Name, address, and contact details of the charity.

- Mission Statement: A clear description of the charity's purpose and activities.

- Financial Information: Projected income and expenses, including funding sources.

- Governance Structure: Information about the board of directors and their roles.

IRS Guidelines

The IRS provides specific guidelines for completing the Cele Charity Form. These guidelines outline the necessary information required, the format for submission, and the timeline for processing. Adhering to these guidelines is crucial for ensuring that the application is accepted and processed in a timely manner.

Quick guide on how to complete cele charity form

Effortlessly Prepare Cele Charity Form on Any Device

Online document management has gained increased popularity among businesses and individuals. It offers a suitable eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, alter, and electronically sign your documents swiftly without delays. Manage Cele Charity Form on any device using airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to Modify and eSign Cele Charity Form with Ease

- Locate Cele Charity Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal weight as a traditional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Cele Charity Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cele charity form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a cele charity form and how can it be used?

A cele charity form is a digital document specifically designed for organizations to collect donations efficiently and securely. With airSlate SignNow, you can create, send, and manage your cele charity form, ensuring that donor information is protected and easily accessible.

-

How much does it cost to use the cele charity form with airSlate SignNow?

The pricing for using a cele charity form with airSlate SignNow is flexible, catering to various organizational needs. We offer different subscription plans that suit multiple budgets, allowing organizations to choose the plan that best fits their financial capabilities while enjoying the full range of features.

-

What features are included in the cele charity form with airSlate SignNow?

The cele charity form includes essential features such as document templates, eSignature capabilities, and data analytics. Additionally, users can customize their forms, set up automated reminders, and track the status of submissions to enhance efficiency and donor engagement.

-

What are the benefits of using a cele charity form?

Using a cele charity form streamlines the donation process, making it easy for donors to contribute and for organizations to manage their fundraising efforts. This user-friendly solution enhances the donor experience and can signNowly increase fundraising opportunities through simplified accessibility.

-

Can I integrate the cele charity form with other tools?

Yes, airSlate SignNow allows for seamless integration of the cele charity form with popular tools such as CRMs, payment processors, and email marketing platforms. This connectivity maximizes efficiency and streamlines workflow, helping organizations maintain organized records and enhance communication with supporters.

-

Is the cele charity form secure for collecting sensitive information?

Absolutely! The cele charity form created with airSlate SignNow is designed with top-notch security features that protect sensitive donor information. With encryption and secure data handling practices, organizations can ensure their donors' data remains private and secure during the donation process.

-

How can I customize my cele charity form?

airSlate SignNow provides numerous customization options for your cele charity form, allowing you to tailor it according to your organization's branding and specific needs. You can modify fields, add your logo, and adjust color schemes to create a unique form that resonates with your audience.

Get more for Cele Charity Form

- Schedule or asc np oregon adjustments for form or 40 n and form or 40 p filers 150 101 064

- Form sp 771968981

- Hours of work averaging agreement template form

- House cleaning agreement template form

- House buyout agreement template form

- House agreement template form

- House cleaning service agreement template form

- House leasing agreement template form

Find out other Cele Charity Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors