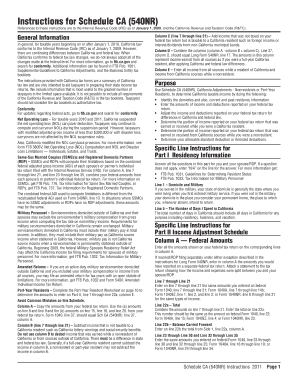

Schedule Ca 540nr Form

What is the Schedule CA 540NR

The Schedule CA 540NR is a form used by non-resident taxpayers in California to report their income and calculate their tax liability. This form is essential for individuals who earn income from California sources but do not reside in the state. It allows taxpayers to adjust their federal adjusted gross income to reflect California-specific tax laws and deductions. Understanding the purpose of this form is crucial for accurate tax reporting and compliance.

Steps to Complete the Schedule CA 540NR

Completing the Schedule CA 540NR involves several key steps. First, gather all necessary documentation, including your federal tax return and information on California-source income. Next, begin filling out the form by entering your federal adjusted gross income. Adjust this figure by adding or subtracting specific items as required by California tax laws. Carefully follow the instructions provided with the form to ensure all entries are accurate. Finally, review your completed form for any errors before submission.

Legal Use of the Schedule CA 540NR

The Schedule CA 540NR is legally binding when completed accurately and submitted in accordance with California tax regulations. To ensure its validity, taxpayers must adhere to the requirements set forth by the California Franchise Tax Board. This includes providing accurate information and maintaining compliance with relevant tax laws. Utilizing a reliable e-signature solution can enhance the legal standing of your submitted documents, ensuring they meet all necessary criteria.

Filing Deadlines / Important Dates

Timely filing of the Schedule CA 540NR is crucial to avoid penalties. Generally, the form must be submitted by April 15 of the year following the tax year being reported. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any specific deadlines for extensions or amendments to ensure compliance with California tax laws.

Required Documents

To complete the Schedule CA 540NR, taxpayers need several key documents. These typically include your federal tax return, W-2 forms, 1099 forms, and any documentation related to California-source income. Additionally, records of deductions and credits specific to California should be gathered. Having these documents on hand will facilitate a smoother and more accurate completion of the form.

Examples of Using the Schedule CA 540NR

The Schedule CA 540NR can be used in various scenarios. For instance, a non-resident who works remotely for a California-based company would report their California-source income using this form. Similarly, a student attending a California university but residing out of state may need to file this form if they earn income from a California job. Each example highlights the importance of accurately reporting income and adhering to California tax regulations.

Who Issues the Form

The Schedule CA 540NR is issued by the California Franchise Tax Board (FTB). This state agency is responsible for managing California's tax laws and ensuring compliance among taxpayers. The FTB provides the necessary forms, instructions, and resources to assist taxpayers in fulfilling their tax obligations accurately and efficiently.

Quick guide on how to complete 540 nr

Prepare 540 nr seamlessly on any device

Managing documents online has gained traction among companies and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed forms, allowing you to locate the necessary template and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without any hold-ups. Handle 540nr on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and eSign schedule ca 540nr 2018 effortlessly

- Locate ca 540nr and then click Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize important sections of your documents or conceal confidential information using tools explicitly designed for this purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to preserve your changes.

- Choose your preferred method to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign 540nr 2016 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ca 540nr instructions

Create this form in 5 minutes!

How to create an eSignature for the 2013 schedule ca 540nr instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask schedule ca 540nr instructions 2017

-

What is 540nr and how does it work with airSlate SignNow?

540nr is a specific form used for notifying the Internal Revenue Service (IRS) and is crucial for various businesses. With airSlate SignNow, you can easily complete and eSign your 540nr documents, streamlining your workflow and enhancing compliance.

-

What pricing options are available for using airSlate SignNow with 540nr documents?

airSlate SignNow offers flexible pricing plans that cater to all business sizes, making it easy to manage costs while using the 540nr form. You can choose from monthly or annual subscriptions, with features that fit your specific needs for document management.

-

What features does airSlate SignNow provide for managing 540nr documents?

airSlate SignNow includes various features that simplify the handling of 540nr documents, such as eSignature capabilities, cloud storage, and document templates. These tools ensure that your 540nr forms are processed quickly and securely.

-

How does using airSlate SignNow benefit businesses filing 540nr?

Using airSlate SignNow for 540nr can signNowly reduce the time and resources spent on document management. This solution automates the signing process, increases accuracy, and ensures that your 540nr submissions are compliant with regulatory requirements.

-

Can I integrate airSlate SignNow with other applications for my 540nr processes?

Absolutely! airSlate SignNow offers integration with various applications, allowing you to streamline your workflow related to 540nr. This ensures a seamless and efficient process when dealing with multiple tools and systems.

-

Is it easy to track the status of my 540nr documents in airSlate SignNow?

Yes, airSlate SignNow provides comprehensive tracking features that keep you updated on the status of your 540nr documents. You can easily monitor who has signed and when, ensuring your process remains transparent and efficient.

-

What security measures does airSlate SignNow have for 540nr documents?

airSlate SignNow takes document security very seriously, particularly with sensitive 540nr forms. The platform uses bank-level encryption, secure cloud storage, and compliance with regulations to protect your data from unauthorized access.

Get more for california schedule ca 540nr 2018

Find out other schedule ca 540nr 2019

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease