South Carolina Fillable Quarterly Withholding Form Wh 1606 for

What is the South Carolina Fillable Quarterly Withholding Form WH 1606 For

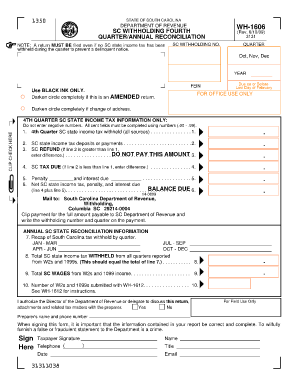

The South Carolina Fillable Quarterly Withholding Form WH 1606 is a tax document used by employers to report and remit state income tax withheld from employees' wages. This form is essential for ensuring compliance with state tax laws and helps maintain accurate records of withholding amounts. Employers must submit this form quarterly to the South Carolina Department of Revenue to fulfill their tax obligations.

How to use the South Carolina Fillable Quarterly Withholding Form WH 1606 For

To use the South Carolina Fillable Quarterly Withholding Form WH 1606, employers should first download the form from the South Carolina Department of Revenue website or access it through a digital platform like signNow. After obtaining the form, employers can fill it out electronically, entering the required information such as the total amount of state income tax withheld during the quarter. Once completed, the form can be submitted electronically or printed for mailing, depending on the employer's preference.

Steps to complete the South Carolina Fillable Quarterly Withholding Form WH 1606 For

Completing the South Carolina Fillable Quarterly Withholding Form WH 1606 involves several key steps:

- Download the form from a reliable source.

- Enter your business information, including the employer identification number (EIN).

- Fill in the total wages paid and the total state tax withheld for the quarter.

- Review the information for accuracy to avoid potential penalties.

- Submit the form electronically or print and mail it to the appropriate state agency.

Legal use of the South Carolina Fillable Quarterly Withholding Form WH 1606 For

The legal use of the South Carolina Fillable Quarterly Withholding Form WH 1606 is crucial for employers to comply with state tax regulations. This form serves as an official record of the taxes withheld from employees' wages and must be filed on time to avoid penalties. Employers are required to maintain copies of submitted forms for their records, as they may be requested during audits or reviews by the South Carolina Department of Revenue.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the South Carolina Fillable Quarterly Withholding Form WH 1606. Typically, the form is due on the last day of the month following the end of each quarter. For example, the deadlines are as follows:

- First Quarter (January - March): Due April 30

- Second Quarter (April - June): Due July 31

- Third Quarter (July - September): Due October 31

- Fourth Quarter (October - December): Due January 31

Penalties for Non-Compliance

Failure to file the South Carolina Fillable Quarterly Withholding Form WH 1606 on time can result in significant penalties. Employers may face fines based on the amount of tax due or a fixed penalty for late filing. Additionally, repeated non-compliance can lead to increased scrutiny from the South Carolina Department of Revenue, potentially resulting in audits or further legal action.

Quick guide on how to complete south carolina fillable quarterly withholding form wh 1606 for

Complete South Carolina Fillable Quarterly Withholding Form Wh 1606 For effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your files swiftly without delays. Handle South Carolina Fillable Quarterly Withholding Form Wh 1606 For on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to modify and eSign South Carolina Fillable Quarterly Withholding Form Wh 1606 For effortlessly

- Find South Carolina Fillable Quarterly Withholding Form Wh 1606 For and then click Get Form to initiate.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to retain your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device of your preference. Modify and eSign South Carolina Fillable Quarterly Withholding Form Wh 1606 For and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the south carolina fillable quarterly withholding form wh 1606 for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the South Carolina Fillable Quarterly Withholding Form Wh 1606 For?

The South Carolina Fillable Quarterly Withholding Form Wh 1606 For is a tax document used by employers to report and remit state income tax withheld from employee wages. It must be filed quarterly, ensuring compliance with state tax laws. By utilizing airSlate SignNow, you can easily fill, sign, and submit this form electronically, streamlining your tax process.

-

How can I fill out the South Carolina Fillable Quarterly Withholding Form Wh 1606 For using airSlate SignNow?

Using airSlate SignNow, you can easily complete the South Carolina Fillable Quarterly Withholding Form Wh 1606 For directly online. Simply upload the form, fill in the required fields, and save your changes. Our user-friendly interface allows for a quick and efficient filling process, facilitating hassle-free submissions.

-

What features does airSlate SignNow offer for the South Carolina Fillable Quarterly Withholding Form Wh 1606 For?

airSlate SignNow provides a variety of features to simplify the process of handling the South Carolina Fillable Quarterly Withholding Form Wh 1606 For. These include electronic signatures, template creation, and document sharing capabilities. Additionally, our platform enables real-time collaboration to ensure all stakeholders can contribute seamlessly.

-

Is the South Carolina Fillable Quarterly Withholding Form Wh 1606 For secure when using airSlate SignNow?

Yes, the South Carolina Fillable Quarterly Withholding Form Wh 1606 For is secure when processed through airSlate SignNow. We implement advanced security measures including encryption and secure access controls. This ensures that your sensitive tax information remains safe and protected during the entire process.

-

What are the pricing options for using airSlate SignNow to manage the South Carolina Fillable Quarterly Withholding Form Wh 1606 For?

airSlate SignNow offers competitive pricing plans that are designed to fit various business needs for managing the South Carolina Fillable Quarterly Withholding Form Wh 1606 For. Pricing is based on a subscription model, which includes access to all features necessary for document signing and management. You can choose a plan that best suits your business size and requirements.

-

Can I integrate airSlate SignNow with other software for handling the South Carolina Fillable Quarterly Withholding Form Wh 1606 For?

Absolutely! airSlate SignNow offers seamless integrations with a variety of third-party applications and tools. This enables you to sync information and manage your business processes more efficiently while handling the South Carolina Fillable Quarterly Withholding Form Wh 1606 For. Compatible software includes CRMs, project management tools, and more.

-

What benefits do I get from using airSlate SignNow for the South Carolina Fillable Quarterly Withholding Form Wh 1606 For?

Using airSlate SignNow for the South Carolina Fillable Quarterly Withholding Form Wh 1606 For provides multiple benefits, including time savings and improved accuracy. Our platform simplifies the document preparation and signing process, reducing the likelihood of errors. Furthermore, it enhances compliance by ensuring timely submissions, which is vital for businesses.

Get more for South Carolina Fillable Quarterly Withholding Form Wh 1606 For

Find out other South Carolina Fillable Quarterly Withholding Form Wh 1606 For

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer