Etrade 1099 Form

What is the Etrade 1099

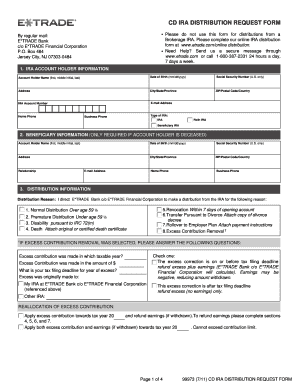

The Etrade 1099 is a tax document issued by Etrade that reports various types of income earned during the tax year. This form is essential for individuals who have engaged in trading activities, as it includes information on dividends, interest, and capital gains. Understanding the Etrade 1099 is crucial for accurate tax reporting and compliance with IRS regulations. The form consolidates all relevant financial data, making it easier for taxpayers to complete their tax returns.

How to obtain the Etrade 1099

To obtain the Etrade 1099, users can log into their Etrade account and navigate to the tax documents section. Typically, the forms are available for download after the end of the tax year, usually by mid-February. Users should ensure their account information is up to date to receive notifications regarding document availability. In addition, Etrade may also send physical copies of the 1099 form to the registered mailing address, depending on user preferences.

Steps to complete the Etrade 1099

Completing the Etrade 1099 involves several key steps. First, gather all relevant financial information, including transactions and income sources reported on the form. Next, ensure that all entries are accurate, checking for any discrepancies in reported amounts. It is important to categorize income correctly, as different types may be subject to varying tax rates. Finally, once the form is filled out, it should be submitted to the IRS along with your tax return by the designated deadline.

Legal use of the Etrade 1099

The Etrade 1099 is legally binding when completed correctly and submitted on time. It is essential to adhere to IRS guidelines regarding the reporting of income to avoid potential penalties. The use of electronic signatures for submitting tax documents is permitted under the Electronic Signatures in Global and National Commerce Act (ESIGN). This means that taxpayers can use secure digital platforms, like airSlate SignNow, to sign and submit their forms, ensuring compliance with legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Etrade 1099 are critical for compliance. Generally, the IRS requires that the Etrade 1099 be filed by April 15 of the following tax year. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any state-specific deadlines that may apply. Staying informed about these dates helps prevent late filing penalties and ensures timely processing of tax returns.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Etrade 1099. Taxpayers must ensure that all income reported matches the amounts documented by Etrade. It is important to retain copies of the 1099 for personal records and for potential audits. Additionally, taxpayers should be aware of any changes in tax law that may affect how income is reported, as the IRS updates guidelines regularly to reflect current tax policies.

Penalties for Non-Compliance

Failing to comply with the reporting requirements associated with the Etrade 1099 can result in significant penalties. The IRS may impose fines for late filing, inaccuracies, or failure to file altogether. These penalties can accumulate quickly, leading to increased financial burdens for taxpayers. It is essential to understand the importance of timely and accurate reporting to avoid these consequences and maintain compliance with tax regulations.

Quick guide on how to complete etrade 1099

Finish Etrade 1099 seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as a fantastic eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Etrade 1099 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Steps to modify and eSign Etrade 1099 effortlessly

- Obtain Etrade 1099 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow caters to your document management needs in just a few clicks from the device of your choice. Modify and eSign Etrade 1099 while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the etrade 1099

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the eTrade 1099 form and why do I need it?

The eTrade 1099 form is a tax document that reports income from trading stocks, bonds, and other securities. If you have invested through eTrade, you'll need this form to accurately report your earnings and pay taxes on them. It helps you keep track of your investment income and ensures compliance with tax regulations.

-

How can airSlate SignNow assist with my eTrade 1099 form?

AirSlate SignNow simplifies the process of signing and sending your eTrade 1099 form electronically. Our platform allows you to securely eSign and manage your documents online, ensuring that your tax filings are processed efficiently and safely. This can save you time, reduce paperwork, and streamline communication with tax professionals.

-

Is there a cost involved in using airSlate SignNow for eTrade 1099 form management?

Yes, airSlate SignNow offers a cost-effective solution for managing your eTrade 1099 form and other documents. We have various pricing plans to fit different business needs, ensuring you only pay for the features you use. You can start with a free trial to explore our services before committing.

-

What features does airSlate SignNow offer for handling the eTrade 1099 form?

Our platform includes features like eSignature, document templates, and secure storage, making it easy to manage your eTrade 1099 form. Additionally, you can automate workflows, track document status, and receive notifications, enhancing your efficiency and organization during tax season. This ensures a seamless process from start to finish.

-

Can I integrate airSlate SignNow with other tools I use for my eTrade 1099 form?

Absolutely! airSlate SignNow offers seamless integrations with various tools and platforms to enhance your productivity. You can connect with software like Google Drive, Dropbox, and accounting solutions for easy access to your eTrade 1099 form and other documents, ensuring a streamlined workflow.

-

What are the benefits of using airSlate SignNow for my eTrade 1099 form?

Using airSlate SignNow for your eTrade 1099 form offers numerous benefits, including improved efficiency, enhanced security, and reduced paper usage. Our electronic signature feature allows for quick approvals, while our cloud-based platform ensures you can access your documents from anywhere at any time. This all leads to a more efficient tax filing process.

-

Is it safe to use airSlate SignNow for sensitive documents like the eTrade 1099 form?

Yes, airSlate SignNow prioritizes the security of your documents, including sensitive ones like the eTrade 1099 form. We use advanced encryption and compliance protocols to protect your data from unauthorized access. Your information remains safe while you eSign and manage your important documents.

Get more for Etrade 1099

- Lesson 8 skills practice factor linear expressions answer key form

- University entrance certificate form

- Office of military settlements trust form

- Da form 4037 100115750

- Series nontaxable transaction certificate form

- Adverse possession form 495574242

- Occurrence dateyyyymmdd form

- Speaker request idaho state tax commission form

Find out other Etrade 1099

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy