Authority to Deduct Form

What is the Authority To Deduct Form

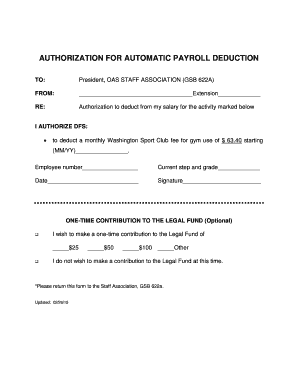

The Authority To Deduct Form is a legal document that allows an individual or entity to authorize another party to deduct specific amounts from their payments. This form is commonly used in various financial and tax-related situations, such as payroll deductions or loan repayments. By completing this form, the signer grants permission for the designated party to withdraw funds directly from their account or payments, ensuring transparency and compliance with financial agreements.

How to Use the Authority To Deduct Form

Using the Authority To Deduct Form involves several key steps. First, ensure that you have the correct version of the form, which can typically be obtained from the issuing entity or relevant financial institution. Next, fill out the required fields, including your personal information, the amount to be deducted, and the recipient's details. Once completed, review the form for accuracy before signing it. It is crucial to keep a copy for your records and submit the original to the designated party to initiate the deductions.

Steps to Complete the Authority To Deduct Form

Completing the Authority To Deduct Form requires careful attention to detail. Follow these steps:

- Obtain the correct form from a reliable source.

- Provide your full name and contact information.

- Specify the amount to be deducted and the frequency of deductions.

- Include the recipient's name and contact details.

- Sign and date the form to validate your authorization.

- Make a copy for your records before submission.

Legal Use of the Authority To Deduct Form

The legal use of the Authority To Deduct Form hinges on several factors. It must be completed accurately and signed by the individual granting authority. Additionally, the form should comply with relevant laws and regulations, including those governing financial transactions and privacy. When executed properly, it serves as a binding agreement that protects both parties involved, ensuring that deductions are made in accordance with the terms specified in the form.

Key Elements of the Authority To Deduct Form

Several key elements must be included in the Authority To Deduct Form to ensure its validity:

- Personal Information: Full name, address, and contact details of the individual authorizing the deductions.

- Recipient Information: Name and contact details of the entity or individual authorized to make deductions.

- Deduction Amount: Clearly state the amount to be deducted and the frequency of the deductions.

- Signature and Date: The form must be signed and dated by the authorizing individual to confirm consent.

Examples of Using the Authority To Deduct Form

The Authority To Deduct Form can be utilized in various scenarios, including:

- Payroll deductions for taxes or benefits.

- Loan repayments where the lender withdraws payments directly from the borrower's account.

- Subscription services that require regular payments.

- Charitable donations that are automatically deducted from an individual's paycheck.

Quick guide on how to complete authority to deduct

Execute authority to deduct effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as it allows you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the resources needed to create, edit, and electronically sign your documents promptly without delays. Manage authority to deduct on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and electronically sign authority to deduct sample without strain

- Locate authority to deduct template and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, painstaking form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign authority to deduct form and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to authority to deduct

Create this form in 5 minutes!

How to create an eSignature for the authority to deduct sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask authority to deduct form

-

What is the authority to deduct feature in airSlate SignNow?

The authority to deduct feature in airSlate SignNow allows users to manage and automate payment processes or deductions with legally binding electronic signatures. This ensures that all parties are aware and in agreement about the deductions outlined in the documents, providing a transparent and efficient way to handle financial transactions.

-

How does airSlate SignNow handle document security related to authority to deduct?

airSlate SignNow employs industry-leading security measures to safeguard documents involving authority to deduct. With end-to-end encryption, secure audit trails, and compliance with regulations, your sensitive information is protected while ensuring that all signature processes are legally valid.

-

Can I integrate airSlate SignNow with other tools for authority to deduct processes?

Yes, airSlate SignNow offers various integrations with popular software tools that enhance the authority to deduct processes. These integrations allow for seamless data exchange and automation, improving overall efficiency and ensuring that all related tasks are synchronized across your business operations.

-

What pricing options are available for using the authority to deduct feature?

airSlate SignNow offers flexible pricing plans that accommodate businesses of all sizes looking to leverage the authority to deduct feature. Each plan is designed to provide value, including access to essential features and resources to help streamline your document management and signing processes.

-

How can I ensure compliance while using the authority to deduct feature?

Using airSlate SignNow's authority to deduct feature, you can ensure compliance by utilizing legally binding eSignatures and maintaining thorough records of all documented agreements. The platform also provides templates and guidance to help you meet industry regulations, mitigating any compliance risks.

-

What are the key benefits of using airSlate SignNow for authority to deduct?

The key benefits of using airSlate SignNow for authority to deduct include increased efficiency, cost savings, and enhanced document security. This user-friendly platform streamlines the signing process, reduces paper usage, and shores up compliance, making it an ideal solution for modern businesses.

-

Is there a mobile app for managing authority to deduct documents?

Yes, airSlate SignNow provides a mobile app that enables users to manage documents and utilize the authority to deduct feature on the go. This flexibility allows you to send, sign, and track essential documents anytime and anywhere, ensuring that your business operations remain uninterrupted.

Get more for authority to deduct

- Field trip or other activity notificat form

- Quality indicators for effective inclusive education guidebook form

- S175 permission to transfer goods between certain vessels form

- Cross curricular reading comprehension worksheets 433230470 form

- Sticker form 16099796

- Test requisition form receptivadx

- Opex ccp review form

- Football clearance form

Find out other authority to deduct sample

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now