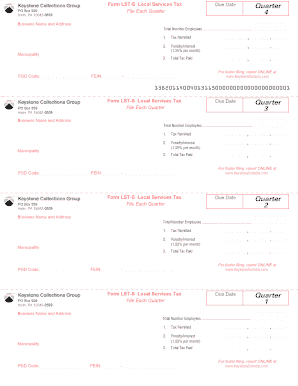

Form LST S Local Services Tax

What is the Form LST S Local Services Tax

The Form LST S Local Services Tax is a tax document used by municipalities in the United States to collect a local services tax from individuals who work within their jurisdiction. This form is typically required from employees and self-employed individuals who earn income in the area. The tax helps fund local services such as public safety, infrastructure maintenance, and community programs. Understanding the purpose and implications of this form is essential for compliance and financial planning.

How to use the Form LST S Local Services Tax

Using the Form LST S Local Services Tax involves several steps to ensure it is filled out correctly. First, obtain the form from your local municipality's website or office. Once you have the form, provide accurate personal information, including your name, address, and Social Security number. Next, report your income earned in the locality. After completing the form, review it for accuracy before submission. Depending on your municipality, you may need to submit the form online, by mail, or in person.

Steps to complete the Form LST S Local Services Tax

Completing the Form LST S Local Services Tax requires careful attention to detail. Follow these steps:

- Download or obtain the form from your local tax authority.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your income earned within the local jurisdiction.

- Calculate the total tax owed based on the income reported.

- Sign and date the form to validate your submission.

- Submit the completed form according to your municipality's guidelines.

Legal use of the Form LST S Local Services Tax

The Form LST S Local Services Tax is legally binding when completed and submitted in accordance with local regulations. It is important to ensure that all information provided is accurate and truthful to avoid legal repercussions. The form serves as a declaration of income earned in the locality and is subject to verification by local tax authorities. Failing to submit the form or providing false information can lead to penalties or fines.

Filing Deadlines / Important Dates

Filing deadlines for the Form LST S Local Services Tax vary by municipality. Generally, the form must be submitted annually, often coinciding with the end of the tax year. It is crucial to check with your local tax authority for specific dates to avoid late fees. Additionally, some municipalities may require quarterly submissions for estimated payments, so staying informed about these deadlines is essential for compliance.

Penalties for Non-Compliance

Failure to file the Form LST S Local Services Tax or submitting it late can result in penalties. These penalties may include fines, interest on unpaid taxes, and potential legal action. Each municipality has its own regulations regarding non-compliance, so it is important to understand the consequences of not submitting the form on time. Staying compliant helps avoid unnecessary financial burdens and legal issues.

Quick guide on how to complete form lst s local services tax

Effortlessly Prepare Form LST S Local Services Tax on Any Device

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents rapidly without any hold-ups. Manage Form LST S Local Services Tax on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and Electronically Sign Form LST S Local Services Tax Effortlessly

- Find Form LST S Local Services Tax and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with the dedicated tools provided by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, cumbersome form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form LST S Local Services Tax to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form lst s local services tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form LST S Local Services Tax?

Form LST S Local Services Tax is a tax document required by certain municipalities for individuals working within their jurisdictions. Businesses must complete this form to comply with local tax regulations and ensure their employees meet local tax obligations. Understanding the details of this form can help streamline your local tax processes.

-

How does airSlate SignNow help with Form LST S Local Services Tax?

airSlate SignNow simplifies the process of completing and submitting Form LST S Local Services Tax by providing an intuitive eSignature platform. Users can easily fill out the form electronically, add necessary signatures, and quickly send it to the appropriate tax authorities, enhancing efficiency and compliance. This reduces the administrative burden associated with traditional paper methods.

-

What are the pricing plans for using airSlate SignNow for Form LST S Local Services Tax?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs when handling Form LST S Local Services Tax. Whether you're a small business or a larger enterprise, you can choose a plan that aligns with your document management and eSigning requirements. Competitive pricing makes it a cost-effective solution for managing local tax forms.

-

Can I integrate airSlate SignNow with other software to manage Form LST S Local Services Tax?

Yes, airSlate SignNow offers seamless integrations with various software applications to enhance your workflow while managing Form LST S Local Services Tax. Integrations with accounting software and CRM systems can streamline data entry and ensure accurate tax reporting. This connectivity improves overall efficiency and effectiveness in handling tax documents.

-

What features does airSlate SignNow offer for handling Form LST S Local Services Tax?

airSlate SignNow includes features like customizable templates, secure eSigning, and document tracking to facilitate the management of Form LST S Local Services Tax. These features help ensure compliance, reduce errors, and provide a clear audit trail of document exchanges. With these tools, your business can handle local services tax forms more effectively.

-

Is airSlate SignNow secure for processing Form LST S Local Services Tax?

Absolutely, airSlate SignNow prioritizes security and employs advanced encryption methods to protect your documents, including Form LST S Local Services Tax. The platform complies with industry standards to ensure that all sensitive information remains confidential during eSigning and sharing processes. This gives users peace of mind when handling critical tax documents.

-

What are the benefits of using airSlate SignNow for Form LST S Local Services Tax?

Using airSlate SignNow for Form LST S Local Services Tax enables businesses to streamline their tax documentation process, enhancing speed and accuracy. The platform reduces reliance on paper forms, minimizes clerical errors, and allows remote collaboration among team members. Ultimately, this leads to increased efficiency and helps ensure compliance with local tax laws.

Get more for Form LST S Local Services Tax

- Dpsmv 1716 r 12 10 form

- Pre juvenile moves in the field form

- Telegraphic transfers order form summerland credit union

- Patient registration checklist form

- Fin 400 form

- Jimd journal of inherited metabolic disease form for

- Interspousal transfer deed texas form

- Govhealth care for information about va health benefits

Find out other Form LST S Local Services Tax

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe