Form or 706 V, Oregon Estate Transfer Tax Payment Voucher, 150 104 172

What is the Form OR 706 V, Oregon Estate Transfer Tax Payment Voucher, 150 104 172

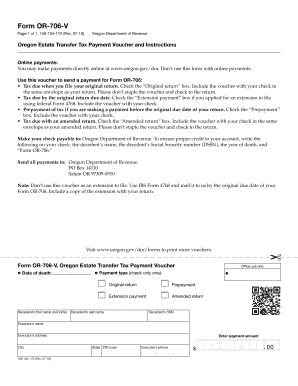

The Form OR 706 V is an essential document used in Oregon for estate transfer tax purposes. This form serves as a payment voucher for the estate tax due on the transfer of property upon a decedent's death. It is crucial for ensuring that the estate complies with state tax obligations. The form captures necessary information about the estate, including the decedent's details and the amount of tax owed. Understanding this form is vital for executors and administrators managing estate settlements in Oregon.

Steps to complete the Form OR 706 V, Oregon Estate Transfer Tax Payment Voucher, 150 104 172

Completing the Form OR 706 V involves several steps to ensure accuracy and compliance. First, gather all relevant information about the decedent and the estate. This includes the decedent's full name, date of death, and Social Security number. Next, calculate the total estate tax liability based on the estate's value. Fill out the form by entering the required details, ensuring that all figures are accurate. Finally, review the completed form for any errors before submitting it along with the payment to the appropriate tax authority.

How to obtain the Form OR 706 V, Oregon Estate Transfer Tax Payment Voucher, 150 104 172

The Form OR 706 V can be obtained through the Oregon Department of Revenue's official website. It is available for download in a printable format, allowing users to fill it out manually. Additionally, physical copies may be available at local tax offices or government buildings. Ensuring you have the correct and most recent version of the form is important for compliance with current tax laws.

Legal use of the Form OR 706 V, Oregon Estate Transfer Tax Payment Voucher, 150 104 172

The Form OR 706 V is legally binding when completed correctly and submitted in accordance with Oregon state laws. It is essential for fulfilling estate tax obligations, and failure to submit this form can result in penalties or fines. The form must be signed by the executor or administrator of the estate, affirming that the information provided is accurate and complete. Compliance with the legal requirements ensures that the estate is settled properly and avoids potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form OR 706 V are critical for ensuring compliance with Oregon tax regulations. The estate tax return, along with the payment voucher, must typically be filed within nine months of the decedent's date of death. It is important to be aware of any extensions that may be available and to keep track of any changes in tax law that could affect these deadlines. Missing the deadline can lead to additional penalties and interest on the owed tax amount.

State-specific rules for the Form OR 706 V, Oregon Estate Transfer Tax Payment Voucher, 150 104 172

Oregon has specific rules governing the use of the Form OR 706 V, which differ from other states. These rules include the thresholds for estate tax liability, exemptions, and deductions applicable to estates. Understanding these state-specific regulations is crucial for executors and administrators to accurately calculate the estate tax owed and ensure compliance. It is advisable to consult the Oregon Department of Revenue or a tax professional for guidance on these rules.

Quick guide on how to complete form or 706 v oregon estate transfer tax payment voucher 150 104 172

Effortlessly Prepare Form OR 706 V, Oregon Estate Transfer Tax Payment Voucher, 150 104 172 on Any Device

Digital document management has gained popularity among organizations and individuals. It offers a great environmentally friendly substitute for traditional printed and signed papers, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the tools you require to efficiently create, modify, and eSign your documents without delays. Handle Form OR 706 V, Oregon Estate Transfer Tax Payment Voucher, 150 104 172 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and eSign Form OR 706 V, Oregon Estate Transfer Tax Payment Voucher, 150 104 172 with Ease

- Find Form OR 706 V, Oregon Estate Transfer Tax Payment Voucher, 150 104 172 and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize signNow sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form OR 706 V, Oregon Estate Transfer Tax Payment Voucher, 150 104 172 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form or 706 v oregon estate transfer tax payment voucher 150 104 172

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form or 706?

The form or 706, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a tax form that estate executors must file to report the estate's value and calculate any taxes owed. It's crucial for compliance with federal estate tax laws.

-

How can airSlate SignNow help with the form or 706?

airSlate SignNow allows you to easily upload, edit, and eSign the form or 706 online. This simplifies the document management process and ensures that your forms are securely stored and quickly accessible.

-

Is airSlate SignNow cost-effective for managing the form or 706?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to manage the form or 706. With flexible pricing plans, you can choose one that fits your budget while benefiting from a robust eSigning platform.

-

What features does airSlate SignNow offer for the form or 706?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and advanced eSignature options, all designed to streamline the submission of the form or 706. These tools enhance the efficiency of completing and managing your documents.

-

Can I integrate airSlate SignNow with other software when completing the form or 706?

Absolutely! airSlate SignNow offers various integrations with essential software, allowing seamless coordination when completing and managing the form or 706. This ensures that your teams can work efficiently and access needed tools.

-

What are the benefits of using airSlate SignNow for the form or 706?

Using airSlate SignNow for the form or 706 provides numerous benefits, including enhanced security, faster turnaround times, and improved collaboration among stakeholders. This makes the process of managing estate tax compliance signNowly easier.

-

Is it easy to obtain support for the form or 706 through airSlate SignNow?

Yes, airSlate SignNow offers dedicated customer support to assist you with any queries related to the form or 706. Whether you need help with eSigning or document management, our support team is ready to help.

Get more for Form OR 706 V, Oregon Estate Transfer Tax Payment Voucher, 150 104 172

- Clash of the titans viewing guide answer key form

- Goods issue note template form

- Va loan comparison worksheet form

- Traffic ticket discovery request sample form

- Room rental agreement washington state form

- Rp 425 wkst form

- Articles of organization oklahoma form

- Washington state accident report pdf form

Find out other Form OR 706 V, Oregon Estate Transfer Tax Payment Voucher, 150 104 172

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online